As part of our commitment to be the number one choice for online MYOB Bookkeeping training courses we are always keeping an eye and ear out for changes and improvements in the bookkeeping industry. If you do your own banking reconciliation, you might agree that sifting through printed statements and checking each entry off in your accounting software is maybe the most tedious part of bookkeeping.

But it need not be. With accounting bank feeds – a new feature in the world of cloud accounting – your bank transactions are automatically synched with your cloud accounting software.

This means that as long as you’ve entered your purchases into your accounting software, when your statement comes in from your bank, it will automatically marry up your purchases for you to approve with just the click of a button.

Automatic bank feeds removes the single most tedious step from the banking reconciliation process, which, depending on the size of your company, can take anywhere fifteen minutes to two hours (sometimes even more).

For a little more detail on how MYOB and bank feeds works, watch this video:

http://youtu.be/XKBUH5ycGYY

Or, for more information on how Xero and bank feeds work, watch this video:

http://youtu.be/qTsy3lW-UZM

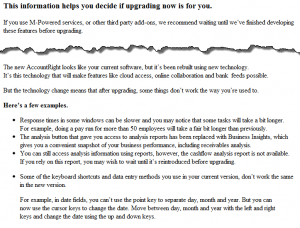

But it’s important to know how your accounting software will access your sensitive banking information as currently there are two main methods for doing so.

First there is the method used by the likes of MYOB where your accounting software provider integrates a direct feed of your bank transactions from each of your banks into your software without needing your bank username and password.

The second method, called screen scraping, requires your accounting software to use a third party to access your bank transactions, thus necessitating your bank usernames and passwords, which can become a grey area with regards to protecting yourself from banking fraud.

While the companies that use the screen scraping method take security very seriously, should a breach occur, you could find yourself in violation of your bank’s terms and conditions because you gave out your usernames and passwords.

It’s up to you to choose what method you feel comfortable with but always check your bank’s terms and conditions before you give out your login in details.

Whatever option you choose, by eliminating the hours of data entry, your saving not only time, but also money.

And for the layperson doing their banking reconciliation themselves, services like Shoeboxed only eliminate the data entry even further.

PS: We’re also almost ready to announce our new Cert IV in Small Business Management with the Australian Small Business Centre so if you are looking to start a business or learn the skills to manage one stay tuned…