Now that paying by card is the norm, retailers have needed to adapt to the cashless customer. If you’ve been to some local markets recently, maybe a sporting club canteen or even your regular café, you may have noticed that you’re tapping your card on a little white square instead of an EFTPOS machine.

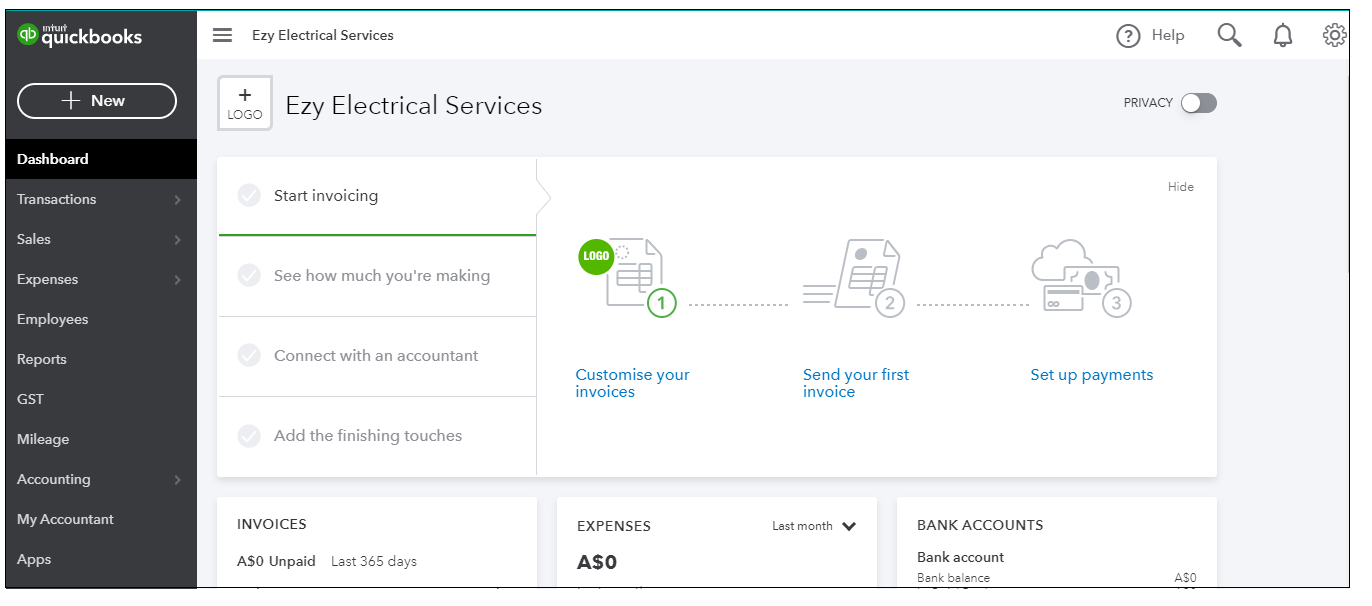

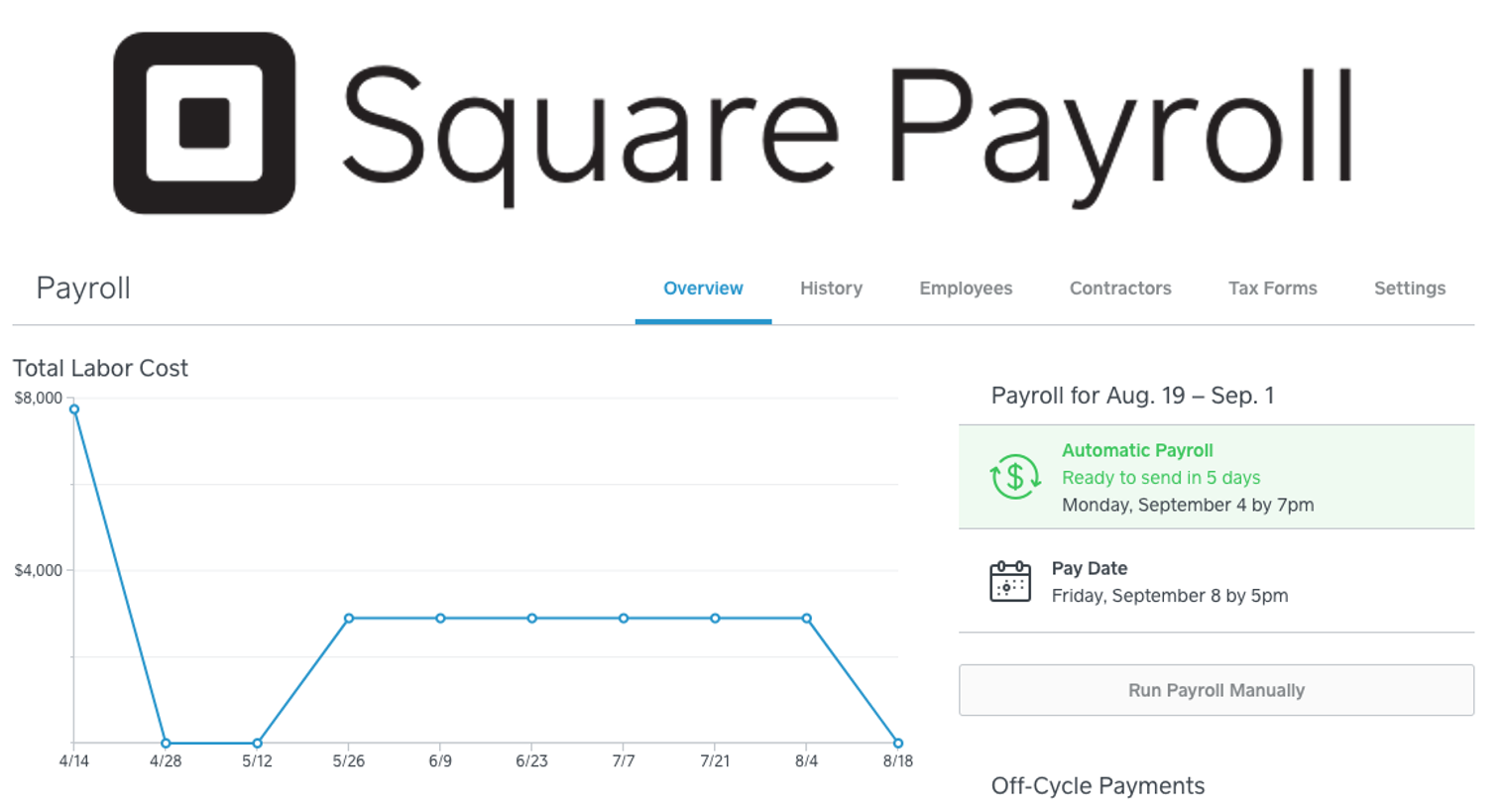

Block Inc. – previously known as Square Inc – is a point-of-sale (POS) system winning over retailers and enterprises across the world. And it’s not just little white payment terminals, Square offers a range of technology and services that range from POS to payroll to inventory to marketing, AND, they recently purchased AfterPay!

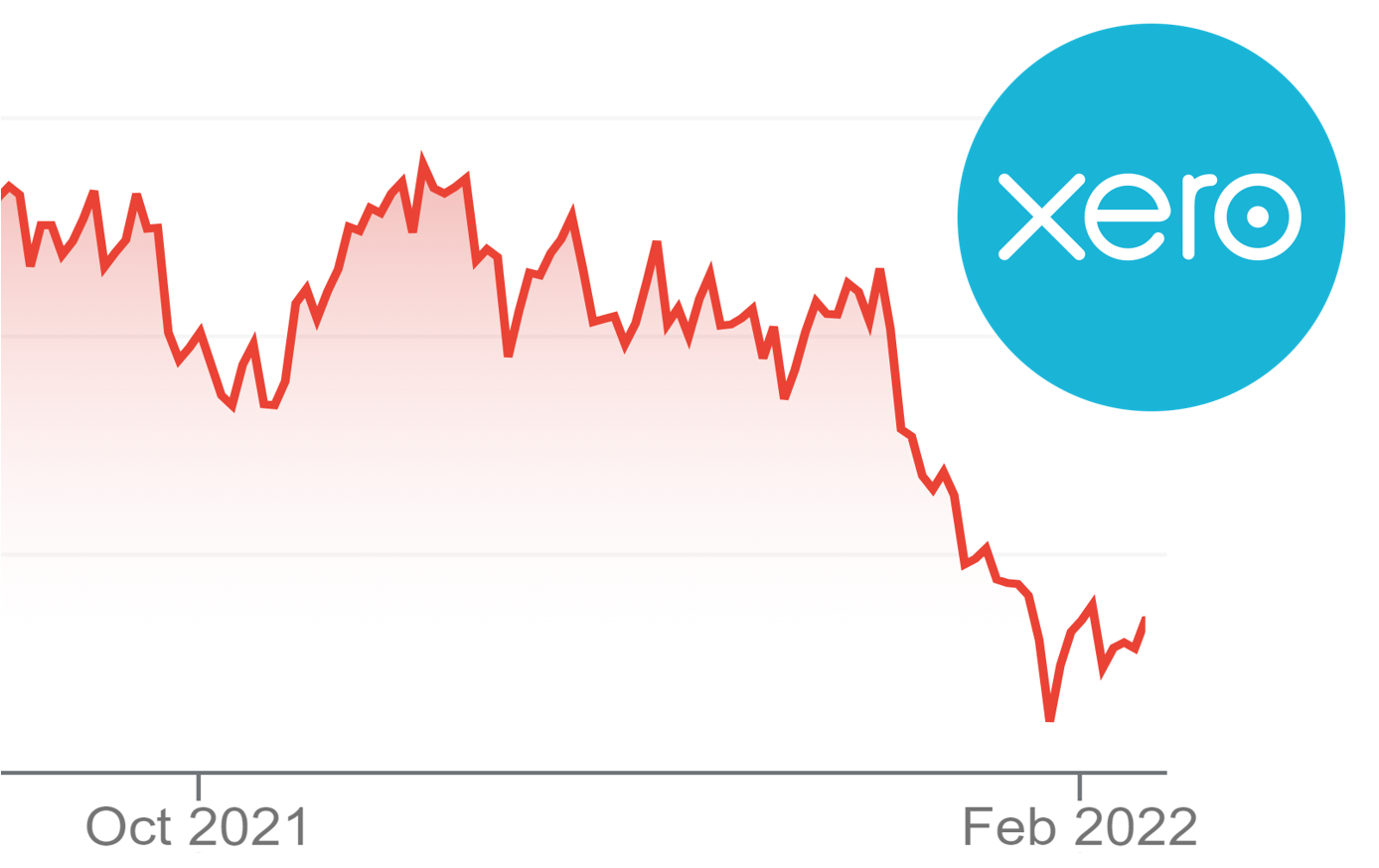

Square integrates with Xero, and considering its popularity, let’s break down what Square is and how it compares to other Xero integrations like Planday.

Continue reading Payroll Training Course Integrations: Square Payroll versus Xero?