No amount of data is too big for Excel’s pivot tables

WE’VE RECENTLY BEEN UPDATING the content for our Excel training courses and were reminded of just how useful Excel is for small businesses. In Excel, you can easily create and manage client databases and then export part or all of that data into a Word document, your accounting software, an email marketing service, or use it in other Excel documents, such as a pivot table.

A pivot table is Excel’s signature, and most powerful, feature — Microsoft trademarked the words ‘pivot’ and ‘table’ in their compound form PivotTable back in the 1990s. So if you intend to use Excel in any meaningful way for your business, knowing how to create and work with pivot tables is an essential skill, one which we cover in our newly-updated, advanced Excel online training courses.

What are pivot tables used for?

A pivot table is a way to quickly summarise and analyse large amounts of data, and the pivot tables you can create in Excel are especially designed for:

- Subtotalling and aggregating numeric data

- Summarising data by categories and subcategories

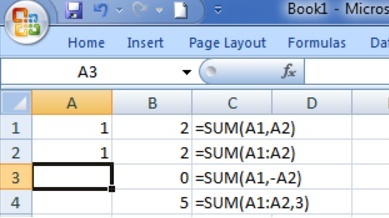

- Creating custom calculations and formulas

- Expanding and collapsing levels of data

- Drilling down on details from summary data

- Filtering, sorting, grouping and conditionally sorting data

- Presenting concise, attractive, and annotated reports

- Moving rows to columns and vice versa (‘pivoting’) to see different summaries of source data.

Pivot table data sources

There are a few ways that you can create a pivot table, though the most common way is to use an existing Excel worksheet — a database, for example — as a data source. Here are a few ways to create a pivot table in Excel:

- Excel tables: Excel tables are already in list format and are good candidates for pivot table source data. When you refresh the pivot table report, new and updated data from the Excel table is automatically included in the refresh operation.

- Using a dynamic named range: To make a pivot table easier to update, you can create a dynamic named range, and use that name as the pivot table’s data source. If the named range expands to include more data, refreshing the pivot table will include the new data.

Create a database in Excel first

The most efficient way to create a pivot table is to create a database in Excel first. Here, you can update and manage as much information about your business — including customer data and financial data — and then use that as a data source for a pivot table.

***

Creating databases and pivot tables are part of our advanced Microsoft Excel training course, but you can start your Excel journey with our FREE Beginners’ Excel Course. Read more about our Beginners’, Intermediate and Advanced Excel training courses on our website, or enrol to start learning by 5pm tomorrow! We cover ALL levels for ONE LOW COST.

And with EOFY looming, be sure to take advantage of our specials!

At EzyLearn we offer online training courses to help you up-skill and find employment. Choose from our range of cloud-based online accounting software courses, to business start up and management courses, to marketing and sales courses, or update and further your skills in a range of Microsoft Office programs (Excel, PowerPoint, Word) or social media and WordPress web design).

Don’t forget that, while a business loan to cover payroll for 12 months will be easy to repay initially, your business’s profits will need to improve substantially over the next year so that you can continue to meet your loan repayments AND your payroll obligations for that year.

Don’t forget that, while a business loan to cover payroll for 12 months will be easy to repay initially, your business’s profits will need to improve substantially over the next year so that you can continue to meet your loan repayments AND your payroll obligations for that year.

EzyLearn Excel, MYOB and Xero online training courses count towards

EzyLearn Excel, MYOB and Xero online training courses count towards

We recently updated our advanced

We recently updated our advanced

Most businesses using an accounting program like MYOB or Xero will use the included payroll package to manage their employees’ payroll. For businesses with only a few employees, however, the additional payroll function is an unnecessary expense.

Most businesses using an accounting program like MYOB or Xero will use the included payroll package to manage their employees’ payroll. For businesses with only a few employees, however, the additional payroll function is an unnecessary expense.  We’ve recently updated our

We’ve recently updated our

Before computers and Microsoft Excel came along, accountants used a pen and paper to keep track of their clients’ business financials. And before that, before the numeral system was invented, the abacus was the main accounting tool used by merchants and traders to keep track of their finances.

Before computers and Microsoft Excel came along, accountants used a pen and paper to keep track of their clients’ business financials. And before that, before the numeral system was invented, the abacus was the main accounting tool used by merchants and traders to keep track of their finances.