Choice of sales vs administration work

They say that, in life, nothing is certain but death and taxes. If you live in Australia, however, it’s fair to say that nothing is certain but death, taxes and real estate, since selling property seems to be the national pastime (Sky News does broadcast live auctions every Saturday now, thanks to a new partnership with REA Group). Since real estate agents and bookkeepers share a thing or two in common (they both handle the two most important aspects of their clients’ livelihoods), we thought we’d look into compliance for both professions.

They say that, in life, nothing is certain but death and taxes. If you live in Australia, however, it’s fair to say that nothing is certain but death, taxes and real estate, since selling property seems to be the national pastime (Sky News does broadcast live auctions every Saturday now, thanks to a new partnership with REA Group). Since real estate agents and bookkeepers share a thing or two in common (they both handle the two most important aspects of their clients’ livelihoods), we thought we’d look into compliance for both professions.

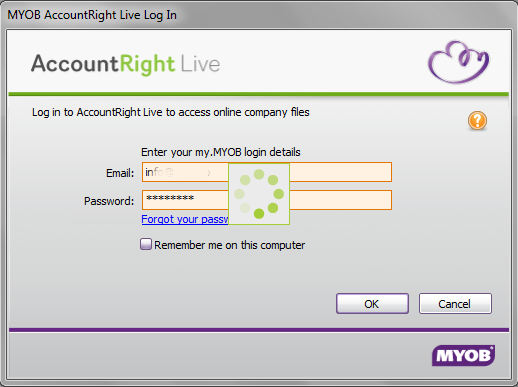

Until 2010, when the Tax Agent Services Act was established in 2009, any person with a reasonably good understanding of an accounting software package, like MYOB, could provide bookkeeping and tax services to clients. With the introduction of the Tax Services Act, however, a bookkeeper wishing to provide tax services to their clients was required to register with the Tax Practitioners board (TPB), which has its own criteria that applicants must satisfy in order to register.

Although a bookkeeper who isn’t registered with the TPB can still provide general data entry services to their clients, by law, only a registered BAS or tax agent can lodge activity statements or tax returns on behalf of their clients. We’ve written about how a bookkeeper can become registered with the TPB before on this blog, so we’re not going to cover that here. Instead, we’re going to look at the compliance requirements for real estate agents and bookkeepers, which for the sake of clarity, we’re going to refer to as BAS and tax agents moving forward.

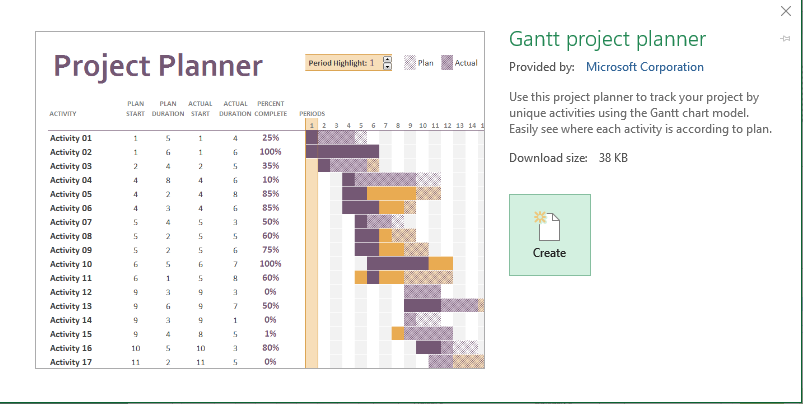

BAS AND TAX AGENTS

|

COMPLIANCE REQUIREMENTS

|

SKILLS

|

| Completion of Certificate IV in Financial Services (Bookkeeping or Accounting) or higher – 12 month course |

Proficiency in major accounting software packages – MYOB, Xero, Quickbooks, etc |

| Register as a BAS and/or tax agent with the Tax Practitioners Board |

Excellent time management skills |

| Become a member of a professional organisation, like the Institute of Certified Bookkeepers (optional) |

Multi-tasking skills – ability manage multiple clients at once |

| Satisfy continuing professional education (CPE) requirements, per the TPB. |

Have excellent customer service skills |

|

Specialist skills in a particular industry – i.e., building and construction (optional) |

Now, let’s turn our attention to real estate agents.

Before we continue, it’s necessary to mention that there are two different kinds of real estate agents, just as there are bookkeepers. When an agent begins their career, they usually complete a short course (approximately three days) that allows them to work as as an agent’s representative. An agent’s representative works under the guidance of a fully licensed real estate agent, and is allowed to assist on a variety of real estate transactions, but is not, by law, legally allowed to carry out real estate transactions for a client unsupervised.

Before we continue, it’s necessary to mention that there are two different kinds of real estate agents, just as there are bookkeepers. When an agent begins their career, they usually complete a short course (approximately three days) that allows them to work as as an agent’s representative. An agent’s representative works under the guidance of a fully licensed real estate agent, and is allowed to assist on a variety of real estate transactions, but is not, by law, legally allowed to carry out real estate transactions for a client unsupervised.

A licensed real estate agent, on the other hand, has fulfilled a more extensive set of educational requirements, which is necessary if they are to carry out a real estate transaction unsupervised or operate their own agency. In Australia, there is no national piece of legislation governing real estate, as it is, instead, overseen by each state or territory government, which are responsible for licensing real estate agents via the relevant department of fair trading, consumer affairs or protection. Licensing requirements vary state-to-state, albeit only minimally, so for the sake of this blog post, we’re going to refer to the licensing requirements as laid out by the NSW Department of Fair Trading.

LICENSED REAL ESTATE AGENTS

|

COMPLIANCE

|

SKILLS

|

| Completion of Certificate IV in Property Services (real estate) -18 month course |

Proficiency in major software applications – MS Word, Outlook, etc |

| Obtain real estate license from Dept. Fair Trading |

Excellent time management skills |

| Obtain auctioneer’s license from Dept. Fair Trading |

Multi-tasking skills – ability to manage multiple clients at once |

| Become member of professional association, like Real Estate Institute of NSW (optional) |

Skilled negotiator and sales person |

| Satisfy continuing professional education (CPE) requirements, per Dept. Fair Trading |

Excellent customer service skills |

|

Specialist knowledge – i.e., local area, commercial/residential/regional real estate, etc |

|

Excellent networking skills |

|

Understanding of marketing and advertising |

As the two tables show, BAS and tax agents are just as educated – and must remain to be so, if they hope to stay registered – as real estate agents. This may come as a surprise to many people, given the long held assumption has always been that real estate agents are uneducated, but that’s clearly not the case – nor has it ever been so, unlike BAS and tax agents who only recently had to meet a minimum educational requirement.

Bookkeepers, BAS and tax agents need to do what real estate agents do

Indeed, although the compliance requirements of both professions are similar, there’s quite a disparity in the skill sets of BAS and tax agents when compared with real estate agents. The latter are skilled negotiators with excellent sales skills, who also have a thorough understanding of marketing and advertising, which, along with networking, they use to get new listings. Few BAS and tax agents, however, have much knowledge of marketing and advertising, and most of them confess that they aren’t very good at sales (and really don’t want to do that type of work).

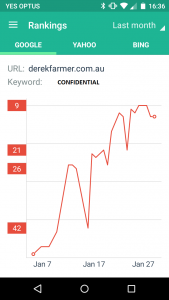

This is okay if they work for a well-known specialist tax franchise, like HR Block, which already has a name for itself and has a marketing department in its head office to oversee the group marketing and advertising needs. But an independent BAS and tax agent working from home, which most of EzyLearn’s students and readers do, don’t have those resources at their disposal. They need to find their own clients and do their own marketing, just like real estate agents do.

OR, someone else can do the marketing for you

If you’re a registered BAS or tax agent (or both!), and you’d like to learn more about sales and marketing so you can grow your client list and your business, become a National Bookkeeping licensee. As a National Bookkeeping licensee, you’re provided with all the resources you need to operate your own bookkeeping business, particularly how to market your business to get new clients. Visit the National Bookkeeping website or make contact to discuss for more information.

If you’re a registered BAS or tax agent (or both!), and you’d like to learn more about sales and marketing so you can grow your client list and your business, become a National Bookkeeping licensee. As a National Bookkeeping licensee, you’re provided with all the resources you need to operate your own bookkeeping business, particularly how to market your business to get new clients. Visit the National Bookkeeping website or make contact to discuss for more information.

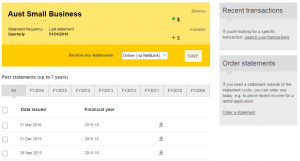

In July last year, EzyLearn published a couple of posts about SuperStream, the government initiative to improve the efficiency of Australia’s superannuation system, which all businesses with 19 or fewer employees must be compliant with by June 30 this year. As we’ve now reaching June 30, it’s important to ensure that you’re fully compliant with SuperStream, the government’s electronic system for sending superannuation payments to your employees’ super funds.

In July last year, EzyLearn published a couple of posts about SuperStream, the government initiative to improve the efficiency of Australia’s superannuation system, which all businesses with 19 or fewer employees must be compliant with by June 30 this year. As we’ve now reaching June 30, it’s important to ensure that you’re fully compliant with SuperStream, the government’s electronic system for sending superannuation payments to your employees’ super funds.

They say that, in life, nothing is certain but death and taxes. If you live in Australia, however, it’s fair to say that nothing is certain but death, taxes and

They say that, in life, nothing is certain but death and taxes. If you live in Australia, however, it’s fair to say that nothing is certain but death, taxes and

Has someone been telling you you must get onto social media? Are you a real estate agent with a Facebook page that is pushing people away? Are you spending hundreds of dollars per month and pushing your Facebook community away from what you do and to all the big companies!?

Has someone been telling you you must get onto social media? Are you a real estate agent with a Facebook page that is pushing people away? Are you spending hundreds of dollars per month and pushing your Facebook community away from what you do and to all the big companies!?

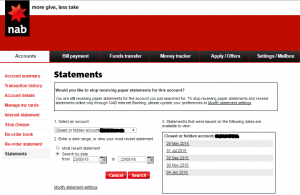

Recently, at the suggestion of her accountant, a friend of mine opened a new bank account, to be used strictly as a business account. My friend has been working as an independent contractor for a number of years, but she only ever had the one bank account. This meant, she was using the same account that her invoices were being paid into to buy things like shoes or groceries, which played havoc with her bookkeeping.

Recently, at the suggestion of her accountant, a friend of mine opened a new bank account, to be used strictly as a business account. My friend has been working as an independent contractor for a number of years, but she only ever had the one bank account. This meant, she was using the same account that her invoices were being paid into to buy things like shoes or groceries, which played havoc with her bookkeeping.  That’s when, after some digging, I came across the

That’s when, after some digging, I came across the