We’re here to help you learn FOR LIFE!

WE HAVE TALKED about lifelong learning in a previous post; lifelong learning being the concept of learning as an ongoing exercise that individuals should undertake throughout their lifetimes, in order to remain productive and engaged members of society. In other words, learning never stops.

WE HAVE TALKED about lifelong learning in a previous post; lifelong learning being the concept of learning as an ongoing exercise that individuals should undertake throughout their lifetimes, in order to remain productive and engaged members of society. In other words, learning never stops.

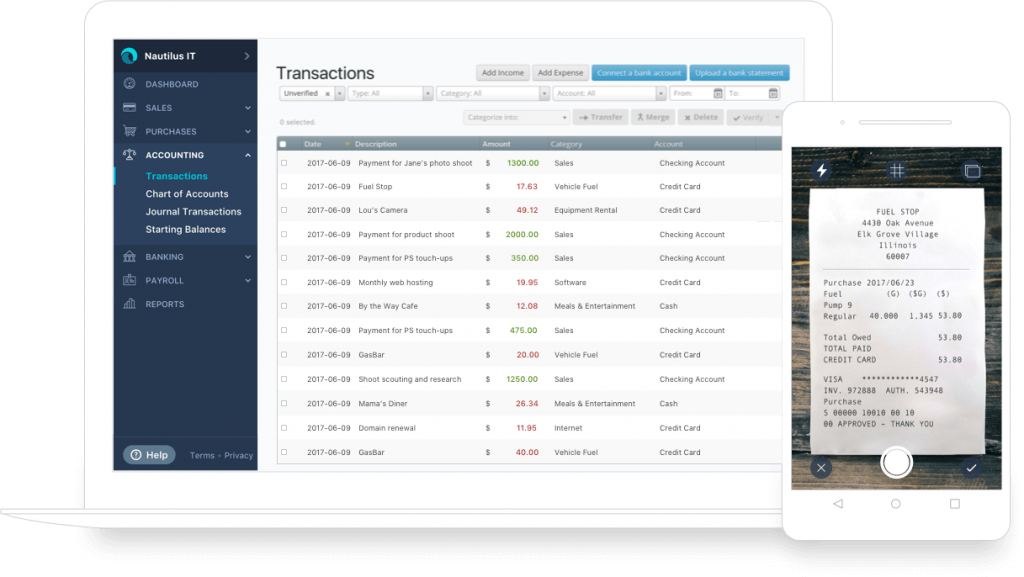

Lifelong learning is particularly important in the workplace, where the rates of technological advancement threaten to wipe out entire professions and replace them with new ones. We’ve talked about Xero’s newly announced lifelong learning platform, which launched in November 2017, in partnership with Swinburne University (for Australia and New Zealand). A full global roll out is expected in 2018.

We are also thrilled to announce our new Lifelong Learning Hub for all EzyLearn students to access. It is part of our Additions and Updates policy and all students who have signed up for Lifetime Access since 2013, and all students within their 12-month access period, can access the following:

- Workface Career Academy for free AND

- Selling Academy for free!

Lifelong learning is a theory, not a platform

Xero’s Lifelong Learning Platform is clever, but it’s a misnomer since “lifelong learning”, as a concept, doesn’t relate to a single pursuit (accounting or finance), but rather an individual’s entire attitude toward learning and how they learn.

If you haven’t already, I recommend you go back and read our post about lifelong learning, specifically the section on the four pillars of learning, which outlines four key types of learning – another topic we’ve covered at length in the past.

Xero’s lifelong learning platform offers just one pillar (learning to do) of lifelong learning, not a framework to engaging in lifelong learning, the concept.

Lifetime Access is what it says it is

Have you ever gone to re-watch a movie or TV show on Netflix and discovered that it’s been removed from the Netflix library to make way for other titles? Good thing, you’ve seen it already.

The same happens at educational institutions that have to update or make way for a new course, and so they purge their content and course offerings. (Just try and find a TAFE that teaches shorthand nowadays, even though it remains a sought-after skill in a lot of professions.)

If you’ve already taken a now-deleted course, the good news is that you’ve learned those skills already. The bad news is that you can’t go back and brush up on them. The ever worse news is that you have to start a new course from scratch if you want to build on your existing skills with the update content.

That’s where EzyLearn’s Lifetime Access training courses are different. When you enrol in a training course with lifetime access, you have access to every version of that training course for life. When we update our course content, we continue to provide you with access to previous content (which includes older versions of the software), so you can go back and refresh your skills.

Lifetime Access for CPD points

As Continuing Professional Development (CPD) is a requirement for most professions today, but particularly for bookkeepers and BAS agents, the Bookkeeping Academy’s training courses with lifetime access are also recognised by the ICB, so you get your CPD points and access to all of our course content for as long as you need it — for one, low price.

Help us provide better courses

If you join the EzyLearn Beta Club, you get access to our courses that are still in development, giving you the opportunity to learn new skills before other students, and provide feedback on the types of exercises and scenarios you’d like to see in our courses.

Our Beta Club courses are important to us because we get to hone our course content based on feedback from students while the courses are still in development. This saves us lots of time, particularly if the feedback from students means we take the course in a substantially different direction.

It also benefits our students and partners who get the content before it’s officially launched, and can request content that covers areas of business relevant to them and their clients. This helps students and partners stay ahead of industry trends, and become experts before the courses are officially rolled out.

***

EzyLearn already has a number of training courses currently in beta and available to our Beta Club members. Visit our website for more information on Lifetime Access training courses and our Beta Club.

AS YOU MAY BE AWARE, each year the ATO updates the tax concessions for businesses. This is usually the result of a budget measure being passed by the Government. Other times it’s due to the ATO simplifying the tax processes for businesses.

AS YOU MAY BE AWARE, each year the ATO updates the tax concessions for businesses. This is usually the result of a budget measure being passed by the Government. Other times it’s due to the ATO simplifying the tax processes for businesses. WE’RE OFTEN ASKED whether

WE’RE OFTEN ASKED whether

IT’S THAT TIME OF YEAR again when my team and I review the success of our marketing for 2017 and plan our strategies for the New Year. The topic of interest-free student loans was on the agenda, so I thought I’ll write something about it.

IT’S THAT TIME OF YEAR again when my team and I review the success of our marketing for 2017 and plan our strategies for the New Year. The topic of interest-free student loans was on the agenda, so I thought I’ll write something about it.

So let’s get to it: there’s work to be done. And this work generally requires some rudimentary knowledge of Australian tax law, copyright law, trademarks and patents.

So let’s get to it: there’s work to be done. And this work generally requires some rudimentary knowledge of Australian tax law, copyright law, trademarks and patents. And as a gift to you, remember our

And as a gift to you, remember our