Should You Send Reports to Late-Paying Clients?

Services provided by EzyLearn

IF YOU’RE RECEIVING the job alerts everyday — indeed, you may even have applied for some jobs already — but you’re still not getting called up for interview, then the following questions of doubt may be brewing:

OFTEN IN LIFE we’re told that if something seems too good to be true then it probably is. Along the same lines as this is the expression that you get what you pay for. Indeed, I’ve commonly used the phrase: “Pay peanuts and you’ll get monkeys” but naturally, there are exceptions to this and plenty of cases where low cost can simply mean low cost – without meaning that quality or value has been compromised.

Continue reading Why such cheap online Xero & MYOB courses?

ONLINE TRAINING IS one of the most convenient ways for busy people to study. While some people take to it naturally, for others the flexibility and freedom it affords itself is a learning curve.

The key to successful online training, however, is family support and we’ve noticed that many students for our Xero & MYOB Courses are parents who are stretched for time.

Continue reading Does Your Family Support Your Study?

I was speaking with someone who just landed a part-time job, in-fact a contract position, even though the job was advertised as a full-time job.

The job seeker was telling me about the advanced new features of Australia’s leading job board, including:

MYOB has recently changed their website and in particular their pages for the free trial software.

We’ve updated the FREE MYOB Trial (within our MYOB courses) so look for the link when you access your MYOB courses and use the free trial software to practice what you learn in the video tutorials and training workbooks.

While we’re on the topic of free MYOB software, did you know that we provide free training course samples for most of our online courses?

Continue reading Don’t use the FREE MYOB Training Student Edition

I’ve written recently about our Accounting Tutor initiative and the response has been fantastic. EzyLearn Accounting Course students are AMAZING!

Our team has gone through dozens of resumes and been very impressed at the knowledge and experience of most of the applicants, but you’ll need to decide which one you like best.

Continue reading We’re using your resume bio to sell you as an accounting tutor

Don’t you just love something new? Some entrepreneurs I know call it the “shiny object” syndrome because it means you’re always focusing your time and energy on something new, rather than doing the daily drudge work. But this is exciting.

I haven’t had a chance to speak with every registrant but this image shows the EzyLearn students who’ve completed our accounting & bookkeeping courses and would love to be tutors to help other students understand how the software is used in the real world.

Continue reading Accounting Tutors getting ready

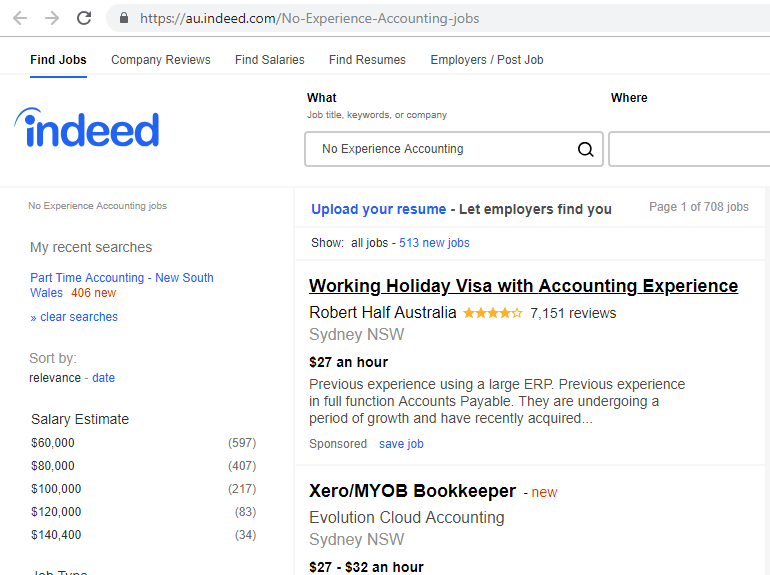

There are plenty of reasons that you have no experience: Changing careers, new graduate or re-entering the workforce after many years away (like when you’ve started a family and been out of the workforce as a parent). These circumstances justify your lack of experience but there are things you can do.

Our team has reviewed the features of some of Australia’s biggest job boards for accounting jobs and we’ve used some of the features that can help job seekers receive notifications when new jobs become available. There is hope and there are things you can do.

Continue reading How to get an accounting job with no experience

Our team did a little research into job sites for accounting jobs and thought we’d explore a bit about why people like using the major job board in Australia.

The biggest reason is that they are the biggest job board in Australia so most advertisers spend the little bit extra to promote their positions available at the site. But there are some great tools for job seekers to be registered on the site. Continue reading Reasons Why Seek is Number 1 for Accounting Job Search

Setting goals is not just about earning more money but at this time of year many people spend their time thinking about how much they want to earn and what type of work they want to do.

Although earning money seems like a goal the real goals you should be setting are more practical and relate to what’s currently going on in your life. We’ve been working on some new initiatives and I hope you take advantage of them to have an extra source of income. Continue reading FREE Digital Marketing Seminar Presentation

Xero is complicated, let’s be honest. I know that Xero tell you the software is beautiful and simple to use but in reality it’s accounting software and if accounting software was easy then everyone would have their BAS’s lodged on time and have no credit risk issues.

It also depends on what kind of past experience you’ve had with accounting and bookkeeping work, but there is a way to up-skill in Xero quickly.

If you’re looking for a job it’s a daunting process because you have to sell yourself to an employer and most people don’t have to do this very often. Parents returning from parenting can find it particularly daunting because they’ve found themselves surrounded by nappies, cleaning, cooking and washing and the thought of presenting themselves to other adults can be scary.

I’ve spoken to some EzyLearn students in the last couple weeks about our Accounting Course Tutor Initiative and have been impressed at how capable many of them (you) are!

THE TRUTH IS, writing a blog post takes time. If it were the case of just writing some sentences, it wouldn’t take that long at all.

But what’s the point of that? The last thing you want to do in a busy, information-saturated world is waste people’s time. It’s an insult and you’ll put them off.

After all, these people have given up time in their busy days to read what you have to say. Don’t ruin this special relationship forever by churning out rushed, poor quality content or waffle.

Always think: What’s in it for them? Continue reading How Long Does it Take to Write a Blog Post?