Bookkeepers Who Want to Provide BAS Services Need TPB Certification

Whether you are a bookkeeper who uses Xero or MYOB or one of the other accounting software packages that we offer training on, you are probably aware that Australian tax legislation has changed recently. As a result, providing BAS services to clients is not as simple as it once was.

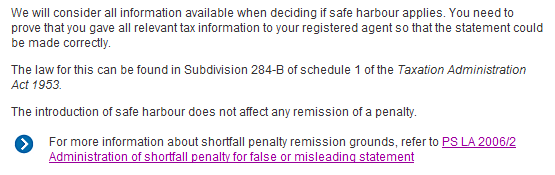

All bookkeepers who wish to provide a BAS service for a fee, must now hold a Certificate IV in Financial Services (Bookkeeping or Accounting) or higher to be eligible for registration.

What makes up a BAS service?

The BAS services page on the ATO website can provide you with information about the qualification requirements and the education requirements for BAS agents to become certified with the Tax Practitioners Board (TPB) so you can offer tax and BAS services to clients.

Becoming certified with the TPB is a lot like getting your drivers license: you need to be able to demonstrate the relevant experience of at least 1400 hours, or 1000 hours if you’re already a member of a professional organisation — like the Institute of Certified Bookkeepers — which you can become a member of for free when you complete an applicable EzyLearn Training Course.

If you’re working under the supervision of another registered Tax or BAS agent, you cannot provide any Tax or BAS services to any clients you may pick up of your own. In other words, you must only provide tax or BAS services to clients known to your supervising Tax/BAS agent.

For some newcomers to the industry, this may seem daunting. But that’s just because conventional wisdom suggests that you must take on some form of permanent employment, working for a bookkeeper or accountant who is registered with the TPB and can supervise you while you gain the necessary skills to go out on your own.

But that’s not actually the case. While this is an option — and a good one if you’ve never worked as a bookkeeper before — it’s not the only one. You can still work with another registered Tax/BAS agent as a contractor, providing these services to the registered Tax/BAS agent’s clients until you’re eligible to go out on your own.

Kick start your own business

This is a great way to get a start on your own business — perhaps just offering non BAS services to start with — while you gain the skills to become registered to offer GST and BAS services. Contract bookkeeping jobs of this nature are actually easier to find that it may seem — often by striking up a working relationship with an accountant or another certified bookkeeper.

***

Find out more information on how to register with the TPB so you can provide tax and BAS services. And remember: you can become a member of the Institute of Certified Bookkeepers for free when you complete an applicable EzyLearn Training Course.