Bookkeeping is an essential part of business, not just to keep track of financial activities for the business’ sake, but also to meet obligations from the ATO. It’s nothing ground-breaking to highlight the importance of bookkeeping, but lots of businesses might start operating without considering the necessity of bookkeeping.

If you’re a business owner who doesn’t have a background in accounting or bookkeeping, then you’ll want to learn at least the basics quickly – even if you intend to hire accounts staff, it’s great to understand the bookkeeping tasks that need to be completed.

EzyLearn has you covered with out new Bookkeeping Basics Training Course. Let’s break down how you’ll learn the foundational aspects of bookkeeping with this course:

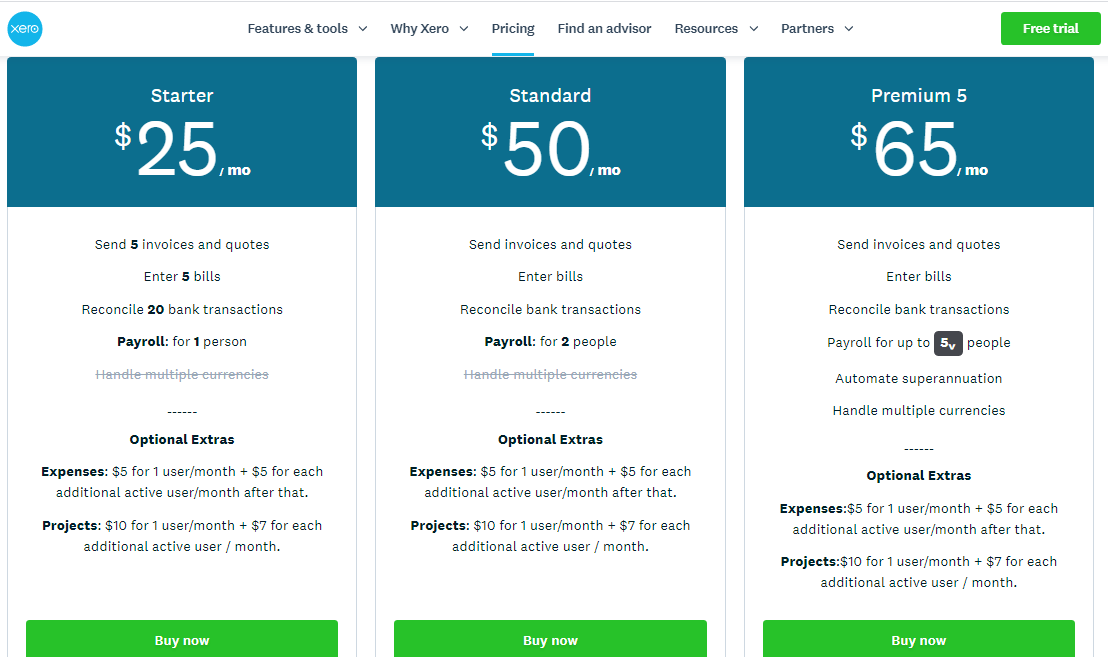

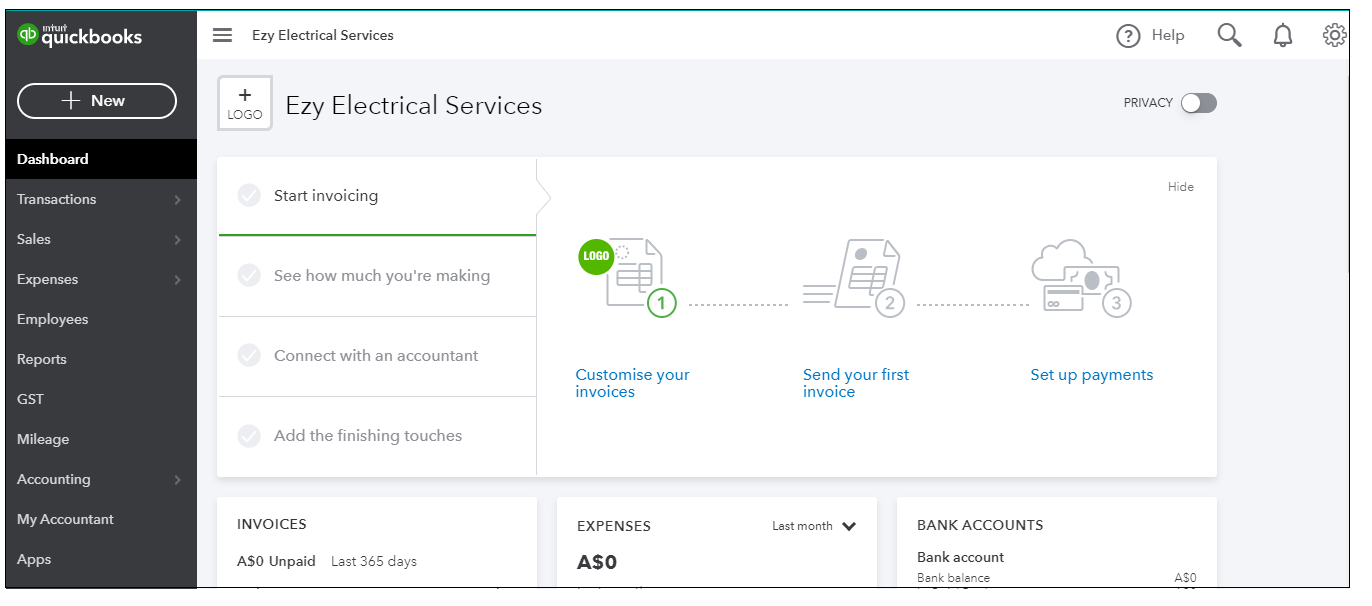

Continue reading NEW “Bookkeeping Basics” Training Course Covers Beginner Level Xero, MYOB & QuickBooks Online