Why It Pays to Call the Switchboard When Doing a Reference Check

I recently had a conversation with a colleague who said she’d never once been asked to produce a copy of her university degree or her transcripts, despite stating on her resume that she’d graduated with a high distinction average.

Gee, I thought, not once? Not a single recruiter or employer had ever requested a copy of her degree? I found this fact astonishing, particularly since more professions require, by law, certain qualifications — as BAS agents are, for example. So how people know my friend wasn’t fibbing in her credentials? Fact is, they didn’t.

Check, even if you use a recruiter

I wrote a blog some time ago about recruiting on LinkedIn and why it’s so important to check references for yourself. People often underestimate the importance of checking a person’s credentials, so long as they get a reference from their last employer. Often, though, most people only provide a mobile number for their references, so whether you’re speaking to the candidate’s former employer, a co-worker, or their mum is sometimes anyone’s guess.

I was reminded of how important reference-checking is again, when I was reading a couple of articles on Longreads, and I found myself utterly fascinated by two of the biggest cases of journalistic fraud ever committed (though I admit to having never heard of them before the weekend, despite one occurring more than 30 years ago).

Sometimes people don’t just lie on their resume

In the first instance, a journalist named Janet Cooke fabricated a story for The Washington Post about an 8-year-old heroin addict. She won a Pulitzer Prize for it in 1981, and then had to give it back when it came out that there was no such 8-year-old. In the second case, Jayson Blair, a journalist for The New York Times, was found to have fabricated or plagiarised 36 out of 73 stories written over a 6-month period, in what turned out to be the biggest scandal in the newspaper’s hundred-plus year history.

What I found most intriguing, though, was that neither Cooke nor Blair had been properly vetted before their employers hired them. In fact, it was Cooke’s falsified resume that was ultimately her undoing when, after receiving the highest honour in the field of writing, a former employer noticed something was amiss with her Pulitzer biography — her education and professional achievements had been grossly overstated. (Rather ironically it was Bob Woodward, of Woodward and Bernstein — the journalists who uncovered the Watergate Scandal — who signed off on hiring Cooke.)

The same would prove true for Blair, who, it turned out, never graduated from university, and had a murky work history with the Times’ sister publication, The Boston Globe, where his superiors had been less than impressed with his less-than-high standard of work.

(Of course, the equally interesting case of Australian author, Helen Demidenko, who won the Miles Franklin Award in the early 1990s, only to later be dubbed by the Sydney Morning Herald as a ‘literary hoax’ also springs to mind.)

Benders-of-truth almost always get caught

Plenty of people lie or embellish on their resumes, and while a good majority of them go unnoticed, others are caught out — sometimes very publicly, and often only after the organisation has been very publicly embarrassed, as in the case of Cooke and Blair.

My advice, then, is to always check the references of new hires meticulously. Rather than calling the mobile numbers or direct lines of the candidate’s references, call the main switchboard and ask to speak to that person’s manager or superior.

And always ensure to ask for a copy of any credentials, like university degrees. If you’re employing someone where, by law, they’re required to hold a certain qualification — as is the case for BAS agents, for instance — it’s imperative you can verify the person’s credentials.

***

At EzyLearn we offer online training courses to help you up-skill and find employment. Choose from our range of cloud-based online accounting software courses, to business start up and management courses, to marketing and sales courses, or update and further your skills in a range of Microsoft Office programs (Excel, PowerPoint, Word) or social media and WordPress web design).

At EzyLearn we are constantly refreshing the content of our online training courses. Where possible, we draw on real-life case studies as examples, to help you learn, and apply your skills, in a relevant way that makes sense.

At EzyLearn we are constantly refreshing the content of our online training courses. Where possible, we draw on real-life case studies as examples, to help you learn, and apply your skills, in a relevant way that makes sense.  We recently updated our advanced

We recently updated our advanced

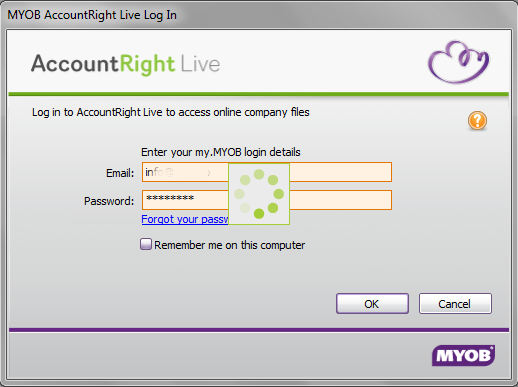

Most businesses using an accounting program like MYOB or Xero will use the included payroll package to manage their employees’ payroll. For businesses with only a few employees, however, the additional payroll function is an unnecessary expense.

Most businesses using an accounting program like MYOB or Xero will use the included payroll package to manage their employees’ payroll. For businesses with only a few employees, however, the additional payroll function is an unnecessary expense.

We’ve recently updated our

We’ve recently updated our

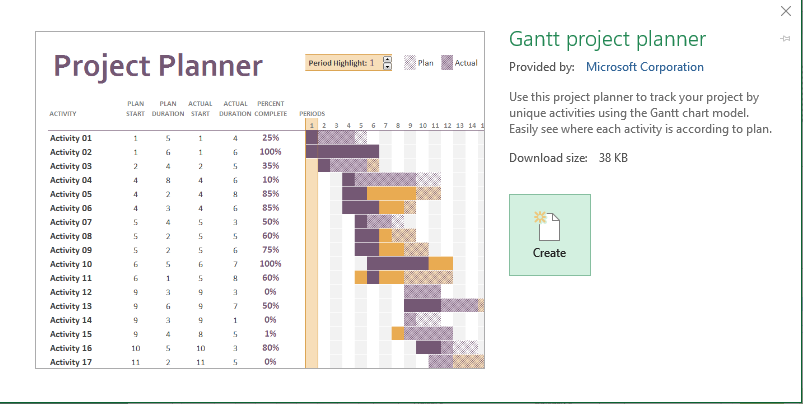

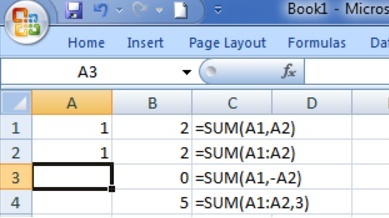

Before computers and Microsoft Excel came along, accountants used a pen and paper to keep track of their clients’ business financials. And before that, before the numeral system was invented, the abacus was the main accounting tool used by merchants and traders to keep track of their finances.

Before computers and Microsoft Excel came along, accountants used a pen and paper to keep track of their clients’ business financials. And before that, before the numeral system was invented, the abacus was the main accounting tool used by merchants and traders to keep track of their finances.

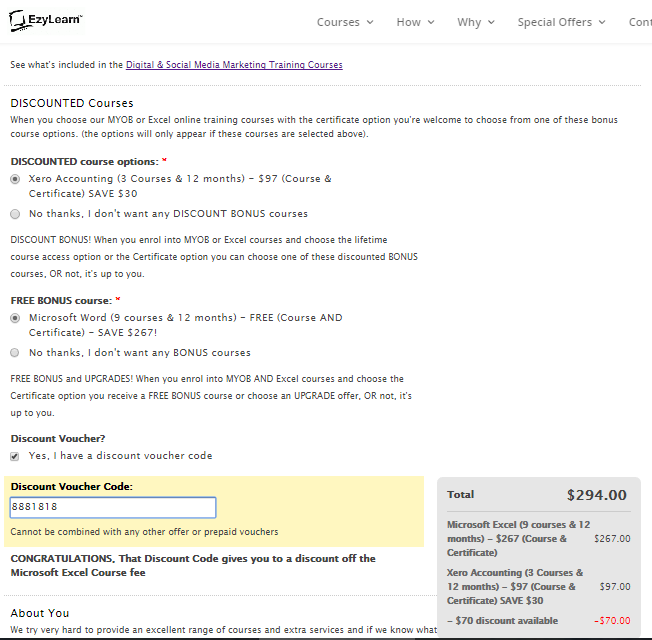

With the New Year coming fast we find most of our students are looking to change careers and/or up-skill so as to feel confident with their computer skills in job interviews and the like, so our current special offers will train you up to be your best, cheaply. Here’s all you need to do:

With the New Year coming fast we find most of our students are looking to change careers and/or up-skill so as to feel confident with their computer skills in job interviews and the like, so our current special offers will train you up to be your best, cheaply. Here’s all you need to do:

One of the most powerful internet based applications that we use everyday is Dropbox. It’s powerful because it enables you to automatically backup any files you save into your Dropbox folder AND it enables you to access your files from any computer. When you delve deeper into Dropbox and start using it on your Smartphone you’ll also discover that every photo you take on your phone (and screen shot) can be automatically saved into your “Camera Uploads” folder within Dropbox so no matter how much phone storage space you have you’ll always have a copy of images in Dropbox.

One of the most powerful internet based applications that we use everyday is Dropbox. It’s powerful because it enables you to automatically backup any files you save into your Dropbox folder AND it enables you to access your files from any computer. When you delve deeper into Dropbox and start using it on your Smartphone you’ll also discover that every photo you take on your phone (and screen shot) can be automatically saved into your “Camera Uploads” folder within Dropbox so no matter how much phone storage space you have you’ll always have a copy of images in Dropbox.