In our last post we discussed why we updated our MYOB training material to include MYOB’s cloud accounting software Account Right Live and how you could benefit from operating a completely remote or virtual bookkeeping business, which is great; but how do your clients benefit from your working remotely?

Convincing the Clients

Winning new clients is always difficult, but it can be especially difficult to convince the old school business owner that hiring a virtual bookkeeper is the way to go: “But I like having someone come in and sit down with me” is not an uncommon counter remark; while for many the idea of a remote bookkeeper conjures notions of unqualified cowboys.

If you’re thinking about starting a virtual bookkeeping business or turning your existing business into a virtual one, then you need to get used to overcoming these obstacles if you’re going to have any success.

It’s worth stating upfront to any potential clients, or existing clients you’re trying to convert, the benefits of retaining a remote bookkeeper over your bookkeeper that makes house calls, or office calls, rather.

Just some benefits:

- By retaining a virtual bookkeeper, your clients only pay for time worked; that means their hourly rate is not inflated with hidden travel costs, which usually includes the time they spend commuting to your office

- Virtual bookkeepers don’t have the costly overheads of renting office space, paying for utilities, equipment, storage space, and so forth — all of which decreases their hourly rate

- For those businesses that may usually employ a bookkeeper as a full-time or part-time member of staff, using a remote bookkeeper means they’re no longer paying sick leave, annual leave and other entitlements

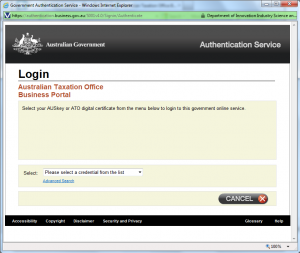

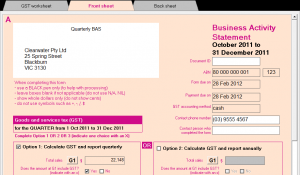

- All bookkeepers, whether they work remotely or otherwise, have to be accredited by the Tax Practitioners Board to offer BAS services.

***

If you’re thinking of starting a virtual bookkeeping business, our online MYOB course covers MYOB Account Right Live — a necessary piece of software to make any virtual bookkeeping business not only successful, but also feasible.

To combat stress and losses in productivity, managers and employees alike, need to implement protocols to enable teleworkers to switch off.

To combat stress and losses in productivity, managers and employees alike, need to implement protocols to enable teleworkers to switch off.