Accounts Receivable & Payable Courses, FREE sample

I’m excited to be delving deeper into a micro course specifically targeting how you can manage on-the-job costs and track your project. This will be included in all of our Xero, MYOB and Quickbooks online accounting courses.

IF YOU’RE RECEIVING the job alerts everyday — indeed, you may even have applied for some jobs already — but you’re still not getting called up for interview, then the following questions of doubt may be brewing:

In our educational guide, Bookkeeping Beginner Basics, which you can download from the EzyLearn website for free, you’ll learn how to record journal entries in your accounting software, whether you’re using MYOB, Xero or QuickBooks. Most bookkeeping newbies don’t know what a journal entry is, though, which is what this blog post – the latest in our Bookkeeping Beginner Basics guide companion series – is going to help you to understand.

An accounting journal is the record that keeps accounting transactions in chronological order (i.e., as they occur), while the general ledger is a record that keeps accounting transactions by the account – see our previous post on the chart of accounts [Bookkeeping Beginner Basics: The Chart of Accounts] if you need help understanding what the term ‘account’ means in this context. Before computers, bookkeepers used to log all the financial transactions of a business in paper journals, and then at the end of the month transfer these journal entries into the general ledger, which was divided into various accounts that is now called the chart of accounts, and all the transactions were posted to these accounts using a method called double-entry bookkeeping.

Today, however, accounting systems, such as MYOB, Xero, QuickBooks and the like, will automatically record most business transactions into the ledger immediately after the software prepares sales invoices, issues cheques to creditors, or processes receipts from customers, and as such you don’t have to create journal entries for most of your business’s transactions.

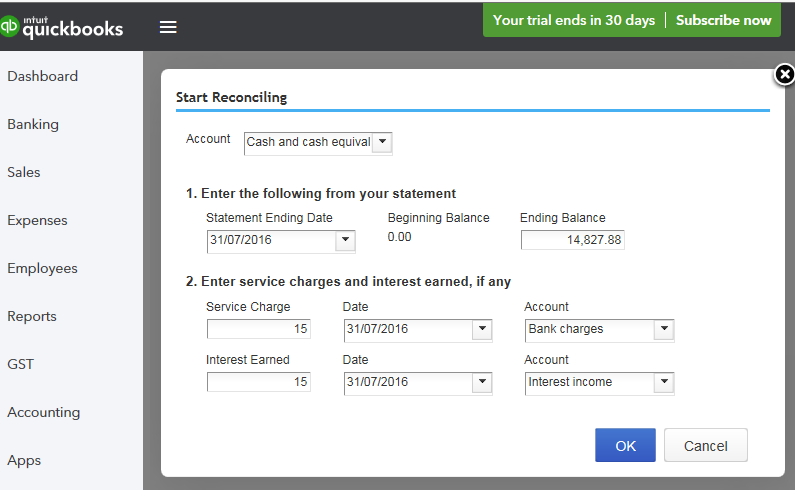

That being said, some journal entries still need to be processed, in order to record transfers between bank accounts and to record adjusting entries. You would need to make a journal entry, for example, at the end of each month to record depreciation or to record interest accrued on a bank loan.

If journal entries and general ledgers and the double entry bookkeeping method sound a bit too much, and you think you’d rather stick to the cash-based accounting method instead, prepare yourself for bad news: all businesses, whether they use the cash-based accounting method or the accrual accounting method, use double-entry bookkeeping to keep their books, and all accounting software applications, by default, are set up to adhere to the double-entry method, too. The double-entry bookkeeping method reduces errors and also ensures that your books balance, so as complicated as it may seem, it’s much easier in the long run.

If you still feel a little out of your depth, however, you can hire a reliable bookkeeper to manage your bookkeeping system and deal with all the journal entries and double-entry business for you, instead. Visit the National Bookkeeping website for to find a highly qualified bookkeeper whose experience and skills suit your business needs.

This blog post is part of our Bookkeeping Basics series, which are being published to complement our new educational guide, also titled Bookkeeping Beginner Basics, which you can download for free from the EzyLearn website.

We’ve previously blogged about how QuickBooks accounting compares with MYOB. We’ve also done a comparison of all three accounting programs — MYOB, Xero and QuickBooks.

In doing so, it’s interesting to note that QuickBooks, for small business owners, at least, was the clear winner against MYOB in terms of reporting and user experience. But how does QuickBooks stack up against the increasingly-popular Xero? You may be surprised at the results.

DO YOU GET frustrated when you see the little box at the bottom of the BAS lodgement form? You know, the one where they ask how long it took to complete the form because I feel like writing, “It took 10 minutes to complete the form, but 4 hours to do the data entry and bank reconciliation work!”

Junior bookkeepers, accounts receivable and accounts payable clerks, and office administrators will all share that their most time-consuming work is data entry, coding and bank reconciliations. However, there is software available which almost totally automates this work — and it’s becoming increasingly accurate and speedy.

Continue reading Receipt Scanning, Automatic Coding – Boon for Bookkeepers or Job Killer?

The Internet has spawned several cloud accounting software program all over the world including:

Continue reading SPECIAL OFFER: MYOB, Xero & QuickBooks Online Courses ALL for One Low Price

WE HAVE CREATED A brand new Cash Flow Reporting, Budgets and ROI Course for Xero and one of the things you’ll learn is how to import your bank statements into Xero.

The sales spiels of many of the notable online accounting software packages like QuickBooks, Wave Accounting, Outright, Kashoo, LessAccounting, Clearbooks and even Xero, claim that this feature will save you time and effort as it imports your bank transactions. The truth is, this is not foolproof and won’t work 100 percent of the time (even if it’s just a matter of not being able to get your software and your bank to “connect” just as your mobile phone connection inexplicably doesn’t work sometimes).

Therefore, always double check your bank transaction data has been imported accurately. This said, importing your bank statement into Xero (or whatever accounting software you use) is a really important step in the bookkeeping process that a lot of business owners forget or don’t know how to do. And the technology is only going to get better!

To import your bank statement into Xero, you must ensure it’s in the correct format. Xero can only work with a CSV file of your bank statement. Depending on your bank, you might be able to download your bank statement as a CSV file from your internet banking, or you will have to create one from scratch.

Creating one from scratch isn’t too difficult. If your bank doesn’t give you the option of downloading a bank statement as a CSV file, you can create one yourself in Microsoft Excel.

You can download an Excel template from Xero. It includes the recommended fields and is already set up as a CSV file, so all you need to do is add in your data.

Once you’ve created and uploaded your bank statement to Xero, you’ll need to set up transaction rules for recurring expenses. You’ll learn how to do this in our Cash Flow Reporting, Budgets and ROI Xero Course.

Setting rules for recurring transactions helps speed up the reconciliation process, which depending on the type of business you operate and how often you reconcile your account, can be the most time-consuming part of the process.

Importing your bank statement and creating rules for transactions that occur each week, month fortnight, year, etc, greatly speeds up this process.

If your business has lots of expenses every week, and your bank doesn’t let you download your bank statement in a CSV format, you may find that manually creating one in Excel each month is too time consuming.

Set up bank feeds instead. Bank feeds is the process of linking all of your business accounts, whether they’re credit cards or bank accounts, to your accounting software, so that each time you make an electronic purchase, it’s automatically imported into your accounting software.

This will allow you to reconcile your account each fortnight, week or more frequently, if you desire, than once a month when your bank statement comes in.

Bank feeds save your business time and money. Find out more about setting up automatic bank feeds in Xero and importing bank statements into Xero. You can also read more about our new Cash Flow Reporting, Budgets and ROI Course for Xero, visit our website or enrol today!

Learn Microsoft Excel from scratch or brush up your Excel skills, at your own pace, with our affordable Excel online training courses — where you get THE LOT (that’s 9 courses in total) for ONE LOW PRICE — everything included! Volume corporate discounts are available and our courses count towards CPD Points. NOW is the time to learn to use Excel, one of the most-used software applications in the world.

In a previous post I wrote about the three tell-tale signs that your bookkeeper isn’t paying attention and thought I’d expand on this a little further by writing about three of the things your bookkeeper shouldn’t be doing — and what it means if they are.

Continue reading Three Things Your Bookkeeper Shouldn’t Be Doing

If you’re working as a contractor and using an Australian business number (ABN), rather than a tax file number (TFN), you’re self-employed, and this means you will need to invoice your customers for the products or services you provide in order to get paid.

If you’ve only ever worked as an employee before, you’re probably used to being able to set your clock to payday, but unfortunately this isn’t often the case when you’re a contractor.

Getting paid late — or worse, not at all! — can seriously affect your cash-flow, and in turn, affect the success of your business, which is why we cover things like financial planning in our Small Business Management and Start Up Course.

Continue reading Get Paid FASTER! Credit Management Strategies