Earn an Income Working From Home

EzyLearn is an established and leading brand in the short course and vocational training sectors in Australia. We focus on teaching students how to use software to

- find jobs,

- be more productive in their current jobs,

- start a business and

- use technology to manage their business better

Partner with EzyLearn to start your own online business as a bookkeeping tutor and teach clients how to use MYOB & Xero as well as Microsoft Office.

As an Online Only training company we specialise in online training courses and support so when you come on board as a tutor you get access to all training and support resources from a support team that use the latest digital technology and tools.

Digital Marketing is a function of our organisation that is integrated into our customer service and support services so when you join you get plugged into the marketing story and get introduced to potentially thousands of new clients.

Your Brand, reputation & digital profile

Leverage our brand, group marketing and educational content and support with your own personal knowledge and experiences and you have a solid, inexpensive foundation to earn an income working remotely, from home.

Leverage our brand, group marketing and educational content and support with your own personal knowledge and experiences and you have a solid, inexpensive foundation to earn an income working remotely, from home.

As part of your joining fee we’ll create a digital profile and send interested traffic to this site to help you get discovered by potential clients.

Exclusive Leads in your area

As a Remote Contractor you’ll receive leads for bookkeeping and office administration services from your area.

As a Remote Contractor you’ll receive leads for bookkeeping and office administration services from your area.

These leads can result in ongoing work with your very own clients and as a licencee you benefit by only paying an annual licence fee instead of a percentage of every dollar you earn with some franchise systems.

Customer Service and Sales Training

You’ll receive training about how to create compelling ads for marketing campaigns that will attract clients.

You’ll receive training about how to create compelling ads for marketing campaigns that will attract clients.

When clients call you will be equipped with questions and suggestions to identify good clients and guide them towards becoming your client.

You’ll also learn how to help customers who are not ideal and be able to refer them to other team members in your referral network.

Earn $35-$80 per hour

As an EzyLearn Tutor partner you can add extra income to your bookkeeping or virtual assistant business and earn $50 ph teaching clients how to use software for business purposes.

Ongoing Support

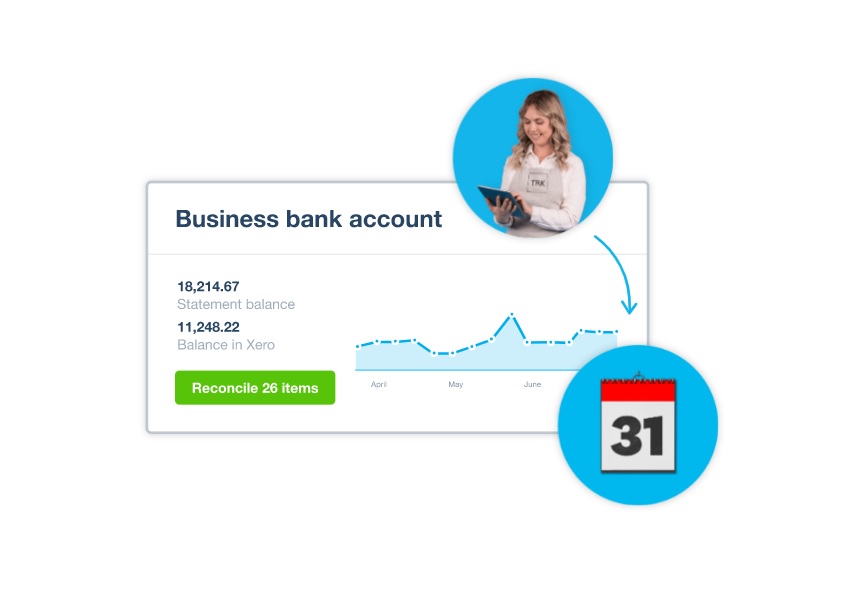

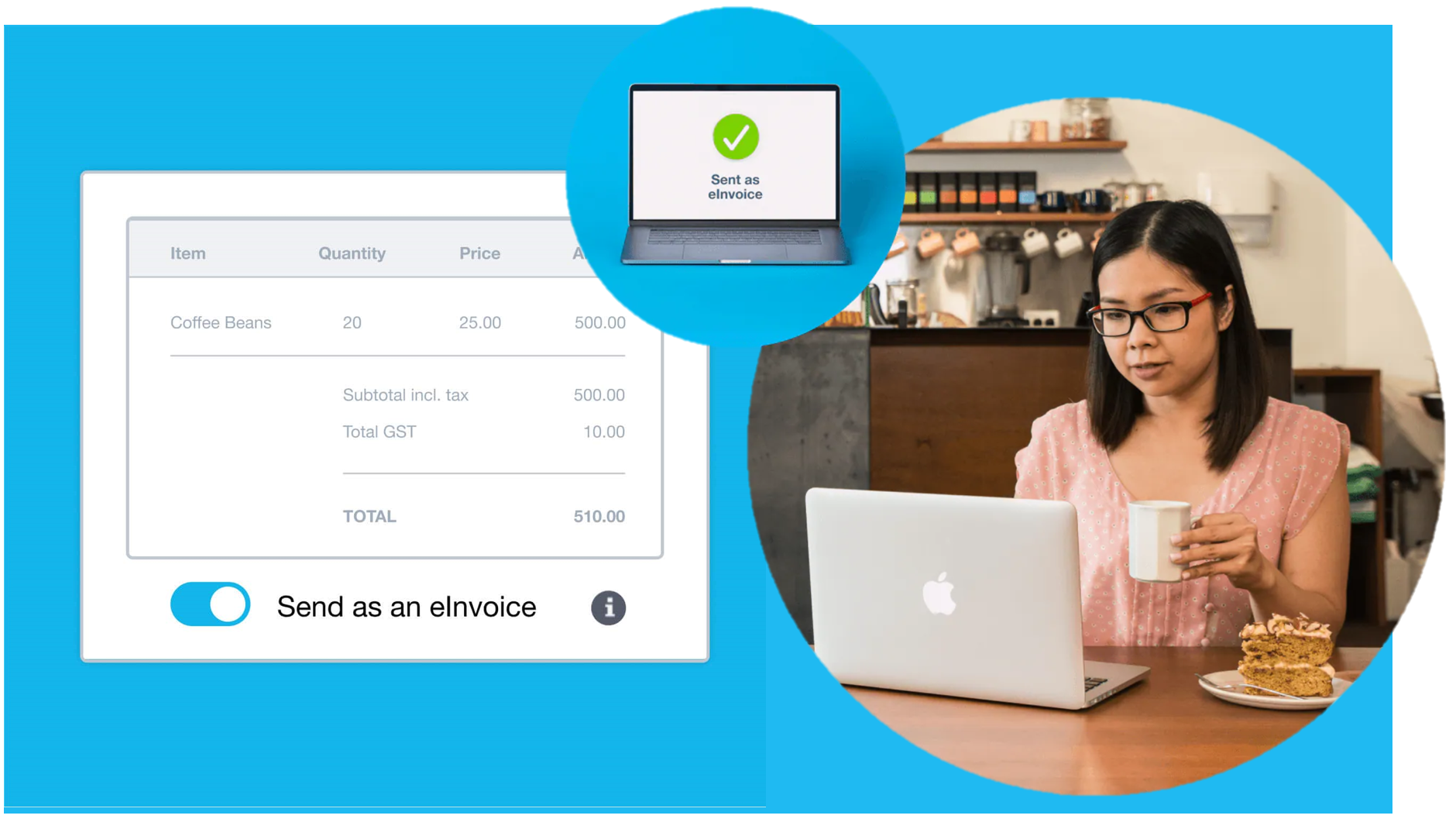

Xero, MYOB & Quickbooks Online are accounting programs in the cloud and because they are now based on a subscription model they are constantly updated and the updates are pushed out live.

Not only do you receive ongoing online course access as an affiliate but you also receive ongoing knowledge support of the training materials and new content we create.

As a member you receive ongoing support from our team on all the course contents you’ve already enrolled into as long as you are a member.

Learn more about how Ezylearn courses work and how your learning is supported

Ask questions on topics that are NOT included in the courses

EzyLearn ANSWERS is a program that guides our training content development based on the needs of our students and tutors. Student members use Ezylearn training courses for lots of different reasons, including:

- employees to upskill and fill out gaps in their knowledge for their current jobs,

- job seekers to increase their confidence to apply for and get jobs,

- corporate managers to ensure their staff are using productive features of the software

- business owners who want their staff to have a solid understanding of how to use their business software

Our courses are designed based on real world scenarios and the questions we receive via EzyLearn ANSWERS helps us constantly improve.

Learn more about EzyLearn ANSWERS

Earn a Passive Online Income

The EzyLearn affiliate program is a way to earn a secondary source of income by mentioning EzyLearn courses in your social media feed and through your own low cost online mentions.

Used by some of the largest digital organisations in the world affiliate marketing enables you to cheaply start an online business leveraging the existing brand and marketing of an established business.

Learn more about EzyLearn’s Affiliate Program.

Skills Training and Practical Projects

- Accounting & Bookkeeping Fundamentals

- Managing Accounts Payable, Accounts Receivable

- General Journal & Adjusting Entries

- General Ledger & Trial Balance

- Depreciation

- Reports & Financial Statements

- Accounting with MYOB Essentials

- Accounting with MYOB AccountRight (Windows)

- Beginner to Advanced Xero Accounting

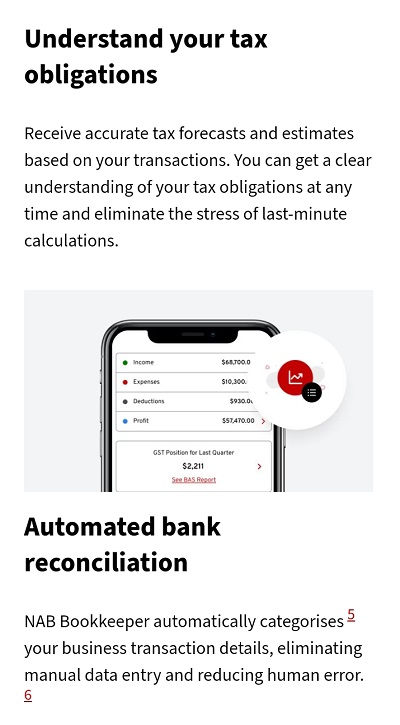

- Understanding GST

- Fundamentals of Payroll

- Advanced Payroll Administration

- Microsoft Word Beginners

- Microsoft Excel Beginners

- Budgeting, Forecasting and Cashflow Management

Office Administration Courses

Data Entry & Microsoft Office (included)

Master the fundamentals of office administration tasks using Microsoft Office Word (word processing) and Excel (spreadsheets).

Topics include:

- Understanding and navigating around the software programs & default Settings

- Microsoft Word font & paragraph typing,

- Microsoft Word editing data and formatting,

- Microsoft Excel open sample data files, navigate and understand data entry

- Microsoft Excel creating brand new files using data entry and editing spreadsheets

- Microsoft Excel formulas, functions and formatting

Data Entry course

Data Entry & Microsoft Office Beginners Training Course

- Microsoft Word Beginners: The screen, non-printing text, editing characters

- Microsoft Word Beginners: Saving, Selecting and formatting

- Microsoft Word Beginners: Page, character and paragraph formatting

- Microsoft Word Beginners: Borders, shading and bullets

- Microsoft Excel Beginners: Selecting, editing and resizing cells & columns

- Microsoft Excel Beginners: Database structures

- Microsoft Excel Beginners: Formulas and functions introduction

- Microsoft Excel Beginners: Formatting and autoformats

Data Entry & Microsoft Office Beginners Training Course

Office Support & Administration using Microsoft Office

- Microsoft Word Intermediate: Tabs and Tables that Structure Data

- Microsoft Word Intermediate: Headers/Footers, templates and page breaks

- Microsoft Word Intermediate: Customising screen, toolbars/ribbons

- Microsoft Word Intermediate: Symbols, clipart and images

- Microsoft Word Intermediate: Drawing and Graphics

- Microsoft Excel Intermediate: Complex views & printing

- Microsoft Excel Intermediate: Charts & Graphs

- Microsoft Excel Intermediate: Functions and Cell Referencing

- Microsoft PowerPoint: Create and Edit Presentations

- Microsoft PowerPoint: Design templates and complex formatting

- Microsoft Outlook: Email and Meetings

- Microsoft Outlook: Invitations and time management

- Microsoft Outlook: Customer Relationship Management and tasks

Office Support & Administration using Microsoft Office training course package

Advanced Office Certificate Training Course

- Advanced Certificate Microsoft Word: Working with Databases

- Advanced Certificate Microsoft Word: Using Microsoft Word for Complex documents

- Advanced Certificate Microsoft Word: Using Microsoft Word for Corporate Style & Navigation in documents

- Advanced Certificate Microsoft Excel: Databases, filter/sort and Named Ranges

- Advanced Certificate Microsoft Excel: Advanced Formulas, Protecting Cells & Pivot tables and Charts

- Advanced Certificate Microsoft Excel: Goals, Forecasting, Data Consolidation

See more detail about what is included in the Advanced Office Admin Certificate Courses

Industry Connect for Virtual Assistant Training

The case study in this training package is for a real estate agents office. You’ll use your Office Administration skills to create an advanced Excel spreadsheet with financial forecasts, depreciation etc and then combine marketing collateral and images to present that information in a Proposal using Microsoft Word and a Presentation that you’ll deliver to our course assessors using Zoom.

-

Publish a Presentation

Publish a Presentation- Use Outlook to manage weekly goals

- Use Outlook to assign tasks

- Collaborate on a document

- Use cloud based storage like Dropbox and One Drive to maintain backups, annotations and version control

- Use Zoom to make a presentation to colleagues

- Use Excel to decide on the best financial investment

Business Administration and Bookkeeping Courses

You’ll receive access to training in either MYOB AccountRight, Business Pro (Online version), Xero or QuickBooks Online to cover all the topics needed in a micro business as well as most small to medium businesses.

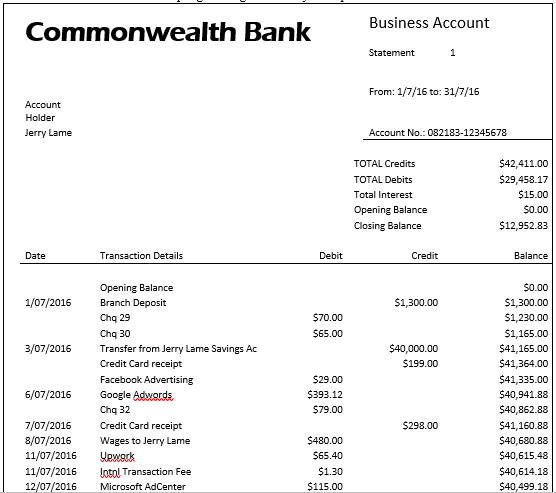

Beginners Bookkeeping Certificate Training Courses

Learn about bookkeeping

- data entry,

- quoting,

- invoicing,

- purchases,

- receipts,

- payments,

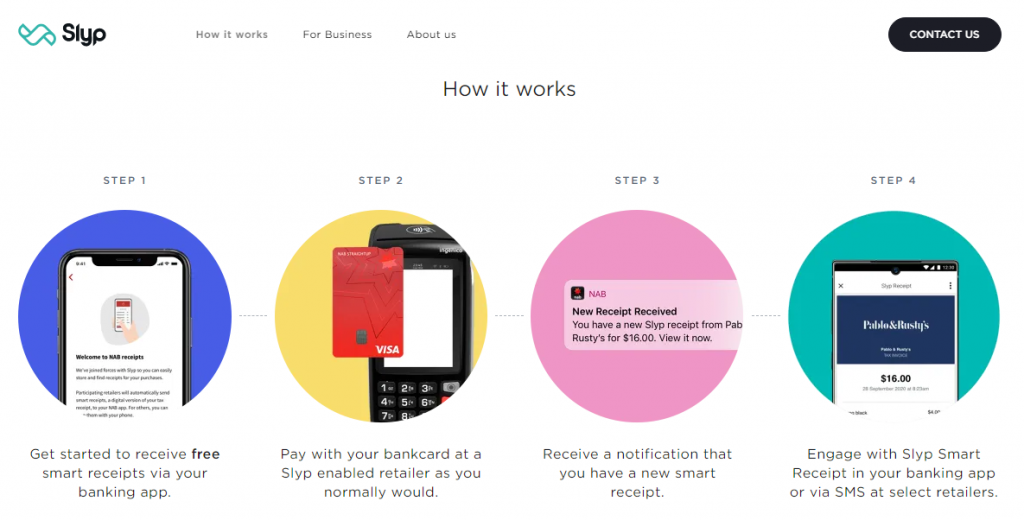

- bank feeds,

- bank reconciliation and

- journal entries.

Advanced Bookkeeping Certificate Training Courses

Learn about advanced bookkeeping and accounting tasks, including:

- GST and BAS

- Reporting,

- Payroll Administration.

Website and Digital Marketing Course

Creating a website is simple and cheap and a great way to get discovered online. Learn how to use Crazy Domains and WordPress to create and update website pages, posts and menus.

You can then use your website to attract potential customers to use your services. If you do a good job your website will become valuable and attract “organic” traffic from Google, which is free.

These skills will help you with your own contracting work but also give you skills that are very valuable to most small business employers.

Websites & Digital Marketing Training

Advertising and Lead Generation

One of the most challenging tasks facing both established and new business owners is advertising to attract potential buyers and getting these prospects to make contact with you.

Learn how to focus your advertising on the needs of your best potential clients and then how to manage those leads you receive. You’ll learn how to do this for your own business as a remote working virtual assistant as well as your clients (if needed).

Advertising and Lead Generation for Virtual Assistants

Online Customer Service Certificate Training Course

This training course package will give you skills and exercises to confidently start a business and have strategies to start marketing your business and making money. Includes

- Real Business case studies

- 6 months mentor support

- Tools to work from home remotely

- Real life practice

- Internship opportunities

Online Customer Service Training Course

Leverage our brand, group marketing and educational content and support with your own personal knowledge and experiences and you have a solid, inexpensive foundation to earn an income working remotely, from home.

Leverage our brand, group marketing and educational content and support with your own personal knowledge and experiences and you have a solid, inexpensive foundation to earn an income working remotely, from home. You’ll receive training about how to create compelling ads for marketing campaigns that will attract clients.

You’ll receive training about how to create compelling ads for marketing campaigns that will attract clients. Publish a Presentation

Publish a Presentation