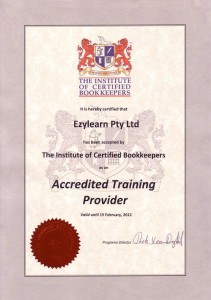

In our last post about getting bookkeeping clients for free, we mentioned how the Institute of Certified Bookkeepers (the ICB) only adds bookkeepers to its Practice Directory who are Cert IV-qualified. Having a Cert IV qualification in bookkeeping enables you to apply to the Tax Practitioners Board to become certified to provide BAS services to your clients.

Only Needed for Lodgement of BAS

However, most of the work carried out by a BAS agent is work that can be completed by a bookkeeper without a Cert IV; it’s just that only registered BAS agents can lodge a BAS return for their client.

So while it may be useful for some contract bookkeepers to get their Cert IV qualification so they can lodge their client’s BAS returns among other things, it’s not necessary if you only want to manage the data entry for your clients.

Bookkeepers Needed for Data Entry

In fact, bookkeepers carrying out data entry is one of the core functions required by a lot of small businesses and sole traders because they have become too busy to look after it themselves and because it takes them away from their core work.

An experienced bookkeeper that can look after a business’ books is still an incredibly valuable asset to any business, and as more and more Australians go into business for themselves, the demand for bookkeepers is going to increase.

***

So if you’ve completed our LIFETIME access MYOB Training Course with the certificate option, contact us today to arrange to have your profile placed on the MYOB Bookkeeper Directory.