Video, Video, Video. Everyone tells me you need to do it

I’M NO STRANGER TO NETWORKING, no stranger to making speeches, doing presentations and so forth. But creating a video is still NERVE WRACKING!

We all have issues about how we look, how we sound, how well we present ourselves and I went through all of these emotions before creating this video — SO I hope you like it.

It’s only short and covers all the topics I was hoping to convey and I’d love to hear your feedback. It’s so easy to create videos and publish them on your own website these days and we show you how to do this in our WordPress courses.

EzyLearn is a small business and we’ve been teaching students how to use software to:

- find a job

- do better at their current job and

- start and manage their own business

And,we’ve been doing it for over 20 years.

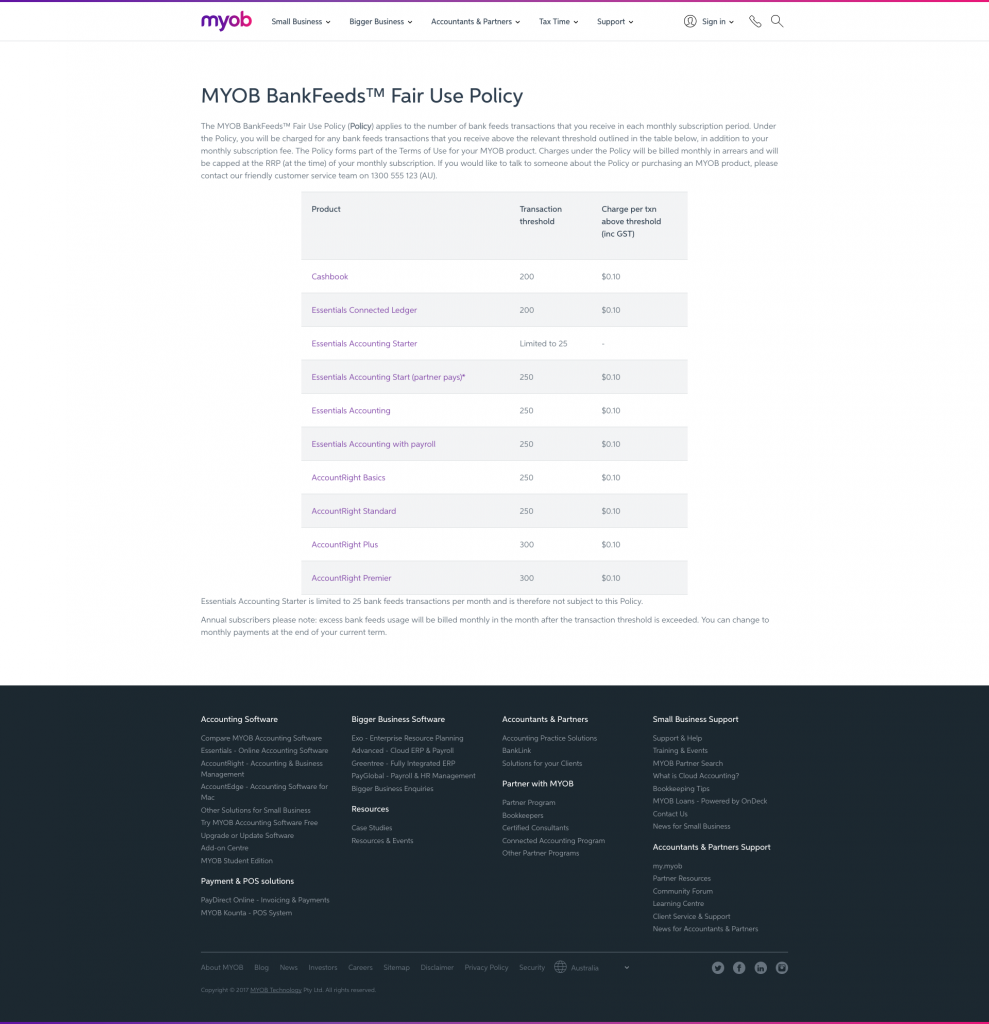

When we created the training courses for MYOB in the late 1990’s I decided that we, as a company, need to create our own training materials so that we could define the learning stories that take students from epiphany to epiphany — that is one of the most rewarding aspects of training.

I was fortunate enough to work with some very experienced MYOB Certified Consultants who helped deliver and influence the contents of our MYOB bookkeeping course training materials. Since those days we have added and added, and refined content, based on feedback from student feedback.

We’ve also worked with registered BAS agents, accountants and corporate accounting staff to continue to add to and refine our courses so we can keep providing the BEST VALUE FOR MONEY COURSES in Xero & MYOB.

Working with the Best People

Having a good track record, great training courses and satisfied students is a great reward for running EzyLearn, but the best part — and the part that I could not do without — is the team of people I’m fortunate enough to work with, and part of this message is to thank YOU for helping me grow and manage the EzyLearn experience. Those people are:

- Ange: For doing the research, putting new technology into perspective and writing many of the words that people read in our blogs and other training content over the last 6 years

- Iroshini: For managing the technical end of our multiple Learning Management Systems

- Brian: For helping to automate our Enrolment Voucher System that enables thousands of students to access low cost courses automatically

- Tracey: For providing the last word in what is correct and incorrect in regards to anything BAS-related

- Helen: For helping to co-ordinate the mammoth task of creating, version control and design of training materials

- Luke: For consistently great customer service so that every student can get through their courses quickly and efficiently and new students understand all the information on our websites

- Richard: For making sure that all of our procedures are followed meticulously and changed where needed

- Rosie: For making sure that our accounts are something that I don’t need to worry too much about

- Yvette: For coordinating and editing content and helping with marketing for all various aspects of the business

- Linus: For the deep level coding and hosting advice you have provided when we need it

Plus there are the various smaller tasks which our international workers and virtual assistants have helped with as well, so thanks too to you all!

We’re going DEEP in 2018

As a training course content creator EzyLearn focuses on our niche markets of

As a training course content creator EzyLearn focuses on our niche markets of

- accounting

- office administration

- marketing

and in 2018 we’re going to give existing students more (watch out for an announcement about our LIFELONG Learning Platform — which will include MYOB and QuickBooks courses, not just Xero).

We’ve also beefed up the success programs for employees working through their careers and the sales success program to help our students upskill and reskill to earn more in 2018.

Learn more about these programs here:

- Visit Workface for their Career Academy Success Program, and the

- EzyLearn page about the Business Sales Success Program for those who want to learn how to make more sales and get better clients for their business.

Make you subscribe using the form below or at this EzyLearn Blog Subscribe Link to receive these updates.

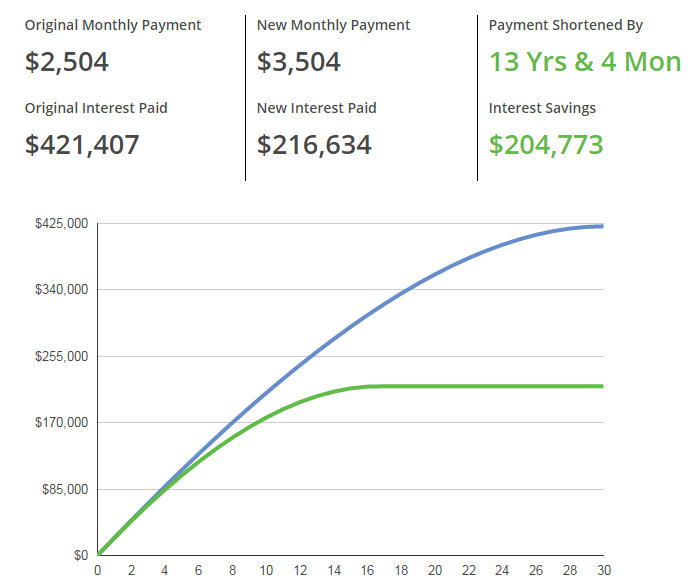

More about Property Investment Courses

I’ve spent a lot of time learning more about property investment, renovation and the real estate industry and we’ll have some new courses in 2018 to help you improve your retirement and wealth by investing in property. Stay tuned for that!

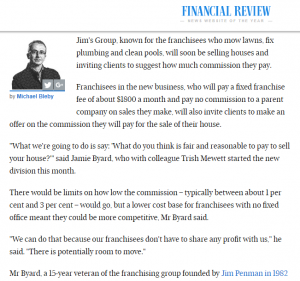

Take Jim’s Group, the franchise group known for mowing lawns and fixing broken antennas. Last week, they announced their intention to

Take Jim’s Group, the franchise group known for mowing lawns and fixing broken antennas. Last week, they announced their intention to

We’ve bundled all of our Excel training courses into 9 half-day short courses — each taking 4 hours to complete — so that, regardless of a student’s skill level, they can access all of the course content from beginner right through to advanced.

We’ve bundled all of our Excel training courses into 9 half-day short courses — each taking 4 hours to complete — so that, regardless of a student’s skill level, they can access all of the course content from beginner right through to advanced.

Use cloud-accounting software like

Use cloud-accounting software like