Teleworking from home

While Australians have had the ability to telework by using laptops, tablet devices, and smartphones, to connect to work for sometime, it’s unusual for employees to do this on a regular basis or even to be employed solely on this basis.

However, research both locally and internationally has shown the great benefits that teleworking can offer employers and employees, and in fact, the country as a whole.

For employers, teleworking assists with the recruitment and retention of staff, particularly young employees and those transitioning to retirement, but it also reduces staff turnover and absenteeism usually triggered by changes to family circumstances.

Teleworking saves money

In other, more tangible senses, teleworking reduces the costs associated with office space, such as energy costs and infrastructure, now that employees can remotely access files and documents using cloud accounting and storage software like DropBox.

But the real benefits for employers are derived from the benefits experienced by their employees.

Being able to work from home has been shown to greatly increase an employee’s work/life balance, which in turn drives job satisfaction and on-the-job productivity.

And by reducing commute times and the mental stress associated with juggling work and family commitments, employees have more time to up-skill by enrolling in distance education or online courses (like one of our MYOB courses), which will be even better with the NBN, which increases the number of highly skilled workers in the labour force.

Teleworking levels the playing field

While employers have access to a larger labour pool and employees likewise have access to a larger pool of employers now that geographical restrictions have been removed, teleworking also increases the instances of people starting a home-based business.

It is these benefits from teleworking, such as the increase in labour participation, the uptake of further education, and the growth in new home-based businesses that is not just great news for Australian employers and employees, but also for the Australian economy.

The scary news about teleworking

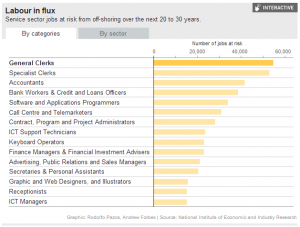

The major risk to Australian workers is that the increased pool of workers also includes workers in developing countries like the Philippines and India who are often very well trained and willing to work very hard for much lower pay. Even if we look at the USA we find remote workers who are willing to perform most small business operational tasks for $15 per hour.

There may be a benefit in living in the Australian time zone, speaking good English and writing well, but when it comes to many fields of work like graphic design it has really become a global market place for workers.