As part of the research into our Continuing Professional Development (CPD) program for MYOB training course students we are exploring different webinar platforms and we thought you’d be interested to learn about it. For existing EzyLearn students it will mean free MYOB Bookkeeping webinars in the coming months.

As part of the research into our Continuing Professional Development (CPD) program for MYOB training course students we are exploring different webinar platforms and we thought you’d be interested to learn about it. For existing EzyLearn students it will mean free MYOB Bookkeeping webinars in the coming months.

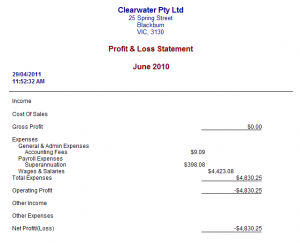

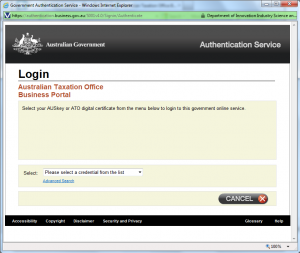

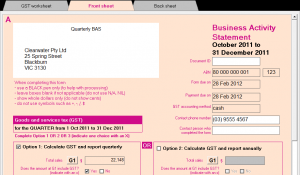

We’re proud of our online MYOB training courses and thousands of students are too, but we’ve found that students are interested in lots of other skills relating to earning money for themselves as either an employee or a contractor. Things like using Word to write a resume, using WordPress to manage their own website, how to use online CRM (Customer Relationship Management) programs to keep track of all their contacts etc. We mentioned in a early blog post about our plans to provide more training resources for working mums and we’re getting closer to our final goal.

The purpose of a webinar is to deliver educational content similar to what you would experience with a seminar except that you save on time, travel, money, petrol and you can even watch the presentation at a later date. Our team has been in contact with accountants, career professionals, online service providers and a host of other industry professionals who will be providing information, training and tips and tricks at our webinars and I hope you can join us in this journey.

If you are an existing student and have some idea or suggestions of topics that you would like us to cover, this is your chance. Send your suggestions to sales@ezylearn.com.au and we’ll discover the most popular and work on a schedule for the rest of the year. If you are not a student yet, this is the time to enrol. Stay tuned for more updates shortly.