What You Can Do this Christmas

DID YOU KNOW research shows that by taking just one short course on small business management, the chance a business will fail is reduced by as much as 50 percent.

This is because business mismanagement is the primary reason businesses fail; the other most common reason is because owner/s fail to implement appropriate credit management processes. In both cases, this failure has come about because the owners, directors, partners or managers lacked the appropriate management skills to make it a success.

Learn the basics in business

The Christmas holidays is a perfect time for taking the steps needed to start your small business. While everyone else has gone on holidays, you’ll be ready to take on your first client or customer by the time business really starts kicking off again at the end of January.

So let’s get to it: there’s work to be done. And this work generally requires some rudimentary knowledge of Australian tax law, copyright law, trademarks and patents.

So let’s get to it: there’s work to be done. And this work generally requires some rudimentary knowledge of Australian tax law, copyright law, trademarks and patents.

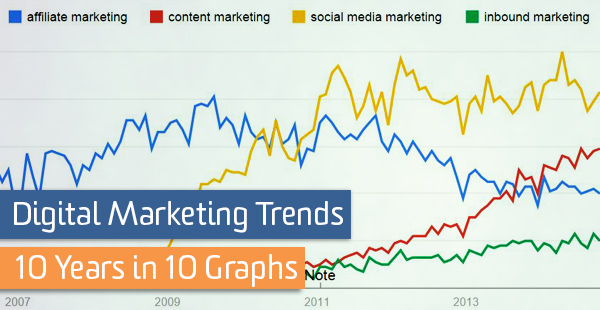

You should also have knowledge of particular software applications, and digital marketing.

Other key areas of business you need to know

The key areas business owners should understand before starting a business include:

- Business planning

- Digital and traditional marketing

- Intellectual property and general law

- Researching the market

- Cloud-accounting software

- Working with content management systems.

Ordinarily, to become skilled in each of those areas, a person would have to take, at least, five different training courses. But few people are ever likely to do this. Instead, they’d be more likely to cherry pick the areas they’re least familiar with, and fly blind with the others. Needless to say, that’s where people run into problems.

Take Advantage of our Christmas Savings!

We don’t want you to wing it or fly blind — our goal is to help small businesses succeed which is what we’ve been doing for nearly 20 years.

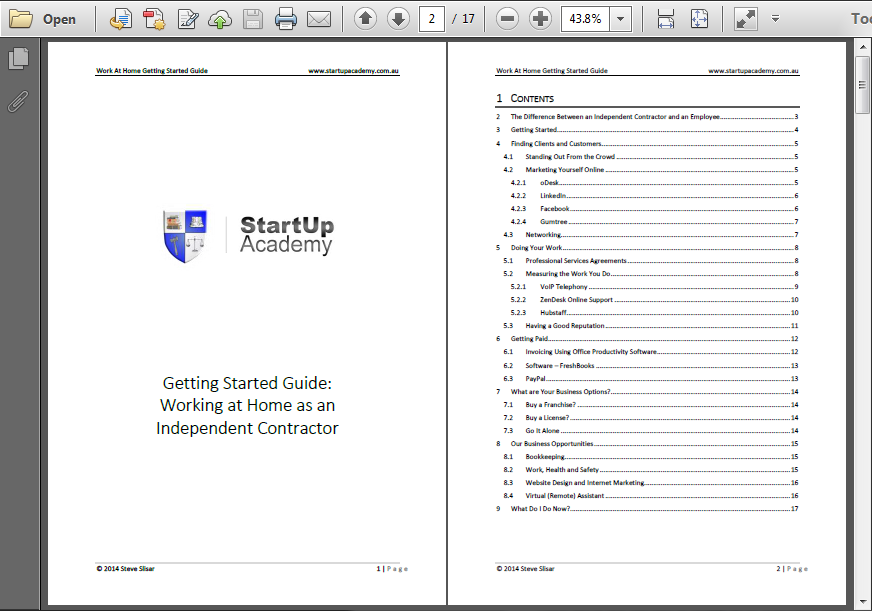

We cover what you need to set up a small business in our EzyStartUp Business Course, priced at just $297. This course covers each of the key areas mentioned above that a small business owner needs to be familiar with, in addition to the following:

- Originating and developing concepts

- Establishing legal and risk management

- Product packaging

- Marketing your business

***

When you enrol you will also receive FREE ACCESS to a bunch of our other online training courses, including Xero Set Up and Beginners’ Excel and Word.

Our Last Dasher Sale is also on now with special Christmas discounts on our online training courses in social media, and cloud accounting software (MYOB, Xero) and Excel, Word and WordPress.

Don’t Wait — Become the Head Honcho Today

Use your time off from work this summer to begin working on your new small business. All of our training courses are delivered online, and can be completed at your own pace, so you can complete them while you’re actually on holidays, or relaxing at home or at a cafe.

And since one of the best ways to start a new business is by operating it as a side project to your other job, if you get all the start up stuff out of the way while you’re on holidays, it’ll be ready to go by the time you back to work.

And as a gift to you, remember our

And as a gift to you, remember our

IF YOU’VE DECIDED THAT this will be the year you start your new business, don’t wait until January to begin your journey to becoming the head honcho.

IF YOU’VE DECIDED THAT this will be the year you start your new business, don’t wait until January to begin your journey to becoming the head honcho.

The other week, we wrote a couple of blog posts, discussing the recent $5.5b worth of breaks [

The other week, we wrote a couple of blog posts, discussing the recent $5.5b worth of breaks [ If you’re like me, then the only reason you still have an account with Telstra is because you need the phone line for your broadband Internet connection. I replaced my Telstra ‘wired line’ with a

If you’re like me, then the only reason you still have an account with Telstra is because you need the phone line for your broadband Internet connection. I replaced my Telstra ‘wired line’ with a