Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

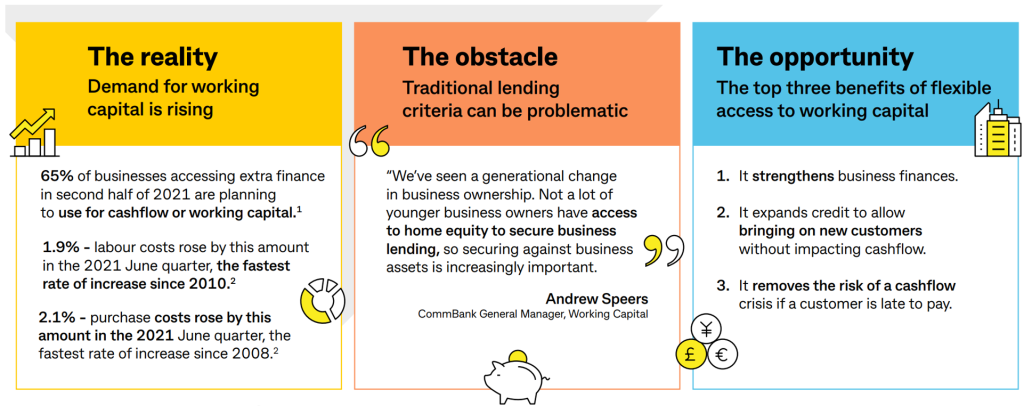

It’s not a secret that in order to stay afloat businesses need to be making money. Access to funds is essential for businesses to not only pay off debts, but also to finance everyday operations and pay their staff and suppliers.

It can become problematic, however, when a business’ cash flow is tied up in unpaid invoices. If a business sells on credit – as many do – they might be in the unfortunate position of waiting to get paid by their customer and struggling to make ends meet in the meantime.

There are a few solutions: one is to use credit management apps like ChaserHQ or Debtor Daddy to help automate the process. Things like chasing up unpaid invoices and escalating debts can be made easier by using these apps that integrate with your accounting software.

The other is to get a loan. Commonwealth Bank’s (CBA) Stream Working Capital is a digital solution for businesses to access the money tied up in their invoices. Here’s what you need to know about it:

What is Stream Working Capital?

Stream Working Capital is CBA’s digital lending solution for B2B customers. It is a type of working capital loan called invoice financing, which allows businesses to borrow money against amounts owed by customers.

If there are some slow-paying accounts receivables, and businesses need access to that money quickly, they may choose to finance their invoices, and they can do this through Stream Working Capital.

“Cash flow is one of the key issues facing small businesses, so we have been looking at how we can support customer’s working capital requirements helping them maximise cash flow and drive business growth.”

Mike Vacy-Lyle, Group Executive of CBA Business Banking

How does it work?

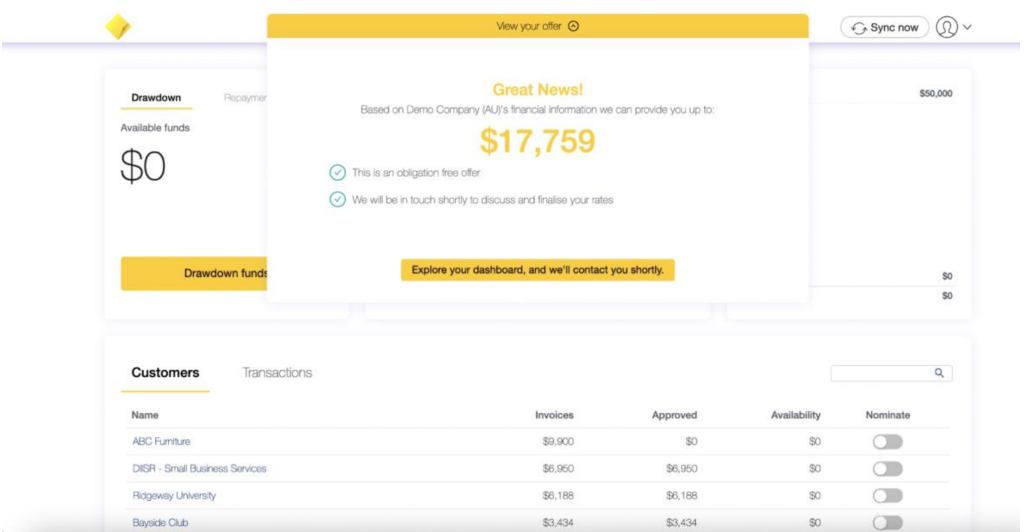

Through Stream Working Capital, CBA will lend eligible businesses up to 80% of nominated outstanding invoices, with these invoices being the loan security (collateral).

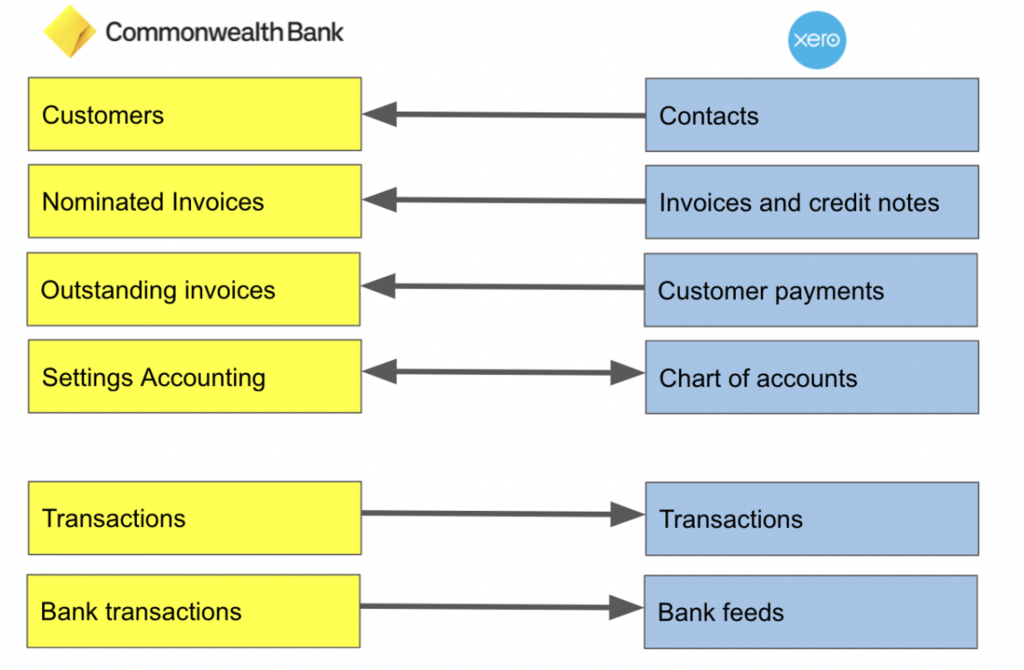

The application process involves you providing some information about you and your business, as well as connecting your accounting software to Stream Working Capital. They will use the data from accounting software like Xero to underpin a business’ working capital needs.

CBA also says that integrating with your accounting software will do away with burdensome processes like scanning and faxing invoices, downloading CSV files from your accounting package, and balancing multiple ledgers.

Stream Working Capital will show you a potential credit limit, and if it’s suitable you click ‘accept’ and are on your way! (but you’ll need to finalise some legal documentation too).

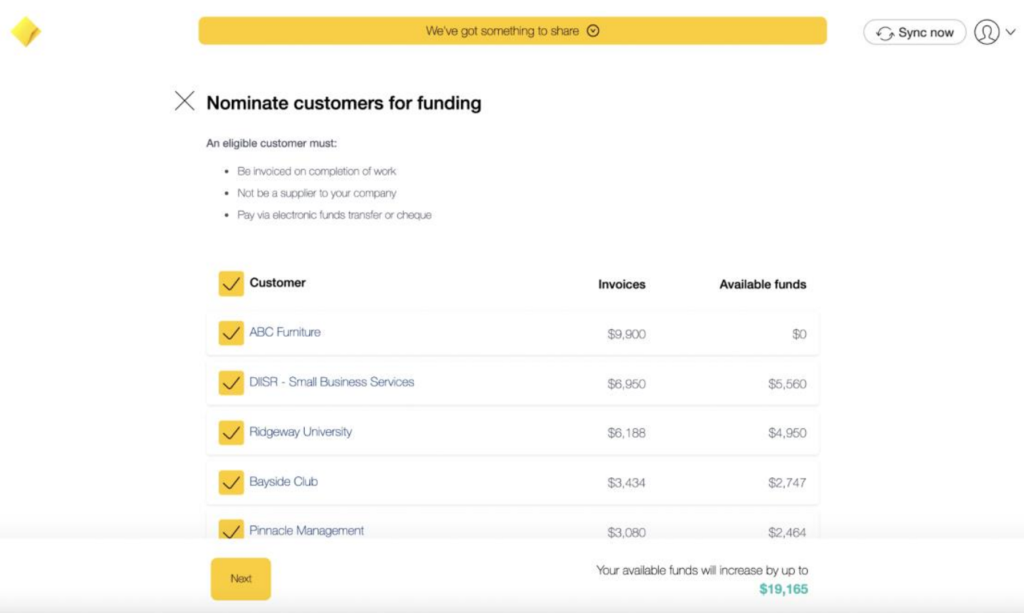

Then you can start nominating invoices to borrow against. The more invoices you nominate, the higher your available limit could be. It also means that your borrowing ability will grow as your business does.

Interest is calculated daily based on the outstanding balance, and you only pay interest on the amount that you draw down. Loan balance is automatically adjusted as your invoices are paid by customers.

Who is eligible?

Only B2B transactions where a business issues invoices of $15,000 per month (or more) can access Stream Working Capital. You’ll also need a Business Transaction Account with CBA to get your invoices paid into.

Other conditions include setting up your business with CBA so they can verify your details with ASIC. You’ll also need to be a sole trader or director of a private company to open an online account with CBA.

It should also be noted that regular bank eligibility and suitability criteria, as well as credit approval process, applies.

CommBank or PayPal?

We’ve written before about PayPal’s Working Capital loan, and it is a similar service to Stream Working Capital, although there are some differences.

Both aim to provide business’ access to short-term capital, but the way they each go about it is a bit different. Whilst CBA’s Stream Working Capital lends based on receivables, PayPal’s Working Capital lends based on a business’ sales history.

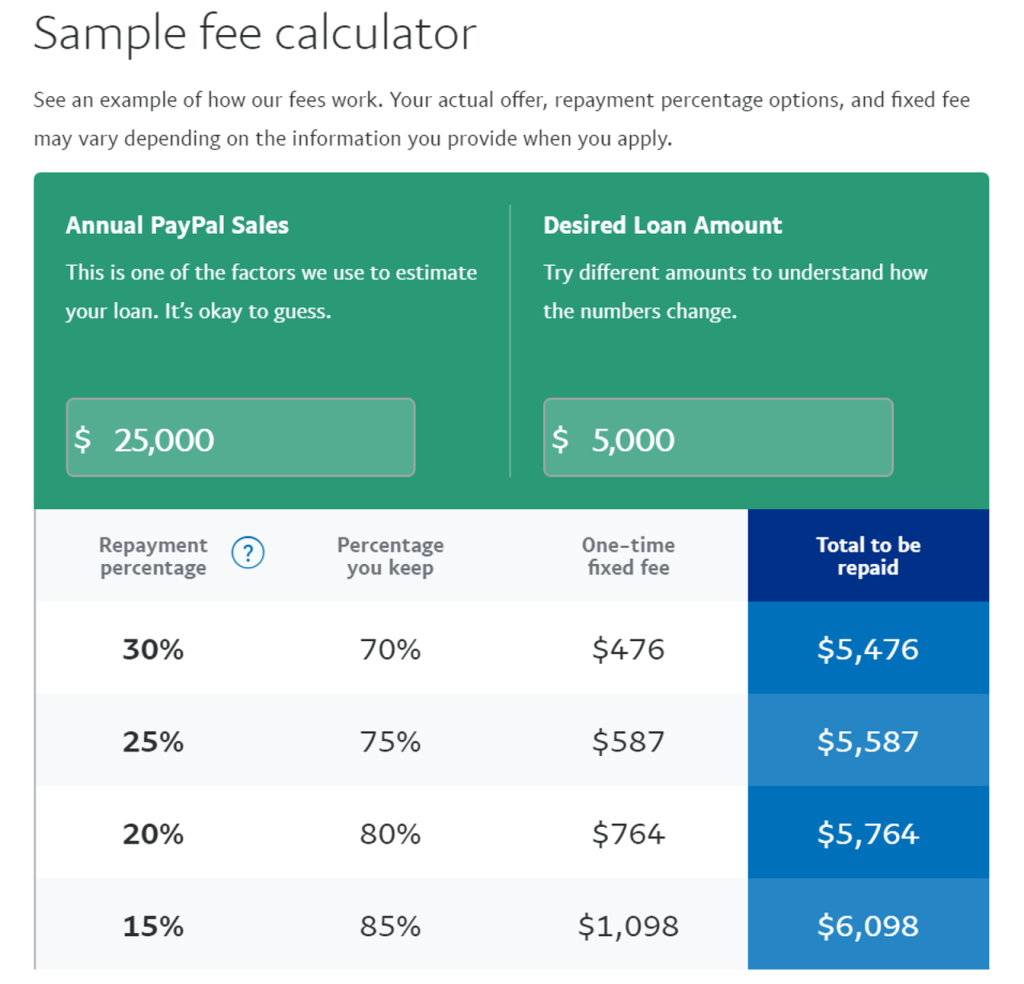

With PayPal, a business is able to borrow up to 25% of their PayPal sales over the past 12 months. Repayment of this loan and fees is also through sales, wherein a business decides how much of their future PayPal sales that will go toward repayment.

Since CBA’s option is only for B2B transactions, its hard to say which is better. It will always depend on your specific business’ working capital needs, and the state of your cash flow, sales, and receivables.

Some things to note are that with CBA interest rates do apply, and with PayPal if you fall behind on sales and aren’t able to meet the repayment amounts your entire loan balance could become due immediately.

Learn how to improve your cashflow with EzyLearn

Want to know more about improving cash flow for your business? Or maybe you’re keen to understand more about credit management apps to help with your role as a bookkeeper or accountant?

EzyLearn has you covered with our Xero Complete Training Course Package, which includes all the foundational and advanced skills you need to master this software, including credit management and cashflow.

Or have a look at our Credit Management & Credit Controllers Training Package, which covers all these important skills across Xero, MYOB AccountRight and Essentials.

-- Did you like what you read? Want to receive these posts via email when they are published? Subscribe below.