In January 2012 we introduced the Student Community and Tutor Support service and we’re announcing some new training guides that have been placed in the Student Support area.

In January 2012 we introduced the Student Community and Tutor Support service and we’re announcing some new training guides that have been placed in the Student Support area.

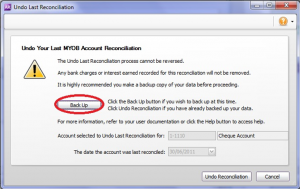

Bank Reconciliation can be a tricky task to master, and that is before you master the motivation to get started! We have a project in our MYOB Bank Reconciliation course where you have to create a new company file, import accounts and transactions and perform a bank reconciliation. It’s a lot like a real world scenario and it causes some grief for existing students so we added an extra guide to help.

We’ve also receive requests in our EzyLearn ANSWER service from students who want help and instructions on how to email invoices using the latest version of MYOB (version 2011) so we have created a guide about how to do it.

We’ve also receive requests in our EzyLearn ANSWER service from students who want help and instructions on how to email invoices using the latest version of MYOB (version 2011) so we have created a guide about how to do it.

Stay tuned for more Student Support Guides over the coming weeks. Enrol to start now and learn at your own pace. Take advantage of LIFETIME student course access and great student support features like EzyLearn ANSWERS and our Student Community and Tutor Support.