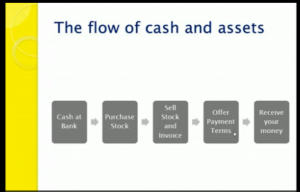

In the past, we have talked about debtor management, the ways you can avoid late-payers by keeping an eye on your cash and assets cycle, and now we thought it was time we talked about the ways you can keep on top of those outstanding invoices without even lifting a finger!

Why Getting Paid on Time Matters

Dealing with late-payers is frustrating, time-consuming, and at times, downright awkward. For freelancers, sole-traders and small businesses, getting paid on time is essential to keeping your cash flow under control.

If you’re not in the position to turn down those perpetual late-payers’ business, then you need to put strategies into place to best manage those late-payers.

Gentle Email Reminders for Getting Paid on Time

Sending a polite, yet firm reminder email to clients a few days before their invoice becomes due is a good way to remind people an invoice is due to be paid, particularly if you have terms of 21 days or more. Often you’ll find most people will pay you once they’re given a gentle nudge via an email reminder.

Of course, there are always those who’ll still try and stretch it out as long as possible — it’s likely their cash flow isn’t much chop; in a sense, by paying you late they’re robbing Peter to pay Paul.

Most of the time, these clients are hoping you haven’t noticed. By sending them a follow up email reminder a couple of days after your invoice was due will show them you have noticed, you haven’t forgotten, and they’ll likely concede defeat and pay — if they still don’t respond, it may be time to implement some of the strategies we discussed here.

More Stringent Payment Terms

But if you find emailing you clients each time their invoices come due and then again when they’re late is not only time-consuming, but also awkward, try setting up the parameters in your invoicing software so that automatic reminder emails are sent out before and after your invoices come due.

Most cloud-based accounting programs, like Freshbooks, Zoho, Shoebooks, Saasu and Salestastic now offer this automatic reminder facility, freeing you up to concentrate on the other areas of your business.

For businesses that have a dedicated accounts receivable department, the ability to send automatic reminders could, depending on the size of your business, save hours, even days of manpower. Plus, it eliminates any awkwardness you may feel chasing someone for a $50 invoice — sure, that one $50 isn’t much, but over time they do add up.

So get paid on time without even lifting a finger by using the automated reminders in your accounting software.

Remember: If you have already completed one of our MYOB training courses and need a bit of a refresher on the Accounts Receivable module, which deals with the ways to get paid on time, you can review it again for FREE if you are within your 12 month enrolment access period OR if you selected our additional option of Lifetime Access.