![]() As part of our Continuing Professional Development (CPD) program for our Bookkeeping Academy we write and inform about products and services that will help bookkeepers build their business and job seekers learn new skills to become more employable.

As part of our Continuing Professional Development (CPD) program for our Bookkeeping Academy we write and inform about products and services that will help bookkeepers build their business and job seekers learn new skills to become more employable.

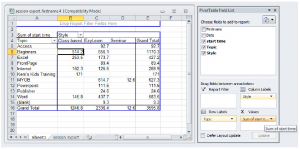

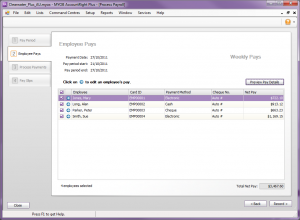

We recently wrote about companies that offer MYOB hosting. This enables companies to access their MYOB datafile from no matter where they are and it also enables remote contractors to manage a companies bookkeeping from their own homes. In this blog post we include a video demonstration about how easy it is to use MYOB in the cloud.

We spoke to John from Bluewave who use to promote his MYOB hosting services under the domain MYOBinthecloud.com (we think it’s a great name because it describes the service that he offered very accurately) and he was kind enough to give us a demonstration account so that we could give a hosted version of MYOB a spin. He said that they provide hosted solutions for more than just MYOB and we were able to create an invoice and email it using Microsoft Outlook.

The MYOB version we used in this demonstration is the stable version 19 (as opposed to MYOB AccountRight version 2011 that had a lot of bad publicity). The great news about MYOB is that it’s navigation hasn’t changed significantly for at least 10 years from our experience.

If you area reading this blog post via email, click on the heading to be able to see the video). If you want to ensure that you get each update as it is published via your email feel free to subscribe. If you want to create your own blog using WordPress and Google Feedburner learn how to create it in our WordPress course.