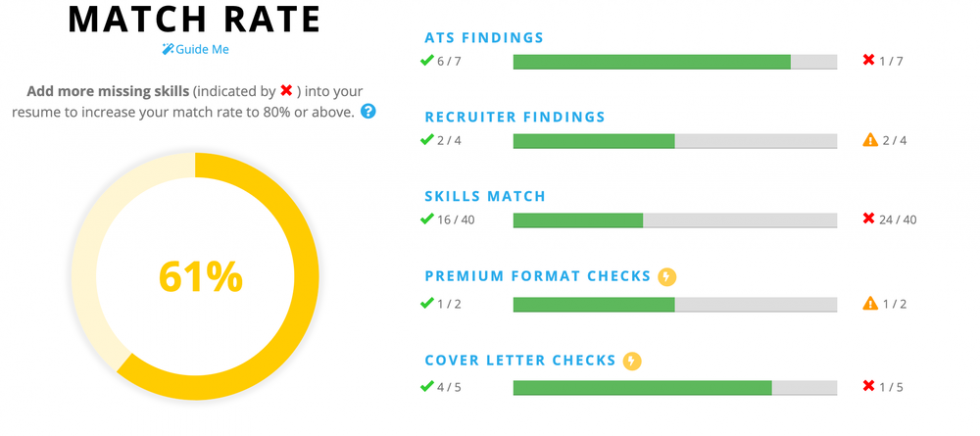

I was speaking with a job seeker recently and she was telling me that she had applied for hundreds of jobs and tried dozens of employment sites but got NO job interviews. I mentioned to her that the employment rate is very low at the moment and that there is a lot of demand so she might do all right if she keeps trying.

What I copped next was flurry of expletives about how the Government is making up lies and that there are no jobs available. This lady continued to bend my ear until I had to excuse myself politely.

The problem that most people have with the Job Application Process is that they’re not practiced at it. There is a method and process to follow when applying for jobs and if you approach it with desperation or you get frustrated you lose sight of how you come across to the employer.

The employer is simply following a process to find the best potential job applicant and they want to make sure they get it right. Need help in the job search and application process? That’s where the Career Academy from EzyLearn come in.

Continue reading Does it feel like you’re knocking your head against a brick wall and not getting job interviews?