Just wanted to give you the heads-up on some cool stuff we’ve been working on. We made this free guide called “Introduction to Bookkeeping Beginner Basics” (super catchy, right? ?) that you can grab on the EzyLearn website.

Think of it as the foundation of your business’s finances. Our guide walks you through setting one up in Xero, MYOB, or QuickBooks, but this blog post is more about why it matters.

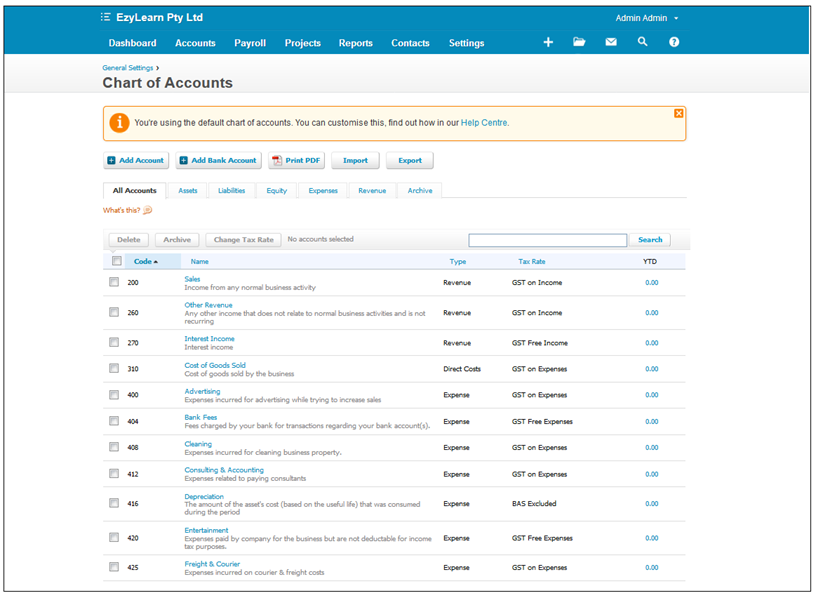

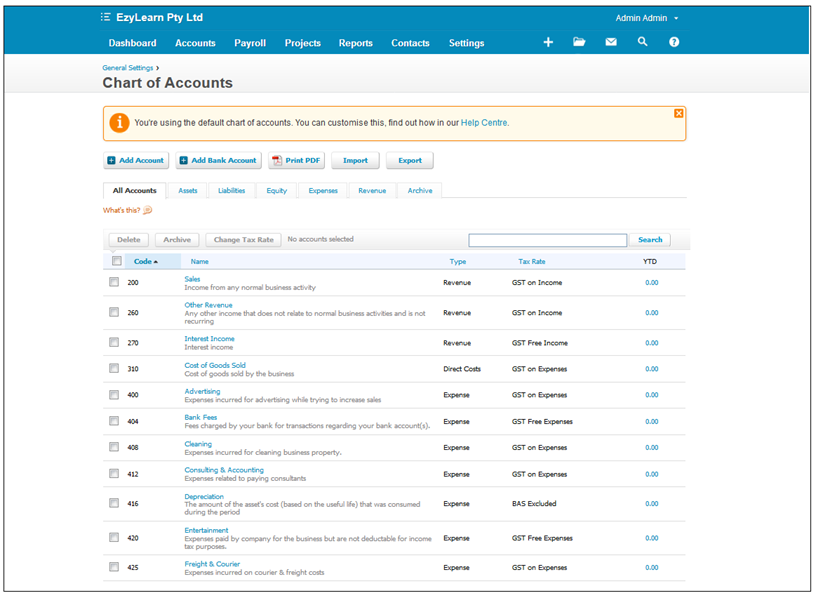

Okay, so what IS a chart of accounts?

Basically, it’s just a way to organize all your business’s accounts (like assets, liabilities, etc.) so you know where your money’s coming from and going.

It makes your reports make WAY more sense and gives you a quick look at your business’s health. It’s like creating categories for your money (spending, saving, making, etc) so you can easily see the flow.

A good chart of accounts helps you play by the rules (financial reporting standards) and can be customized to fit your business perfectly. For example, you could track your income and expenses by product type or department. So you can adjust it as your business gets more complicated.

Xero call is an Accounts List and you’ll learn about this in the Beginners Certificate Xero Courses.

Breaking Down the ‘Accounts’

When you set up your chart of accounts, it will be organized like this: banks accounts, assets, liabilities, equity, income, and expenses in that order.

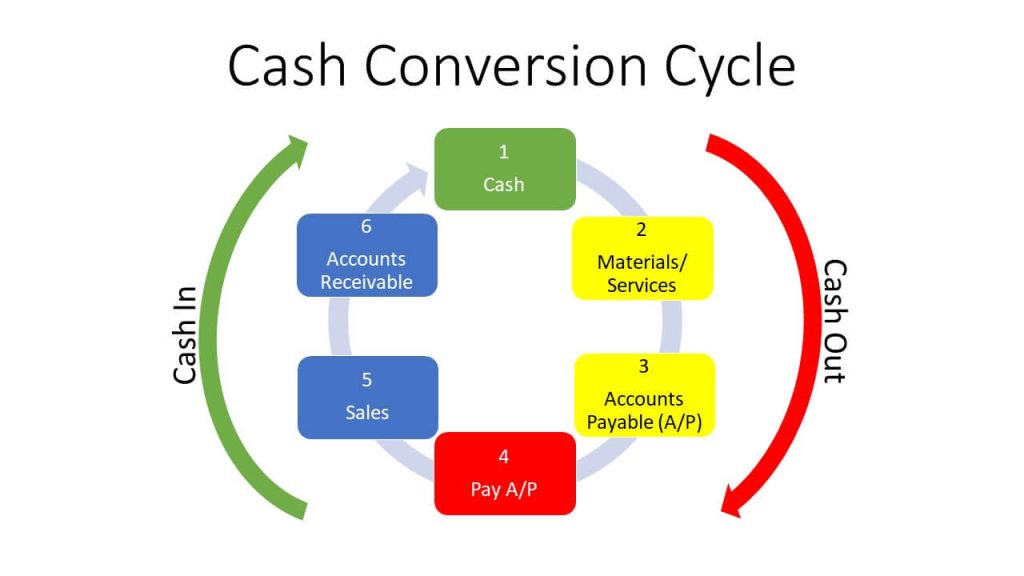

- Assets: This is not money that you have received. So, imagine you invoice someone and they haven’t paid you yet? That’s “accounts receivable,” which is different from actual income!

- Liabilities: Think of these as debts your business owes. Like leases or credit from suppliers.

- Equity: This is stuff your company owns outright, like equipment you’ve paid for. If you sell it, you get the money! Cars and office equipment are equity.

- Expenses: This is the money you spend immediately on running your business. Like gas for your car or office supplies. If you pay right away, it’s an expense. If you get a bill with 14 days to pay, it’s a liability.

Why do you even need a chart of accounts?

No matter how you keep track of your finances (even if you’re still using a spreadsheet!), it’s crucial to know where your money is coming from and going. A chart of accounts is what makes that possible. Keeping it up-to-date will give you an accurate snapshot of your business’s financial health at any moment.

This is just one part of our Bookkeeping Basics series, so don’t forget to download the free guide from the EzyLearn website if you want to learn more!

Learn about bookkeeping basics in the QuickBooks Online, MYOB and Xero course for beginners.