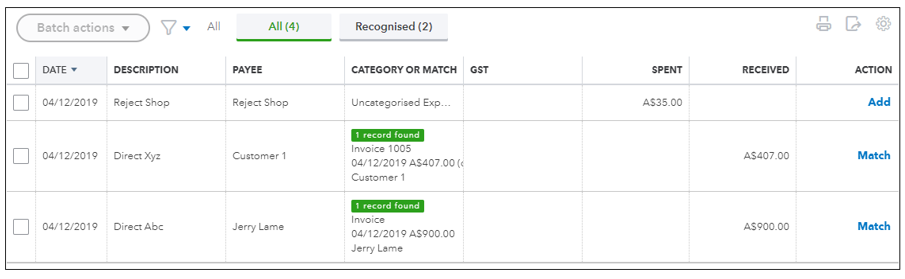

When bank feeds were first introduced they were lauded as a software feature that would save small businesses hundreds of hours of work per week and they have definitely saved time, despite the apparent risks that have been published about how they can compromise your internet banking security.

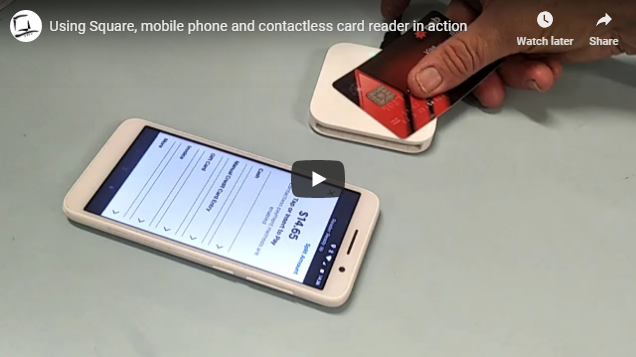

I’ve been working with a business which has a showroom and workshop and they take EFTPOS payments for cash sales as well as deposits for quotes using credit card payments and even though the business isn’t huge it is not as easy as clicking the MATCH button to match a bank feed record to it’s source documents. Continue reading Bank Feeds: Time Saver but NOT a Bookkeeper Replacer – FREE Training Course Material