I’ve been getting up at 5.15am for the last 2 years – am I crazy?!

I’ve been getting up early because I work out with some friends and prefer early mornings to late nights. This means that I’m going to bed earlier and not working as much at night.

In the past I preferred to work late into the night and pushed myself to get as much work done as I possibly could. Sometimes this meant working until midnight but I noticed that the quality of the work wasn’t always the best.

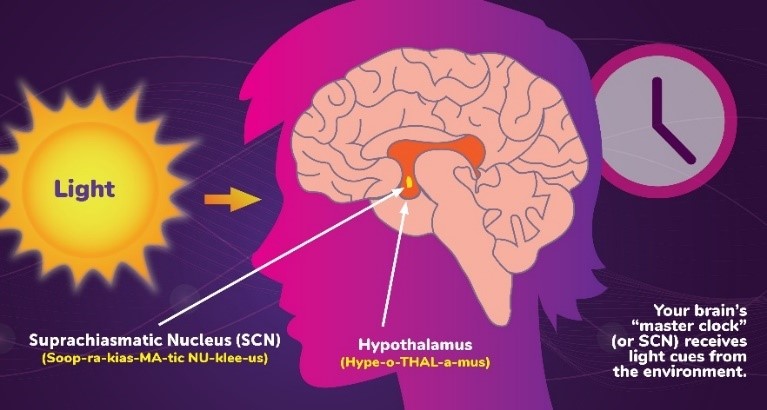

The sun rises pretty early and I’d rather work with the natural light of the day than the artificial light of the night. I dug a little deeper into this and discovered that there are studies that explains how we perform at various times of the day and how that is affected by when we get up and go to bed – Circadian Rhythms.

Circadian Rhythms can affect how well you perform when studying too..

Continue reading When is the best time to study? Early mornings or late nights?