Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

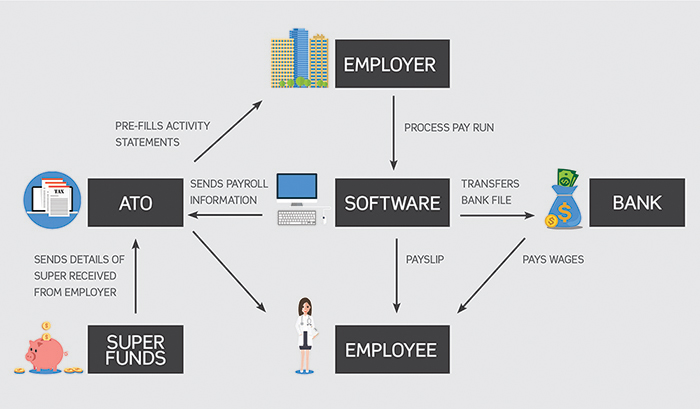

In 2016 the Australian government launched Single Touch Payroll (STP) as part of the Budget Savings (Omnibus) Act 2016. It’s a mandatory obligation for employers with over 9 employees to report their payroll information for each pay run to the ATO.

The idea is to reduce the burden on employers having to report information to multiple government agencies. With STP, employers can report all this information to the ATO through their approved accounting software (like QuickBooks Online, Xero, and MYOB).

But now the rules have changes… AND our Payroll Courses have already been updated!

Here’s what you need to know about Phase 2 of Single Touch Payroll

What is changing?

Mandatory reporting in accordance with Phase 2 of STP commences form 1 January 2022. Basically, the amount of information you have to report to the ATO is increasing.

This might sound like more work, and preparing for the changes is admittedly a necessary task, but the idea behind it all is to further reduce the burden employers feel in having to report information to multiple government agencies.

Now, instead of reporting to multiple agencies like Services Australia, the Departments of Veterans’ Affairs, and the ATO, all the required information can be done through STP Phase 2.

Phase 1 already saw this reduction, but Phase 2 is reducing it further. Here are some of the key things that are changing with Phase 2:

Disaggregation of gross income amounts

In Phase 1, year-to-date gross income was reported to the ATO through the STP-approved accounting software. Phase 2, however, expands this process to other government agencies like those mentioned earlier.

Because multiple government agencies will now be receiving data via your STP reports, gross income amounts will need to be broken down into their individual items (disaggregated).

Since different agencies have their own way of assessing income, disaggregating data will help give them all get the specific information they need.

This will include disaggregating the following components:

- Allowances

- Bonuses and commissions

- Directors’ fees

- Overtime

- Paid leave

- Salary sacrifice (gross amount reported will be the amount pre-sacrifice, with sacrifice reported separately)

Practically, this will require some reworking within your accounting software. For QuickBooks Online, for example, disaggregating gross income means ensuring pay categories are classified correctly. This also applies to leave categories as well, which need to be mapped to their relevant pay categories. We cover pay categories and awards in QuickBooks Payroll Course and Certificate in Xero Payroll Courses.

There’s also been a change to classifying pre-tax deductions, since the ATO also requires these to be itemised. So QuickBooks Online now has two classifications in the Deductions category settings:

- Salary sacrifice (superannuation)

- Salary sacrifice (other employee benefits)

These have been automatically mapped by the system, but if you have made any custom categories ensure they are mapped to salary sacrifice (other employee benefits)

Employment and taxation conditions

The following is now required to be reported in Phase 2 for employment and taxation conditions:

- Employment basis

- Reason for employee termination

- Tax treatment

A big change here is that employers won’t have to separately send their employees’ tax file numbers to the ATO, as this will all be done through the STP-enabled software. Employees still need to make a TFN declaration, but employers hold onto this information and put it in the employee’s profile.

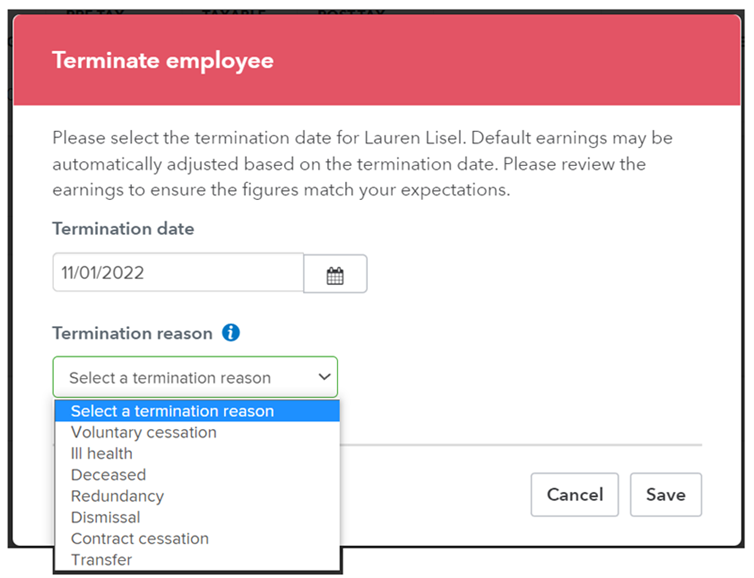

It’s also now required to provide a reason for the termination of employees. You can do this easily in QuickBooks by selecting one of the options in a drop-down menu

Just as there is more information to report, QuickBooks has introduced more categories! You can see this change in the Tax File Declaration screen, which now includes two new categories:

- STP tax category

- Medicare levy

Basically, if your employee fits any of the options in these categories you will select them. They won’t always apply, however, as the STP tax category includes certain specific situations or work types (actor, horticulturalists and shearers, no TFN) that might not apply.

Same goes with the Medicare levy – this will only apply if your employee has an exemption, reduction, or wants to increase their withholding amount.

Child support garnishees/deductions

This is still voluntary, but with Phase 2 of STP child support garnishees and deductions can be reported through STP. Employers therefore won’t have to provide this information separately to the Child Support Registrar.

It’s a simple set-up that means making sure the child support classification is assigned against the relevant child support deduction category.

Income types and country codes

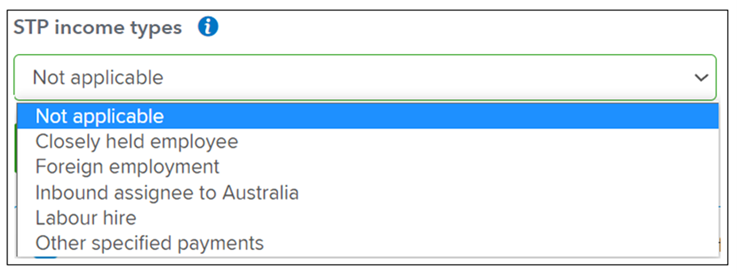

Phase 2 also requires an income type to be assigned to each employee payment. QuickBooks Online now has added categories that are important for certain types of employees, like those shown in the drop-down menu below. You can find all this in the Pay Run Defaults

For country codes, the idea is to make sure employers know their reporting obligations when it comes to tax and international workers. For working holiday makers, the country of their visa needs to be added in the Tax Declaration section of their profile.

What isn’t changing?

Phase 2 is all about expanding, so whilst the information needed is increasing, the stuff already there is pretty much staying the same. What you were already reporting through STP will mostly continue to be reported.

This also includes the way reporting is facilitated (through STP-enabled software), as well as due dates, the types of payments that are needed, tax and super obligations, and end of year finalisation requirements.

You can always have a look at the ATO’s website to find out more

Get ready for STP Phase 2 With EzyLearn!

This blog has been looking at QuickBooks Online for examples, but these ATO changes apply to all STP-enabled software. We have just updated our Payroll Training Courses to include STP Phase 2 information.

Check out our complete packages for Advanced Certificate in Xero, MYOB Essentials, MYOB AccountRight and QuickBooks to understand all you need to know about these accounting software.

You can also have a look at our payroll courses to learn about the tasks and requirements involved in this work.

[…] These payroll courses include training in reconciling superannuation, wages, PAYG taxes, and Single Touch Payroll (Phase 2). […]

[…] The changes you are reading about here is just an example of how often accounting software from MYOB, Xero and QuickBooks changes. New features are added, some are bundled for free and some are built for compliance reasons like Single Touch Payroll Phase 2. […]