Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

There are a lot of things that contribute to a successful business, but there’s no doubt that cash is a pretty significant one. Whether or not a business can generate enough revenue to not only stay afloat, but make a profit, determines whether or not that business can continue to operate.

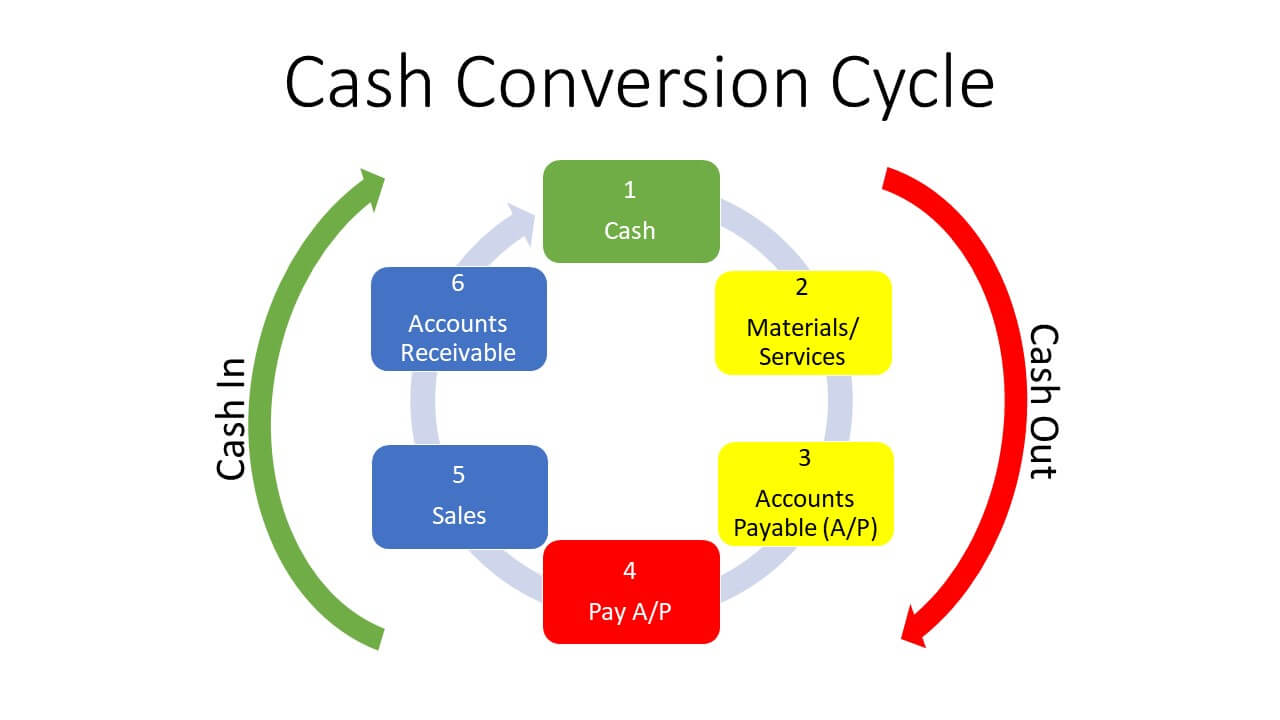

But collecting that cash is not as simple as swiping a customer’s credit card. From the first cent a business spends in buying its stock, to the final cent the business receives in payment from a customer, the cash conversion cycle can tell a lot about just how efficient and effective a business is.

Here’s what you need to know about the cash conversion cycle:

What is the cash conversion cycle?

The cash conversion cycle is a measurement of how long it takes for a business to turn their cash in the bank into cash from the customers.

Imagine a retail business – let’s call it Fiona’s Furniture. These are the steps Fiona has to follow before she can make money from her customers.

- Fiona uses her business’ cash in the bank to buy the materials she needs to make her furniture. She buys it on credit from a supplier.

- Although she hasn’t paid the supplier yet, Fiona still owes them the money for the materials. She puts this as a liability in her accounts payable. When she will have to pay this money depends on the deal she’s worked out with the supplier.

- Fiona builds the furniture from the materials – she’s ready to start selling them!

- Fiona sells one of her items to a customer on credit, so although she hasn’t received the payment yet, she puts this owed money as an asset in her accounts receivable.

- After the specified time (and hopefully not much longer), Fiona receives payment from her customer

This whole process is the cash conversion cycle. It is measured in days, and shows how long it takes to convert cash into inventory, sales, and back into cash.

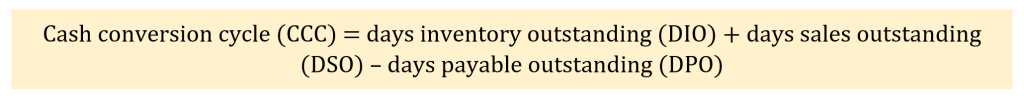

There is a formula for how you calculate the cash conversion cycle:

Let’s break down those terms:

- Days inventory outstanding (DOI): the average time it takes to convert inventory into saleable goods, and then sell them

- Days sales outstanding (DSO): the average time it takes to collect accounts receivable

- Days payable outstanding (DPO): the average time between the business purchasing from suppliers and then paying them (accounts payable)

To figure out these numbers, however, you will also have to do some other calculations:

How does it work?

You want your CCC to be as low as possible – this means that your cash isn’t tied up for too long and your business is generating cash quickly.

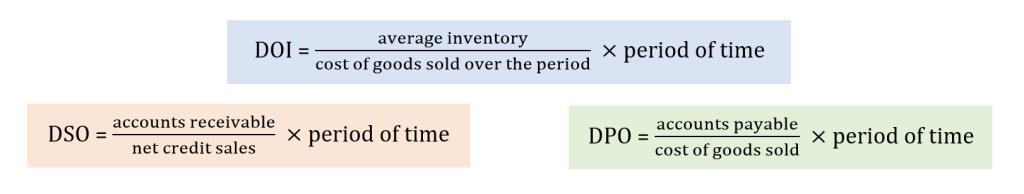

Thinking back to our hypothetical business, Fiona’s Furniture, this is how the cash conversion cycle might look in practice:

Using the formulas and data from above, Fiona’s Furniture would approximately have a:

- DIO of 13 days

- DSO of 17 days

- DPO of 14 days

Making the cash conversion cycle an approximate 17 days.

Why is the cash conversion cycle important?

Following a business’ CCC over time gives an indication of its efficiency. Since the cycle is determined by factors like accounts recievable collections, inventory turnover, and accounts payable, it can show specific areas in which a business may not be performing at its best.

For Fiona’s Furniture, the approximate 17 days it takes for her to collect payment from clients from the initial invoice is contributing to her higher CCC. If in the next quarter she saw that number rise, she would be able to identify this as an area of improvement, perhaps deciding to use credit management apps to help automate the process.

Knowing what specific processes require attention and improvement can be really helpful for business owners. It’s also something that investors might consider when evaluating your business.

Who needs the cash conversion cycle?

The CCC is really only for companies that manage inventory, particularly retailers. Businesses like trade and construction, however, will also use this process. In fact, for businesses that deal with lots of inventory and materials (like tradies), having a shorter cash conversion cycle can make all the difference.

Some businesses might have a negative CCC, which means that they don’t have to pay their suppliers (accounts payable) until after they receive payment for their customers. This is the case with a lot of online retailers, who may use drop-shipping instead of managing inventory, or might not extend lines of credit.

Understanding the cash conversion cycle and how you can make it work for your business can help increase efficiency and cash flow

How can I shorten my cash conversion cycle?

At the end of the day, it’s all about efficiency. If you can collect accounts receivable as soon as possible, whether through automated software or establishing different terms of trade, then that will help reduce your CCC.

The same goes with negotiating with suppliers. The ideal would be not having to pay for inventory until you receive payment from customers, but extending that repayment period by as much as possible can help shorten your CCC.

With inventory, make sure not to over-stock, or you might wind up selling your products at a loss just to try and get rid of them. For Fiona’s Furniture, this could mean she ends up selling a table originally marked up by 100% for merely half the cost price.

Master the cash conversion cycle and other daily transactions!

If you want to learn more about small business accounting, like the cash conversion cycle and managing daily transactions, then check out our daily transactions courses for Xero and MYOB.

Or you can get more information about credit management in the Credit Management & Credit Controllers Training Package

[…] more about improving cash flow here, and learn to master the cash conversion cycle with our daily transactions course for Xero and […]