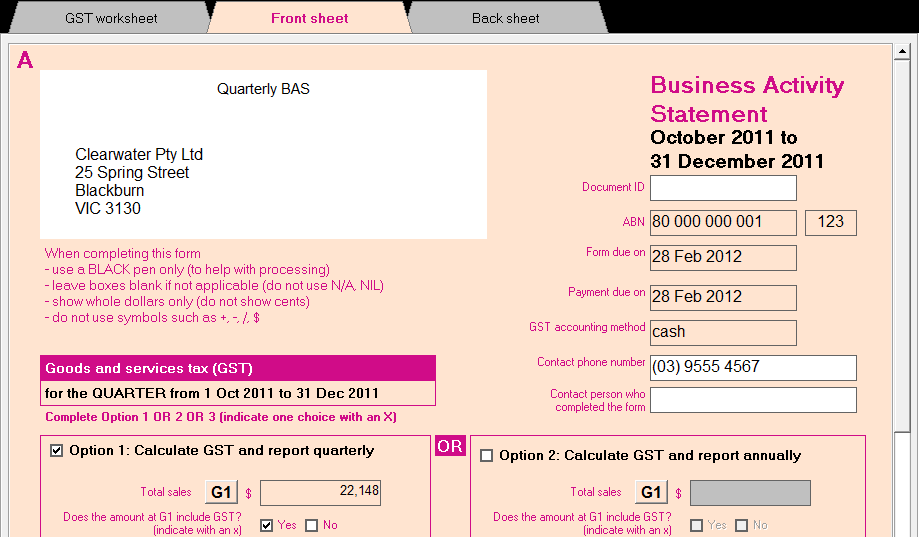

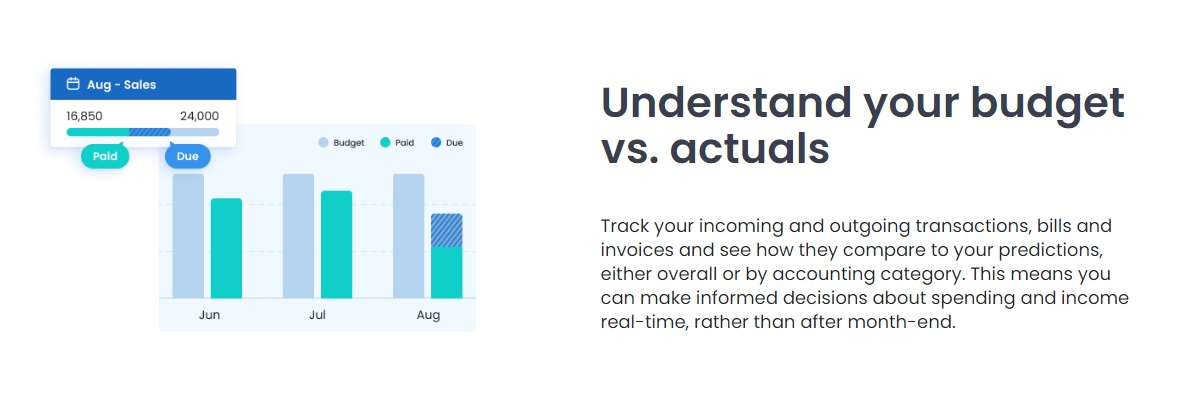

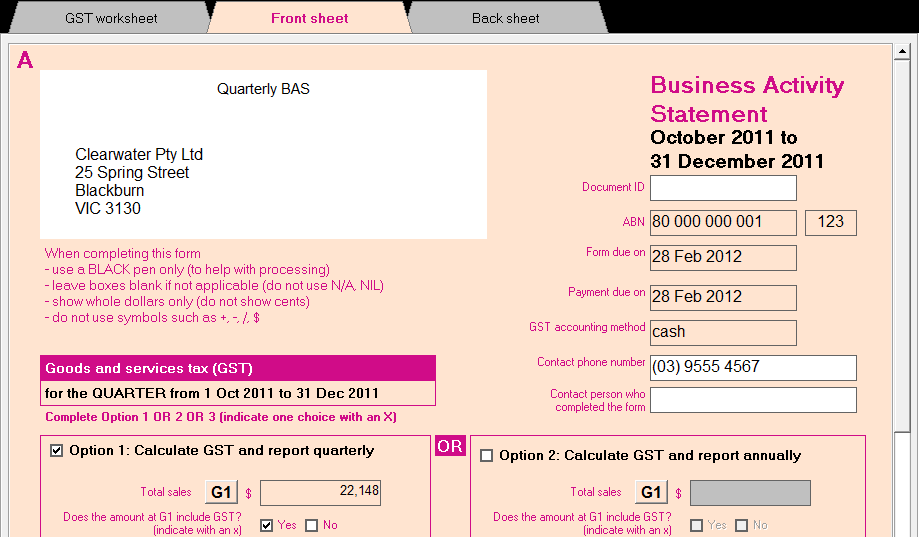

People often ask “How long does it take to complete a Business Activity Statement” but there are several different correct answers to that question.

If all your transactions are entered correctly in your accounting software and your bank account is reconciled the BAS Lodgement takes a matter of minutes.

The hard work is often completed by bookkeepers who do the daily data entry or the catchup bookkeeping to make sure all the data is captured. This task can take days or even weeks!

If you want to save money you can lodge your BAS yourself and use our BAS Course workbooks to learn how to do it.

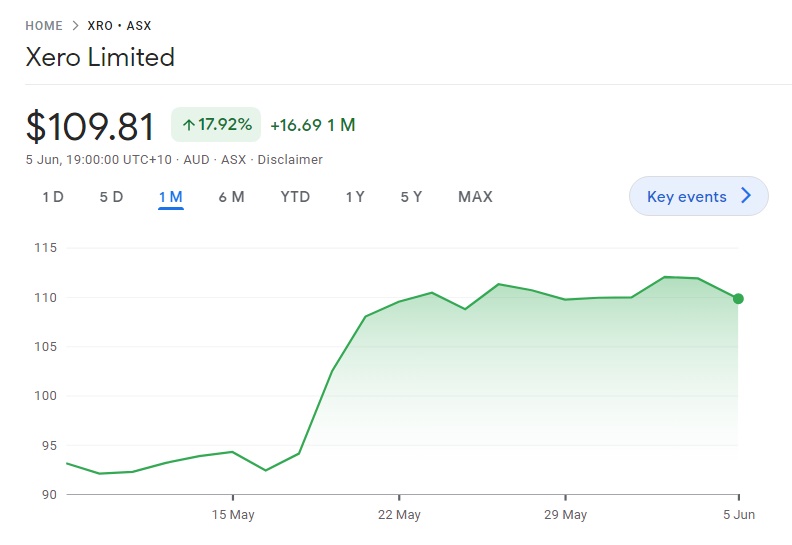

Advanced Xero Training with the BAS Course Workbooks

Learn how to lodge your BAS, including simple payroll wage payments using our Xero BAS Course training workbooks and sample data.

We use Jerry’s Messy Startup case study and you will be his bookkeeper to make sure everything is accurate for lodgement.

It is assumed that you know how to perform daily data entry and bank reconciliations using Xero.

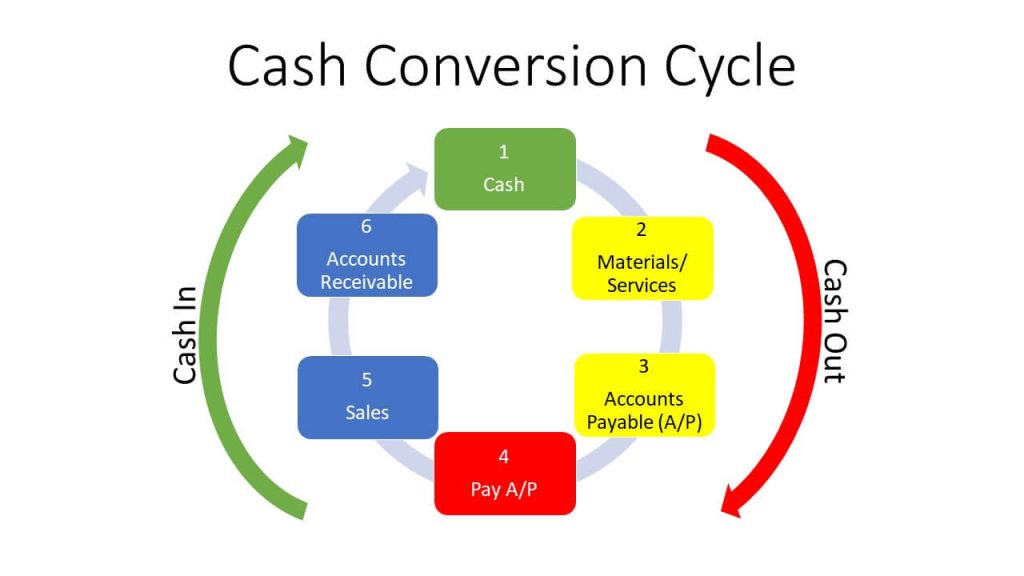

The tricky part of lodging Business Activity Statements is making sure you get the correct tax codes for GST transactions and payroll. If you get these codes wrong you could end up paying less tax to the ATO than you are supposed to or even underpay your staff.

BAS Courses for BAS Agents

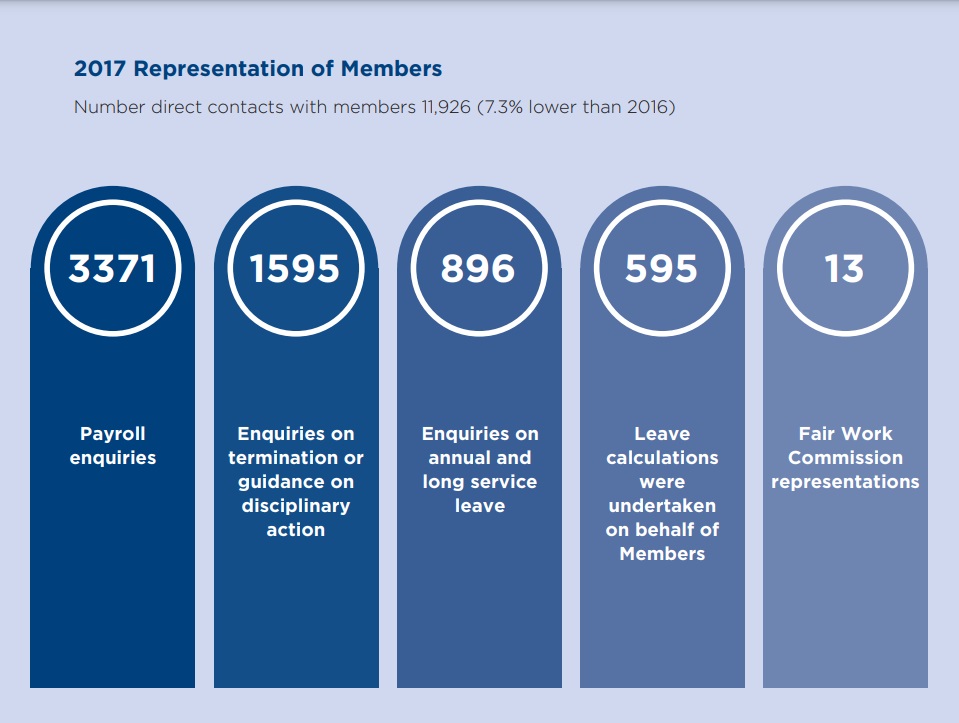

The difference between a BAS Agent and a junior bookkeeper is the compliance requirements to make sure they get it right. A BAS Agent has a duty of care to ensure that the correct tax codes are used and the Cert IV in Bookkeeping and BAS Agent skillset courses (which are Nationally Accredited) take students through the legal framework around compliance.

When a Registered BAS Agent provides these services as a contract bookkeeper they are providing a BAS Service and that is administered by the Tax Practitioners Board.

A BAS Agent is trained but more importantly insured to ensure they get the information 100% correct – otherwise they can be sued. That means they have to have Professional Indemnity insurance to provide BAS Services to clients.

If you want to start your own bookkeeping business and provide BAS Services you need the Cert IV in Accounting and Bookkeeping Course.

You don’t need to complete a Cert IV in most circumstances

In most circumstances where you are completing the BAS as an employee you will be working under the supervision and direction of the business owner, business manager or the bookkeeper or accountant for that business.

Students who enrol into our BAS Courses simply want to know how to perform these tasks using accounting programs like QuickBooks, MYOB and Xero.

See the BAS Courses for Quickbooks, MYOB and Xero