Is it a good time to start a bookkeeping business?

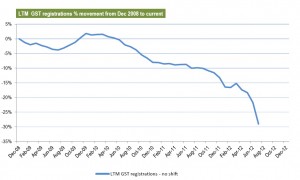

Tim Reed, the CEO of MYOB recently mentioned that they track the number of Australian business registering for GST because it gives a good indication of the number of business entering the market and the chart showed an astonishing decline in the last 12 months. What I found most interesting is that our recent blog about Starting a bookkeeping business cheaply was one of our highest read blog posts. So is it a good time to start one?

Is there a need?

If you ask any business owner or accountant you will soon discover that there is always a need for good bookkeepers. Most business owners start out in business because they are good at their craft and bookkeeping is the last thing they want to worry about. After all, it is a compliance issue not a money earning issue. What do I mean by compliance? I mean the Australian Taxation Office require you to lodge your financial information with them if you want to operate a company.

The next common question is how much will I earn as a bookkeeper and the answer depends on how good you are and how you want to work. If you are an employee working full-time for a company you will most likely earn award wages, if you are a bookkeeping business owner you can charge more because your customers know that you have a business to run, but also because you are only working for them a handful of hours per week or month.

There is a need for MYOB skills

One of the most commonly sort after skills in Australian office administration type jobs is the ability to use MYOB accounting software. We have many students from accounting backgrounds do our MYOB Training Courses because they haven’t used the software in their corporate work. We’ve even had bookkeepers perform our courses because many Cert IV’s in Bookkeeping (a common course for those wanting to be registered BAS agents) do not include training on how to use MYOB – they cover bookkeeping principles.

Who are your competitors?

If you look at the graph in this blog post you should probably be encouraged to start a bookkeeping business because it appears that your competitors are scared to start one right now. It’s also a good time to note that the bookkeeping business is starting to become a regulated industry and a profession in it’s own right. After all you need qualifications and to be a registered BAS agent if you are going to operate a bookkeeping business these days and with these higher standards come higher expectations and higher pay.

If you explore your local competitors in your bookkeeping business planning process you will start to better understand just how important bookkeeping is. It will make you feel more comfortable in choosing your new profession and taking the right steps to get to your desired goal.

Do you have what it takes?

The real question you should ask yourself if you are looking at starting a bookkeeping business is do you have what it takes? Are you good at explaining bookkeeping and accounting terminology to your customers in their own language? Do you have the skills to get the job done quickly and efficiently. Do you have the confidence to speak to prospective customers and charge the amount you want to charge?

The business planning stage is very helpful in building your confidence, but the winning formula is:

- a willingness to speak openly and simply with potential customers,

- find solutions to customers problems and

- explain accounting to them in simple language

Remember that owning a bookkeeping business requires people skills, business skills and bookkeeping skills. If you are interested in starting a bookkeeping business contact our business partners at workface.com.au and begin your journey to flexible hours and business success.