IT’S THAT TIME OF YEAR again when my team and I review the success of our marketing for 2017 and plan our strategies for the New Year. The topic of interest-free student loans was on the agenda, so I thought I’ll write something about it.

IT’S THAT TIME OF YEAR again when my team and I review the success of our marketing for 2017 and plan our strategies for the New Year. The topic of interest-free student loans was on the agenda, so I thought I’ll write something about it.

Personally, debt has always been something that has terrified me until about 5 years ago. This stemmed from a time in my mid twenties when I got a commercial hire purchase (CHP) loan to buy an extra Telstra Mitsubishi van. It was selling for $12,000 at the time (which was a lot of money for me) and I paid it off within a year but needed to pay a penalty because the loan was for a fixed period — it cost me $16,000!

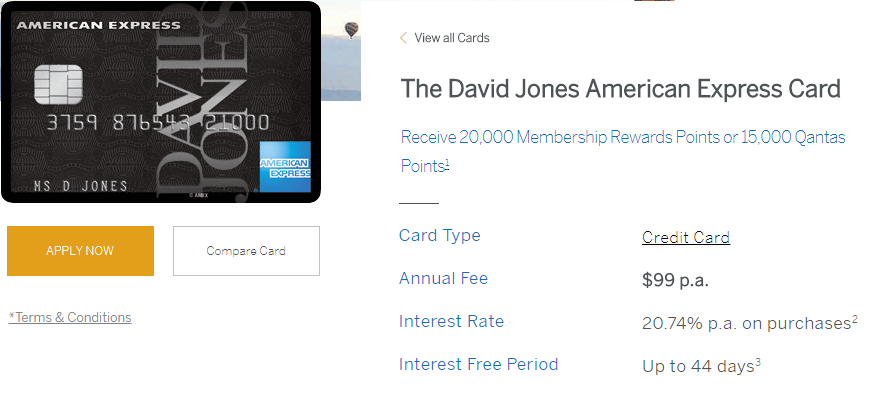

This experience left me feeling completely ripped off and began my intrigue into the different type of loans available to businesses, the risks, and how lenders cover their risks as much as possible. Then Jerry Harvey started spruiking the “buy now with nothing to pay for 3 years” mantra that has become commonplace for many retail businesses. We now have every man and his dog business giving away interest-free credit which usually comes with a credit card attached.

The fact is that borrowing money costs someone and if you’re offered an interest free loan it just means that the loan cost is being absorbed by the seller.

If you’ve completed our MYOB or Xero courses (or you’re already working in accounts) you’d know that a course debt is a liability to the student but an asset to the lender and that asset can be sold or written off. Further, if you read the financial news you’ll see that major retailers are either selling their debt or their in-store cards or credit card to the highest bidder.

The problem I have with any form of debt, except buying an income producing asset like real estate or business assets (or a business), is that if you can’t afford it now how will you be able to pay it back later?

Cashflow for a business is often lumpy and the interest cost for cashflow lending is an expense which comes off your taxable income. In this sense it’s “good debt”, but personal debt that can’t be claimed as an expense is bad and often you’re better off finding the same product or course for a cheaper price and just paying that — or use your existing credit card (and pay it back in time). Read about our newest Xero Cashflow, Budgets and ROI Course.

So, back to our marketing dilemma. EzyLearn has only ever tested part payments of courses and realised that we’re not a lender and rather than pay the cost of having a loan facility we’d prefer to include as much as possible in our courses (including additions and updates) and offer our courses at a cheap and competitive price with occasional special offers.

At EzyLearn we offer online training courses to help you up-skill and find employment. Choose from our range of cloud-based online accounting software courses, to business start up and management courses, to marketing and sales courses, or update and further your skills in a range of Microsoft Office programs (Excel, PowerPoint, Word) or social media and WordPress web design).