I recently wrote about my discoveries of the preferred accounting software for local startup businesses in Sydney and wanted to share something that our resident BAS agent, certified bookkeeper and MYOB trainer has created for you. A training video about how to enter a payment for an invoice you create using Xero online accounting software.

I recently wrote about my discoveries of the preferred accounting software for local startup businesses in Sydney and wanted to share something that our resident BAS agent, certified bookkeeper and MYOB trainer has created for you. A training video about how to enter a payment for an invoice you create using Xero online accounting software.

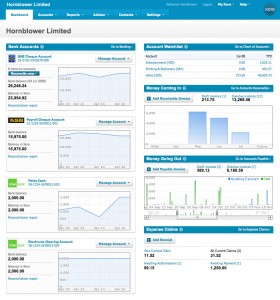

If you are looking at starting your own bookkeeping business it is useful to learn more than just MYOB accounting software to widen your potential client base. It is also good to learn about an online accounting program that is growing very fast in user adoption, such as Xero. Why is Xero growing so fast? There are several reasons, but one simple reason is that you can access your accounting file from anywhere.

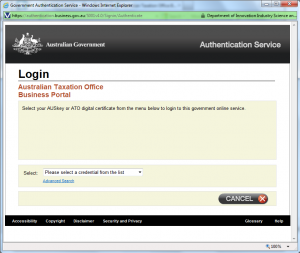

As you can see in the free Xero training video at the bottom of this blog, using online accounting software is just like using many other online services, you login and click, type, tab etc. One of the other great features that we have discovered from speaking with accountants and some IT professionals is that your accountant or your bookkeeper can use your accounting system at the same time as you do, without having to worry about sending a data file and wondering who has the most recent version of that data file.

One of the new great features of doing your MYOB training courses with EzyLearn is that you have 12 months free access to the Bookkeeping Academy, through which we will be releasing hundreds of bookkeeping training videos to help budding bookkeepers learn a wider range of software as well as develop new skills to help them find work or build their own business.

Feel free to let us know if you are a XERO user and share your experiences at our facebook page.