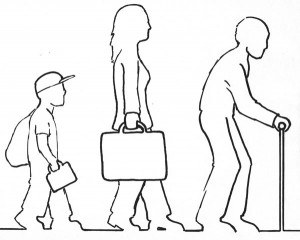

Lifelong learning is the concept that learning isn’t confined to an individual’s childhood, but can be pursued throughout their life, and often in non-traditional settings. With lifelong learning, the knowledge or skills a person acquires through social interactions and other everyday experiences (soft skills) are considered just as important as those learned in formal education settings.

Lifelong learning is the concept that learning isn’t confined to an individual’s childhood, but can be pursued throughout their life, and often in non-traditional settings. With lifelong learning, the knowledge or skills a person acquires through social interactions and other everyday experiences (soft skills) are considered just as important as those learned in formal education settings.

This approach means that learning is no longer considered to take place at two, traditional stages of a person’s life — school and the workplace — but rather is ongoing throughout the individual’s life.

How lifelong learning was born

The concept of lifelong learning isn’t new. It’s been around since the 1970s, when it was referred to as “lifelong education” by the French politician Edgar Faure in his 197s book “Learning to Be”. Lifelong learning gained more recognition during the 1990s, particularly with the publication of the Delors Report by the Delors Commission in 1996.

The Delors Commission was an administration of the European Union led by Jacques Delors through the 1980s and again through the 1990s. The Delors Report proposed an integrated vision of education based on two key concepts:

- Learning throughout life

- The four pillars of learning

The Delors Report identified three characteristics of modern life that made lifelong learning necessary, in order for individuals to remain productive and actively engaged members of society throughout their lives. Those characteristics included technological, economic and social change.

Technology made lifelong learning vital

From the mid 1990s onward, rapid technological advancements have made lifelong learning especially critical for people in the workplace. Aside from the need to keep up-to-date with changes to software (desktop software shifting to the cloud) and the introduction of new technologies (smartphones and tablets), technology has also changed the way people work.

The majority of adolescents who start university today, will be studying for a degree in the profession that will not exist in twenty years time. But in twenty years, jobs will exist that did not today, just as social media and search engine optimisation did not exist twenty year ago. And this drives the need for people to engage in lifelong learning.

Technology has also fundamentally changed our economy. More people engage in freelance or contract work than they did twenty years ago, and that’s given rise to what’s now called the “gig economy” — people engaging in short term, piecemeal or temporary work as their primary means of income.

And that’s all coincided with some big changes to our society. Paid parental leave, for example, sees dads taking time off work to become the primary carer of their children, while a new crop of mums have chosen to start home-based businesses so they can work flexible hours while they care for their children.

In each instance of change, be it technological, social and economic — though technology is the driving force of all three — people have had to learn new skills for their workplace, either formerly or informally.

The four pillars of learning

The Delors Report, which brought the concept of lifelong learning to greater prominence in the 90s, identified the four pillars of learning, which make up a central component of lifelong learning. The four pillars of learning involve:

- Learning to know — the mastery of learning tools rather than the acquisition of knowledge

- Learning to do — acquisition of occupational skills for jobs today and those in the future

- Learning to live together — resolving conflict, discovering other people and culture, fostering community, economic resilience, social inclusion (soft skills)

- Learning to be — education that contributes to an individual’s complete development (to act with autonomy, use judgment and take personal responsibility.

Implementing lifelong learning

Since the 1990s and the release of the Delors Report, universities and other formal education institutions have implemented some elements of lifelong learning, particularly the “learning to know” and “learning to live together” pillars of learning. In high school, students will study society and culture as a component of their HSC. This is designed to equip them with the tools to develop values and attitudes that promote social literacy and cohesion.

Workplaces have also become responsible to promoting lifelong learning by requiring employees to carry out continuing professional development (CPD) — although this is sometimes an industry requirement, as in the financial services and real estate sectors, for example.

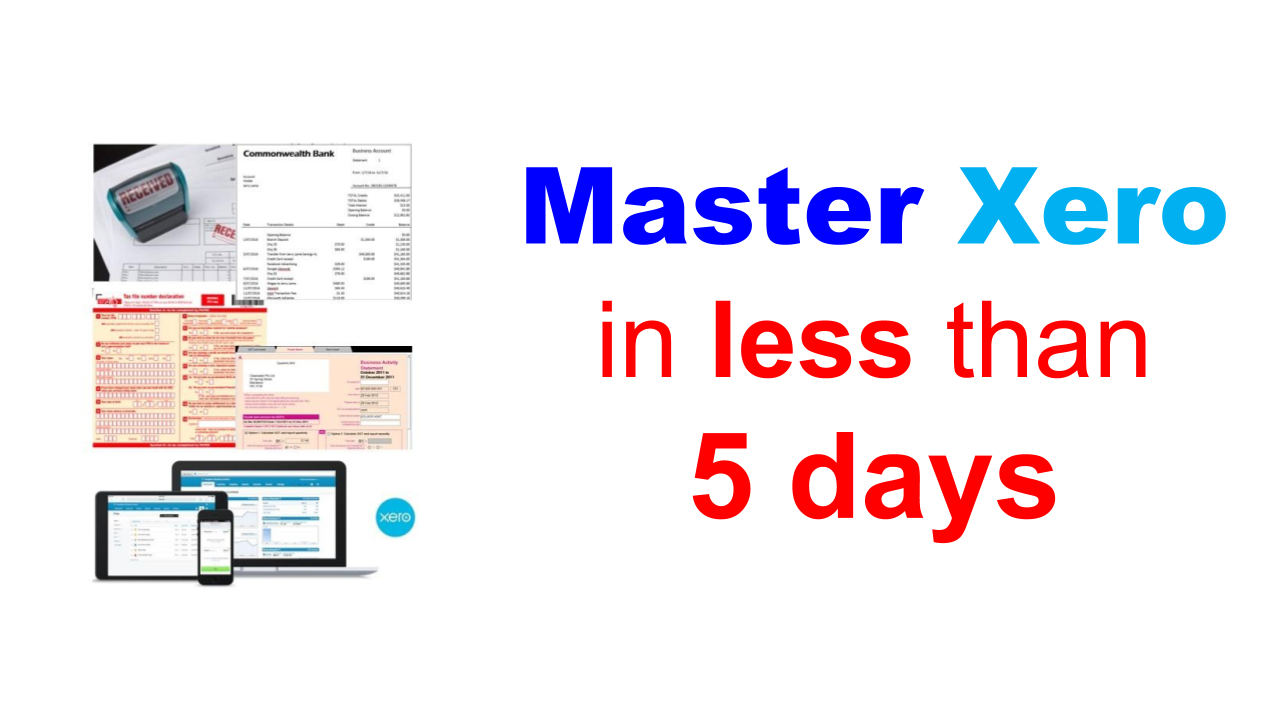

Bookkeepers and BAS agents are required to maintain a certain number of CPD points each year in order to keep their BAS registration. The Institute of Certified Bookkeepers (ICB) is just one of many Recognised Professional Associations and it lists accepted training courses, including Microsoft Excel and cloud-accounting software training which are all available as LIFETIME Courses with EzyLearn! I like to think that EzyLearn can go one better than Delor and offer students the option to get LIFETIME course access to Xero rather than LIFELONG paying for Xero Courses.

Bookkeepers and BAS agents are required to maintain a certain number of CPD points each year in order to keep their BAS registration. The Institute of Certified Bookkeepers (ICB) is just one of many Recognised Professional Associations and it lists accepted training courses, including Microsoft Excel and cloud-accounting software training which are all available as LIFETIME Courses with EzyLearn! I like to think that EzyLearn can go one better than Delor and offer students the option to get LIFETIME course access to Xero rather than LIFELONG paying for Xero Courses.

This November, Xero also launched it’s own lifelong learning platform, in conjunction with Swinburne University. The Xero lifelong learning platform is currently being piloted in Australia and New Zealand, with a full global rollout expected in 2018.

Xero lifelong learning

The Xero offering will be available for secondary and tertiary students, as well as businesses. It will provide students with access to a learning management system (LMS) that will deliver training in the form of business scenarios and simulations, in addition to grading and assessment tools.

Xero’s chief partner officer Anna Curzon said in a statement that technology has “reshaped the way people work” and created a need for lifelong learning so people can “stay relevant in the workforce”.

“Handling finances, both personal and business, is a necessity for everyone, from school age students to retirees,” she said.

“Xero lifelong learning platform allows students to grow their financial literacy to help prepare them for the real world.”

Curzon also said that the gig economy is driving demand for Xero’s services, which in itself is driving demand for a lifelong learning platform centered around financial literacy.

No pricing for Xero’s lifelong learning platform has been released, though it’s understood it will be included in the subscription price of the Xero software for businesses.

Ref#728

And as a gift to you, remember our

And as a gift to you, remember our