As the end of the financial year (EOFY) approaches in Australia, small business owners need to start preparing their financial records and making important decisions.

June 30 is more than just a date — it’s a deadline that can impact your tax bill, cash flow, compliance, and even future funding opportunities.

Whether you’re a sole trader, company director, or small business operator, proper planning can save you stress, time, and money.

Here are the top 5 accounting tasks every small business must do before June 30.

1. Reconcile Your Accounts and Finalise Bookkeeping

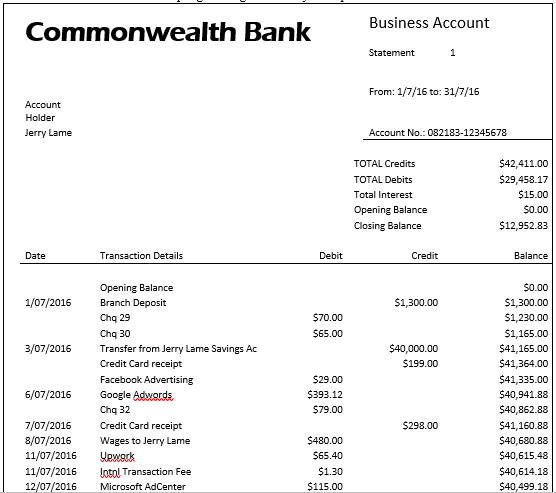

Start by making sure all your accounts are reconciled — including bank accounts, credit cards, loan accounts, and payment gateways like Stripe, PayPal or Square. This ensures your financial data matches what’s in your actual bank account and eliminates discrepancies that could lead to errors in your tax return.

You’ll also want to:

- Ensure all sales and expense invoices have been entered and correctly coded.

- Chase any unpaid invoices and write off bad debts if necessary.

- Categorise and attach receipts to transactions using your accounting software (e.g., Xero, MYOB or QuickBooks).

- Review asset purchases or disposals during the year and update your depreciation schedule accordingly.

Doing this now will make it easier for your accountant to prepare your year-end financials — and help you get your tax return lodged faster.

See our QuickBooks Online, MYOB and Xero Bank Reconciliation Courses

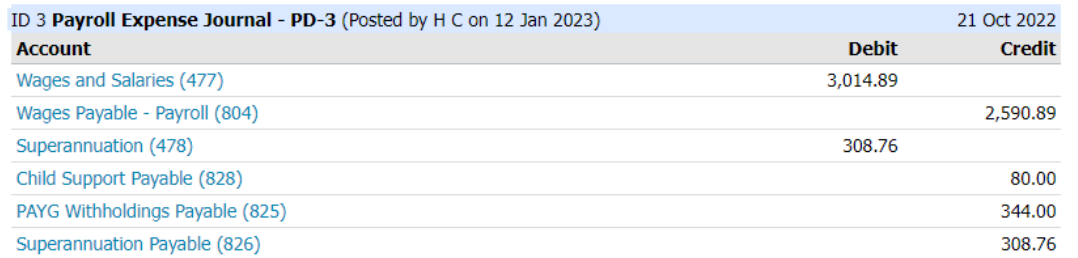

2. Review Your Payroll and Superannuation

If you have employees or even just pay yourself through payroll, your EOFY payroll reporting must be correct and compliant with the Australian Taxation Office (ATO).

Here’s what you need to check:

- STP Finalisation: Single Touch Payroll (STP) finalisation declarations must be completed by July 14. Make sure all payslips are accurate, year-to-date figures are reconciled, and no duplicates exist.

- Super Guarantee (SG): Super contributions for the April–June quarter are due by July 28, but if you want to claim a tax deduction this financial year, ensure they are paid and received by the super fund before June 30.

- Double-check that you’ve met the current SG rate (11% as of FY 2023–24) and that any salary sacrifice arrangements are correctly reported.

Many businesses use this time to switch payroll systems or review wages ahead of the next financial year — so now is a good time to review employee entitlements, awards, and changes to the minimum wage.

See our QuickBooks Online, MYOB and Xero Payroll Courses

3. Take Advantage of Tax Deductions and Instant Asset Write-Offs

EOFY is your last chance to strategically reduce your tax bill by claiming all eligible deductions. This includes everyday operating costs like:

- Business vehicle expenses

- Office rent

- Internet and phone bills

- Accounting software subscriptions

- Staff training

- Marketing and advertising

Additionally, the Instant Asset Write-Off scheme may still apply, allowing you to immediately deduct the cost of eligible business assets purchased before June 30 (subject to thresholds and eligibility). This can include things like laptops, tools, or equipment used to run your business.

Speak with your accountant about whether it’s worth bringing forward expenses (such as pre-paying rent, insurance, or subscriptions) to claim the deduction this year.

4. Do a Stocktake and Review Your Inventory

If your business holds inventory — whether it’s retail stock, food and beverage, raw materials, or finished goods — a stocktake is required at the end of the financial year.

You’ll need to:

- Physically count your stock on hand as of June 30.

- Write down obsolete or unsellable inventory.

- Adjust your accounting software or inventory system to reflect actual quantities and values.

Why it matters:

- Accurate inventory levels help determine your cost of goods sold (COGS).

- It affects your gross profit and taxable income.

- It ensures your balance sheet is accurate and useful for making financial decisions.

Pro tip: Use this opportunity to streamline your inventory system and get rid of slow-moving or obsolete stock through clearance sales or donations.

5. Meet With Your Accountant and Plan Ahead

Finally, book a meeting with your accountant or bookkeeper before June 30 — not after. This allows you to implement any last-minute tax strategies, rather than simply reporting what’s already been done.

During this meeting, consider discussing:

- How your business performed this year

- Your likely tax position and any payments due

- Whether to defer income or bring forward expenses

- Capital gains tax (CGT) events or asset sales

- Superannuation contributions, especially if you’re self-employed

- Budgeting and forecasting for the new financial year

Your accountant can also help you identify whether your business structure is still right for your goals, or if it’s time to move from sole trader to company or trust structure.

Bonus Tip: Stay Organised for Next Year

If you found EOFY stressful this year, use this opportunity to invest in tools or services to make next year easier:

- Set up regular reconciliations in your accounting software.

- Automate invoice reminders to improve cash flow.

- Consider outsourcing your bookkeeping if it’s holding you back.

- Keep digital receipts organised with tools like Dext or Hubdoc.

Final Thoughts

The end of the financial year doesn’t need to be a panic-ridden time if you’re organised and proactive. By reconciling your accounts, reviewing payroll, maximising deductions, completing stocktakes, and meeting with your accountant, you’ll be in a strong position to meet your tax obligations and grow your business with confidence.

Whether you do your books yourself or work with a professional, staying on top of EOFY responsibilities is a sign of a smart, sustainable business.

Now’s the time — don’t leave it until June 29!

Bookkeeping Course Options

Business owners and Managers

EzyLearn’s COMPLETE Bookkeeping Courses include every skill level for most accounting tasks from set up and configuration to financial reporting, BAS and Payroll.

See the Complete Bookkeeping Courses for QuickBooks Online, MYOB and Xero

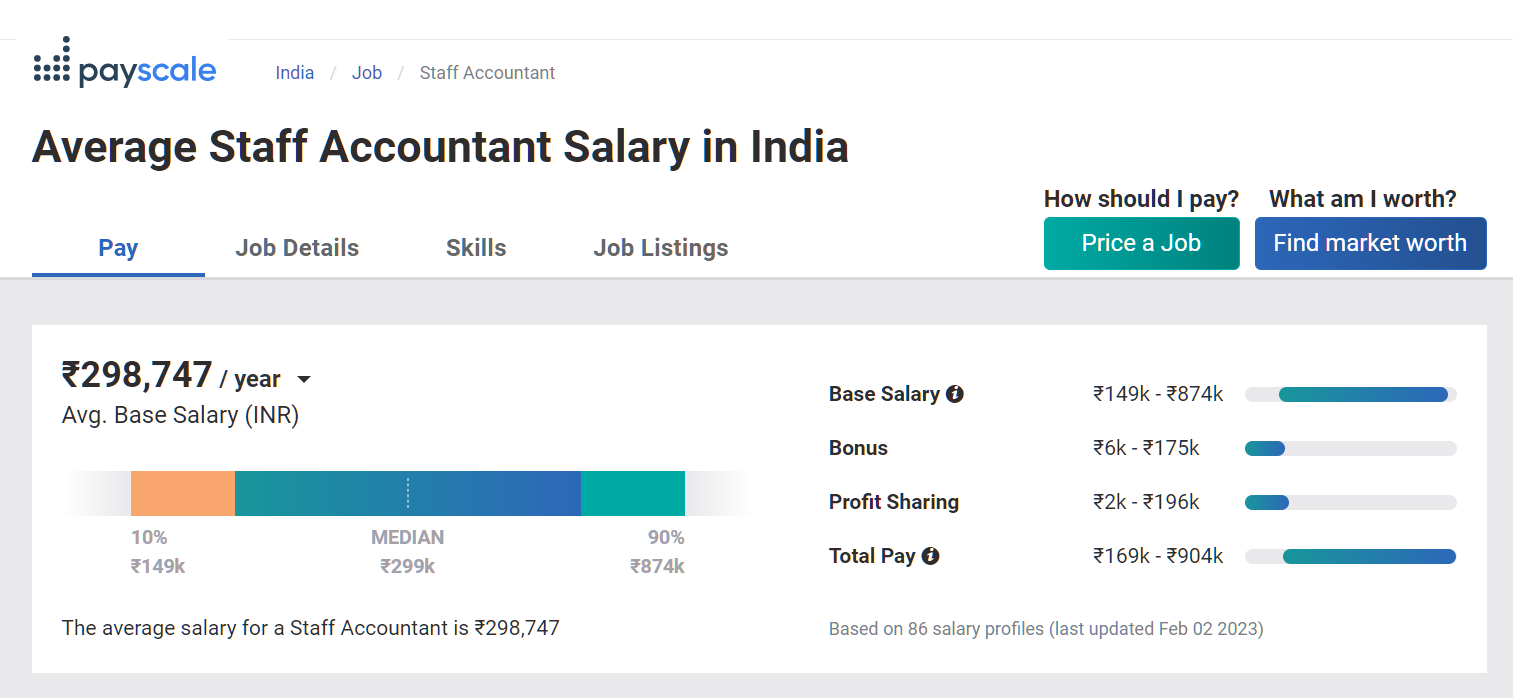

Jobseekers, bookkeepers and part-time employees

If you are looking for work, are a contract bookkeeper who wants more clients or a part-time accounts employee you will find that businesses use different accounting programs. EzyLearn has catered for this with our Bookkeeping Academy course packages.

See Bookkeeping Academy Course Packages

***

***

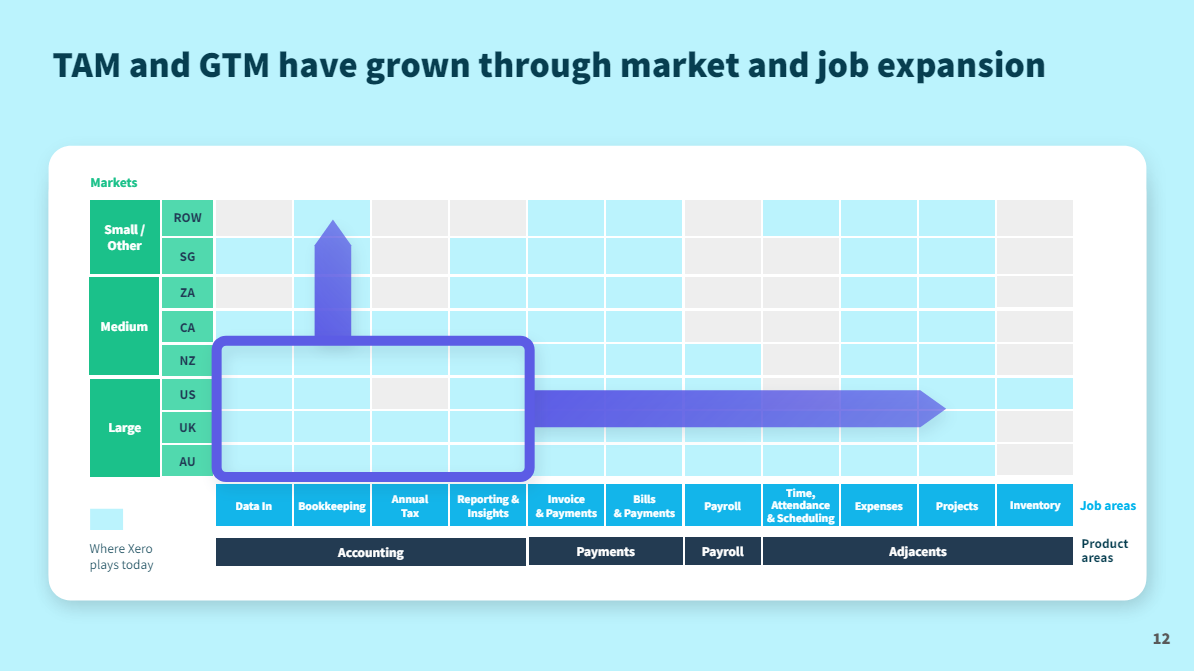

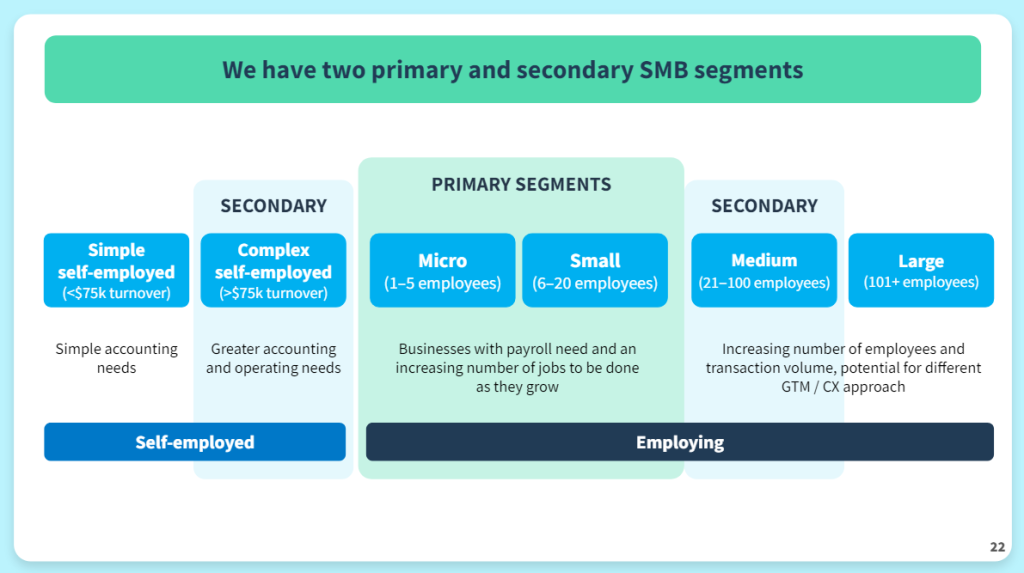

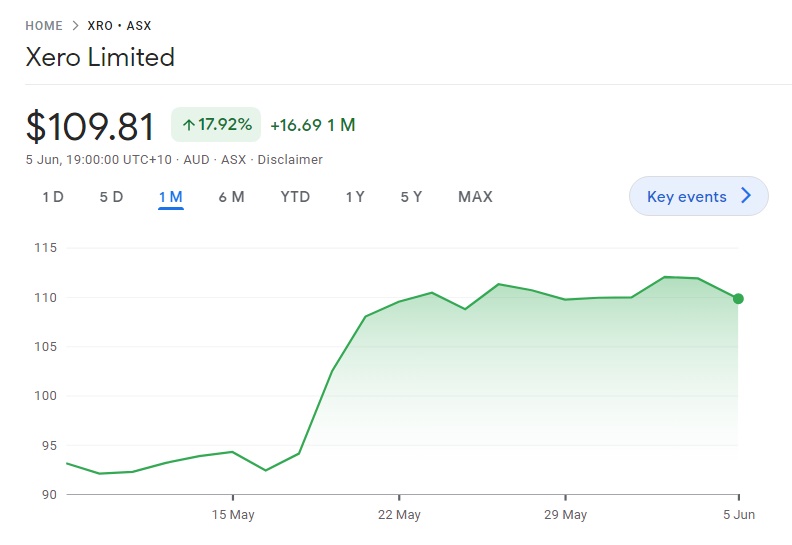

The premium MYOB product with the PLUS on the end of its name has always come with Inventory and Payroll. These have been the major services that justify the premium price that users have been willing to pay. Now Xero comes with it as standard! Is it another nail in MYOB’s coffin?

The premium MYOB product with the PLUS on the end of its name has always come with Inventory and Payroll. These have been the major services that justify the premium price that users have been willing to pay. Now Xero comes with it as standard! Is it another nail in MYOB’s coffin?