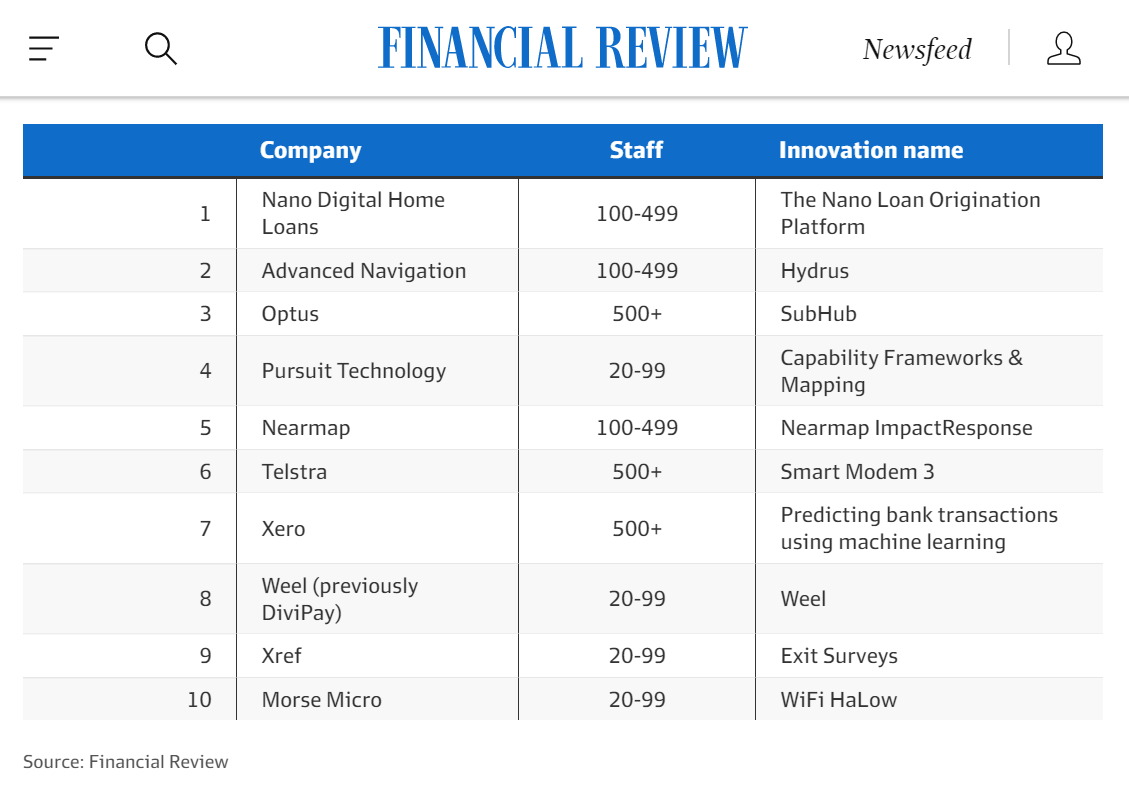

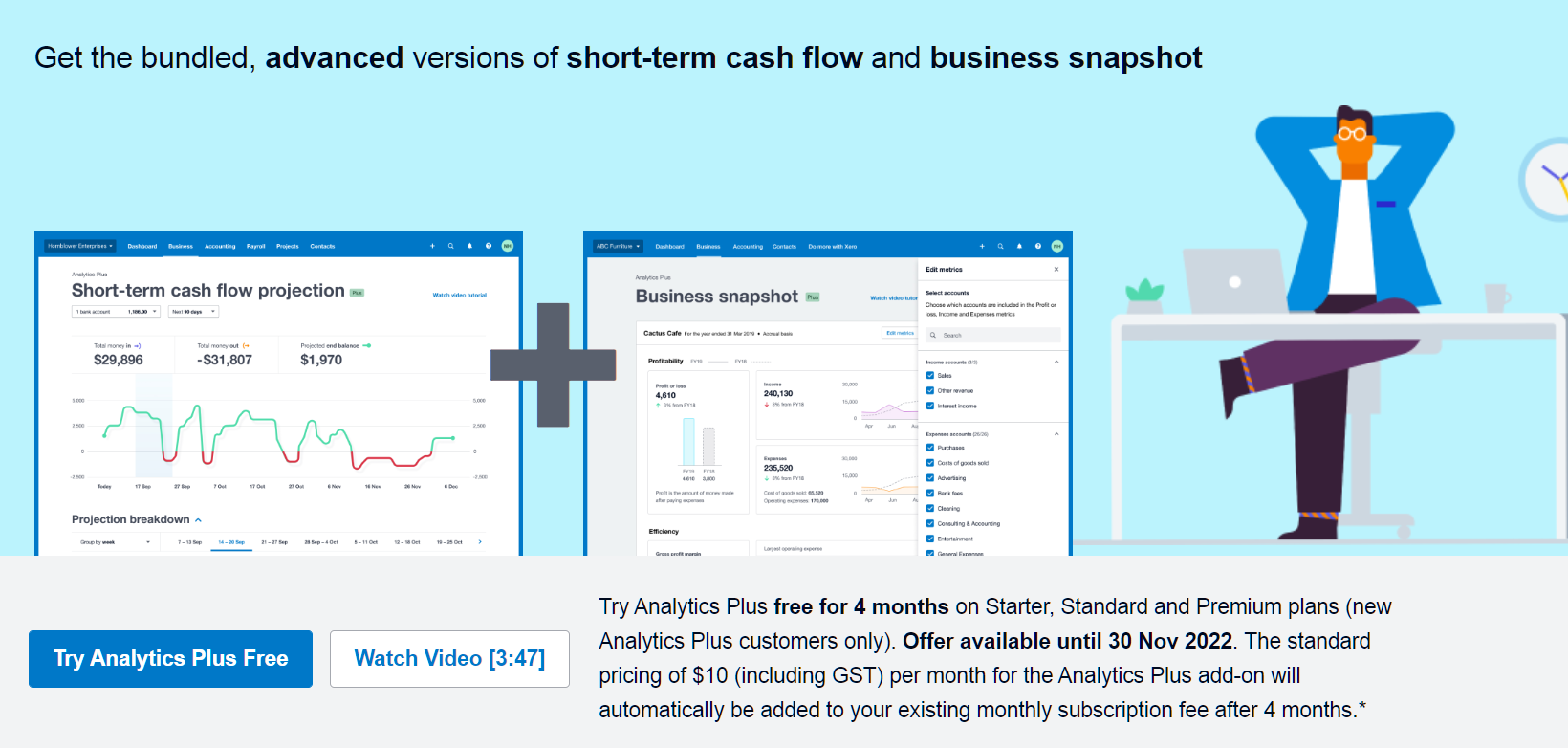

Many new students learnt how to use online accounting software like Xero and MYOB Business Essentials during the Covid Period because they were working remotely from home. Most of those students thought we had just started working from home ourselves but we told them we’ve been online for over a decade.

The conversation topics that came up a lot was how can you work from home, do you get lonely, do you get distracted etc?

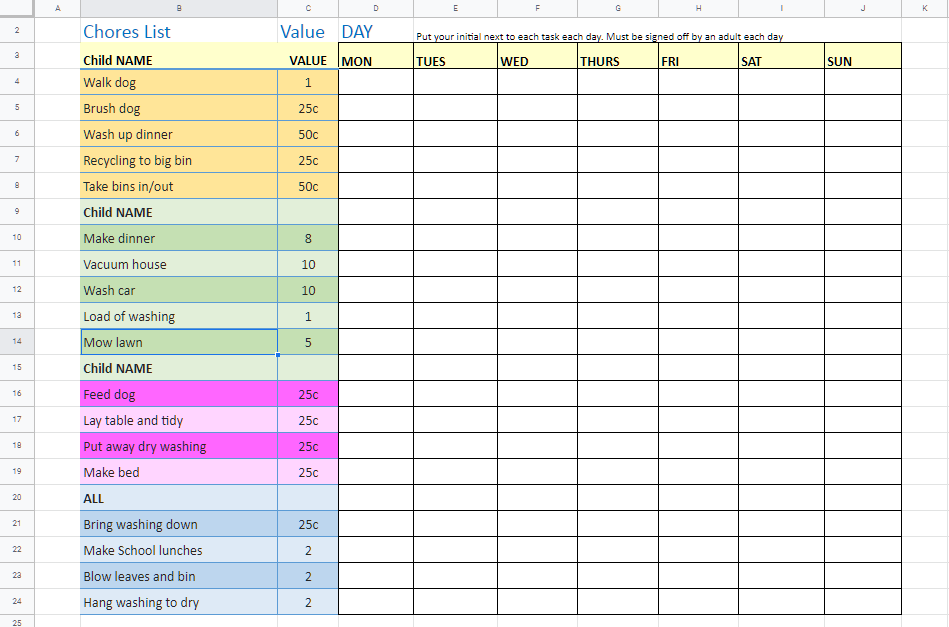

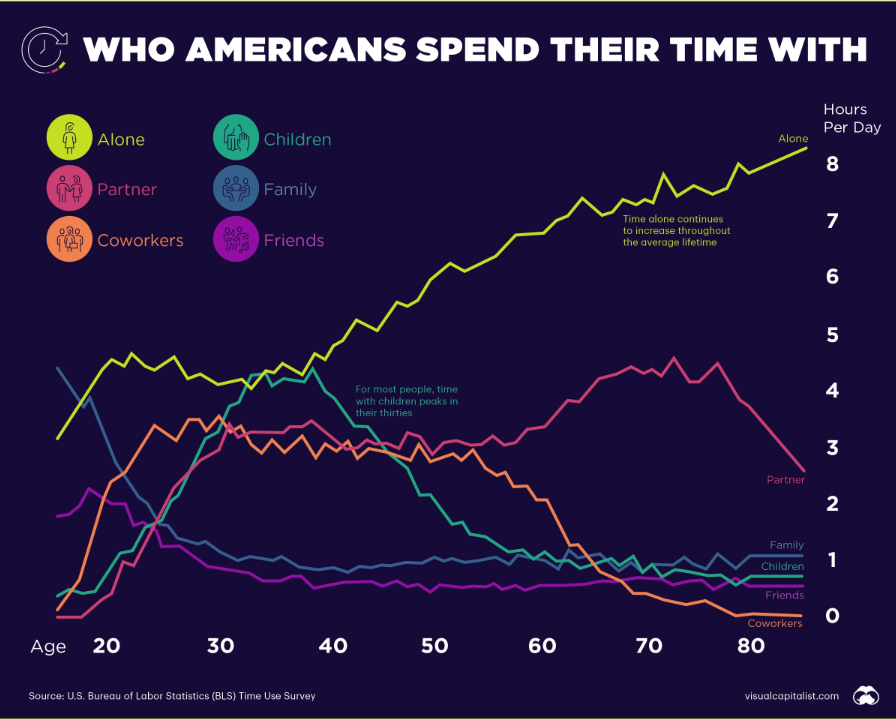

The reality is that our entire team work from home and once you are used to the discipline of working from home you can take lots of breaks when you need them and can focus better on customer service. I found some research that showed just how much time people are now spending alone.

Continue reading R U Spending Too Much Time Alone?