Accounts payable refers to the bills you need to pay and is often referred to as payables or AP. If your business owes money to a supplier that supplier will call and ask for the Accounts payable department or person.

Accounts Payable is available when a supplier gives you credit.

When a supplier sends you an invoice for materials the amount on that invoice is part of your accounts payable and this is a liability for the business. In your supplier’s records however, that invoice is part of their accounts receivable and for that company it is an asset.

Accounts Payable categories include money owed to a supplier for raw materials as part of your “Cost of Goods Sold” or money for an unpaid Internet or phone bill. It could also be better tracked when the good supplied are part of a “project” that your team are working on.

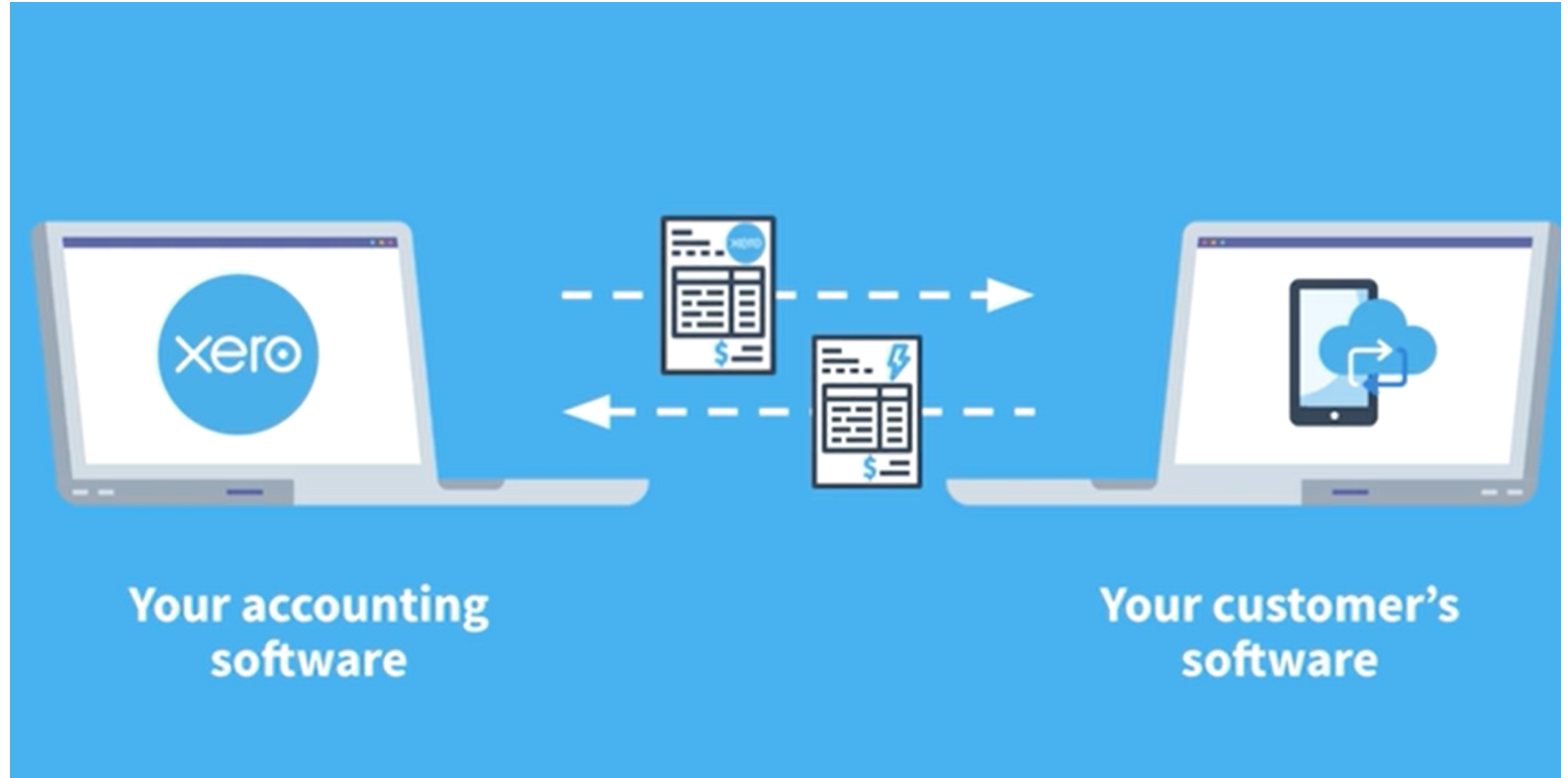

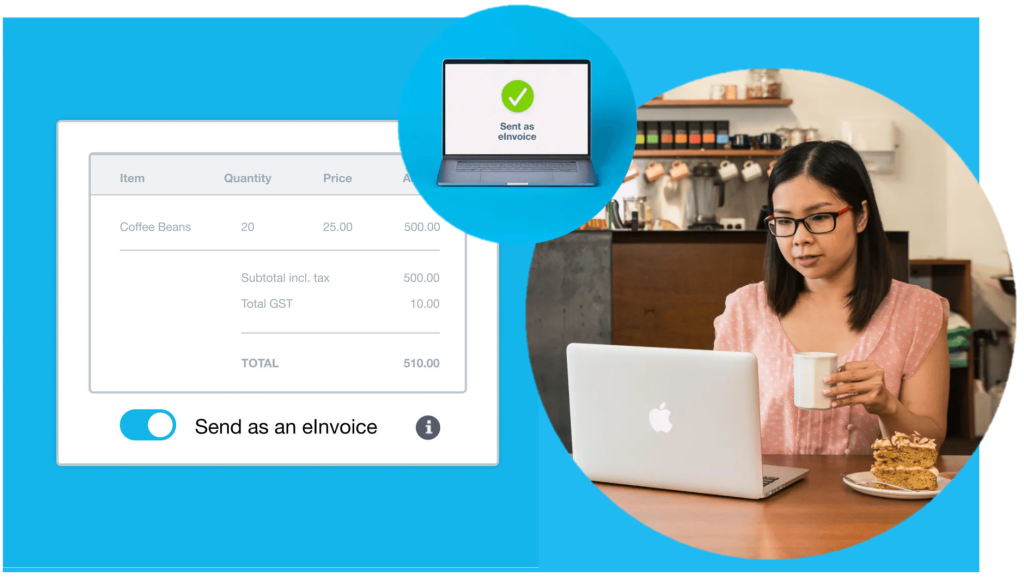

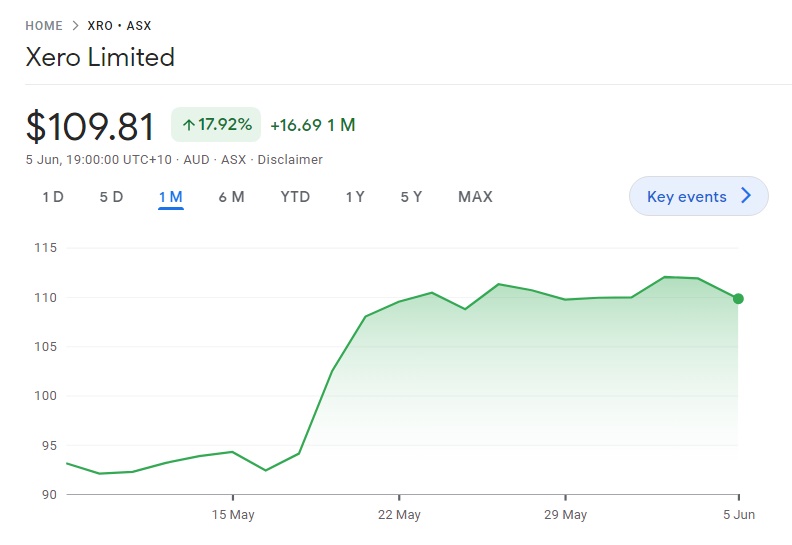

Get Accounts Payable and Accounts Receivable training in the Daily Transactions Courses for MYOB and Xero. This is a great introduction to money owed to your business as well as the money you owe to your suppliers – all in one course.

Credit Management Training

Accounts Receivable and Accounts Payable are part of your credit management policy and Credit Management Training is available in detail in our separate Credit Management Course.

Credit management involves setting up the rules around how you provide credit, the security that you can hold as well as procedures about how to make sure you get paid.

Watch the video about Credit Management.

If you are a retailer who receives payment for good straight away you don’t have an Accounts Receivable issue but if you provide services and give credit – like most trades – then you need to make sure you get paid quickly.

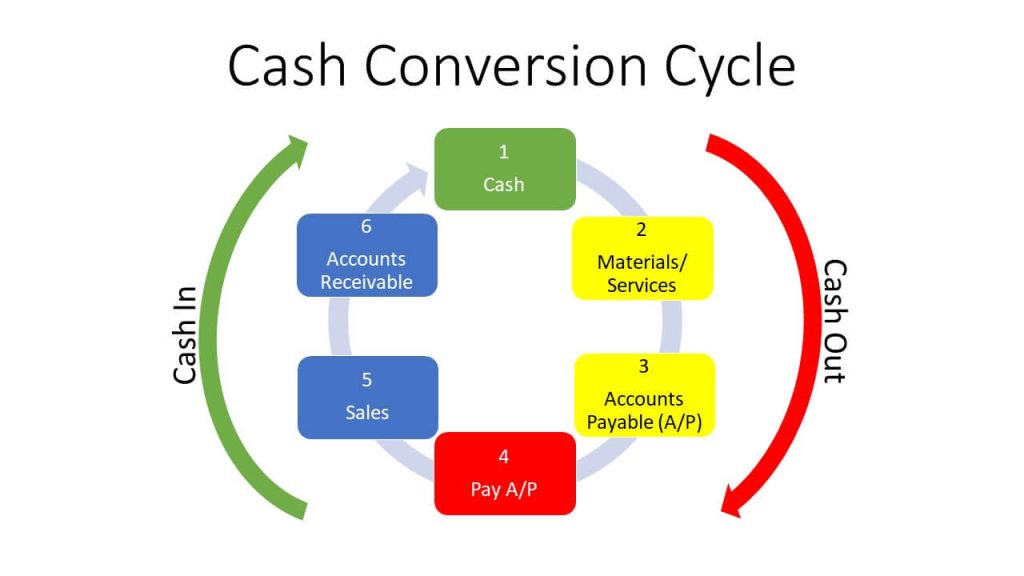

Good credit management involves mastering every stages of the Cash Conversion Cycle so if you give credit, manage it well.