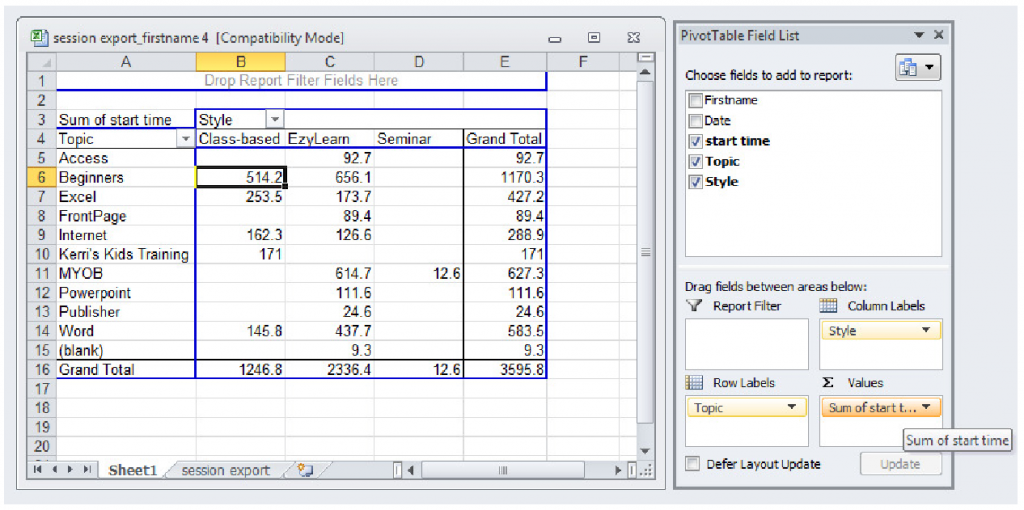

Are you using the Microsoft Word templates that come with MYOB? They are a great way to combine the data in your MYOB accounting software with the layout power of Microsoft Word. It’s also a great way of avoiding the emotions involved in chasing money, particularly if it is long overdue. Using Word Templates with MYOB enable you to maintain a professional, well planned approach to your finances.

Are you using the Microsoft Word templates that come with MYOB? They are a great way to combine the data in your MYOB accounting software with the layout power of Microsoft Word. It’s also a great way of avoiding the emotions involved in chasing money, particularly if it is long overdue. Using Word Templates with MYOB enable you to maintain a professional, well planned approach to your finances.

This blog post contains a new video that will form part of our MYOB online training course. This course delves into the deeper parts of MYOB using some fancy and very handy features of the software. If you are receiving this blog post via email, make sure to click on the heading to get to our blog site to access the free video.

We won’t go into too much description here as the video speaks for itself, but we want to let you know that this new suite of videos will be available for existing students for no extra charge as part of our LIFETIME online training course access feature we announced in January 2011. If you want to receive our blog posts via email, just subscribe at our blog site.

Enjoy..