Don’t get lumped with penalties when you don’t need to!

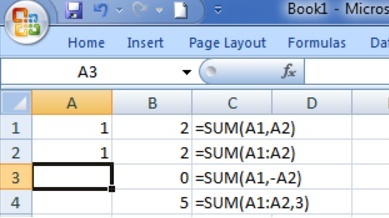

A LOT OF SMALL BUSINESSES have trouble managing their payroll, especially when they only have a few employees and paying to access a payroll system in their accounting package is an unnecessary expense. You’ll learn how to use Excel to manage your PAYG and super contributions in our Intermediate Microsoft Excel Training Courses. However, sometimes you may have a backlog of PAYG and super payments. Let’s take a look at how to manage these.

Rescue bookkeeping

A backlog of PAYG and super payments that date back more than three months is known as rescue bookkeeping, although it can often include other bookkeeping issues, like bank accounts that don’t reconcile with statements.

PAYG payments

For businesses that only withhold up to $25,000 each year, you’re supposed to make PAYG payments and file a withholding report each quarter. You have 28 days from the end of the quarter to do so, after which time, you may incur a Failure To Lodge (FTL) penalty.

Superannuation payments

As with PAYG payments and reporting, you can also incur a FTL penalty for not lodging or paying your employees’ superannuation contributions in time. All businesses, regardless of size, have to make superannuation payments each quarter — the ATO sets out the due dates for each period on their website.

Lodging late PAYG and super payments

The ATO only applies penalties for failure to lodge reports or make payments for each period of 28 days (or part thereof) that a document or payment is overdue. Each period incurs one penalty unit for each document, up to a maximum of five penalty units.

From 2015 onwards, the value of a penalty unit is $180 (previously it was $170) for small businesses, which are defined as entities with an assessable income or GST turnover of no more than $1 million a year.

The maximum penalty a small business will pay is $900 for each document or payment that is overdue. Note too that FTL penalties will also incur a general interest charge (GIC), applied on top of the penalty.

Managing late PAYG and super payments

Use the Ad Hoc Payroll Guide, a new case study that is included in our Intermediate Microsoft Excel Training Courses to determine the rate of PAYG tax to withhold and the required super contribution amounts in Excel. Once you’ve worked out the required amounts (visit the ATO website for tax tables prior to 2017), lodge the necessary PAYG payments and reports to the ATO; pay super contributions using the SuperStream super clearing house.

The ATO will write to you if you are required to pay a penalty — sometimes they are waived for first-time offences, or if the amounts are small.

Our courses now include real-life case studies

Our Intermediate Microsoft Excel training courses will also teach you how to create a payroll spreadsheet from scratch to suit your own business, so you can easily work out your PAYG and super obligations. Visit our website for more information on all of our Excel training courses.

Create brilliant presentations and graphics for all kinds of business purposes.

Gone are the days of excruciatingly dull PowerPoint slide presentations. Nowadays PowerPoint is the hidden gem used to generate animations, videos, movies, advertising and graphics. It’s a great ally to the marketer or social media person in your organisation.

This creative program can also be used to conjure up the most beautiful and modern pictorial slides to enhance any presentation or induction. Find out more about our 2016 version PowerPoint courses.

EzyLearn Excel, MYOB and Xero online training courses count towards Continuing Professional Development (CPD) for bookkeepers and accountants. We’ve been an accredited training provider of the Institute of Certified Bookkeepers ever since the organisation started in Australia. Find out how CPD points can be of benefit to you.

EzyLearn Excel, MYOB and Xero online training courses count towards Continuing Professional Development (CPD) for bookkeepers and accountants. We’ve been an accredited training provider of the Institute of Certified Bookkeepers ever since the organisation started in Australia. Find out how CPD points can be of benefit to you.

We recently updated our advanced

We recently updated our advanced

A business’s balance sheet is a snapshot of its financial position at a particular period of time,

A business’s balance sheet is a snapshot of its financial position at a particular period of time,

Most businesses using an accounting program like MYOB or Xero will use the included payroll package to manage their employees’ payroll. For businesses with only a few employees, however, the additional payroll function is an unnecessary expense.

Most businesses using an accounting program like MYOB or Xero will use the included payroll package to manage their employees’ payroll. For businesses with only a few employees, however, the additional payroll function is an unnecessary expense.  We’ve recently updated our

We’ve recently updated our

Before computers and Microsoft Excel came along, accountants used a pen and paper to keep track of their clients’ business financials. And before that, before the numeral system was invented, the abacus was the main accounting tool used by merchants and traders to keep track of their finances.

Before computers and Microsoft Excel came along, accountants used a pen and paper to keep track of their clients’ business financials. And before that, before the numeral system was invented, the abacus was the main accounting tool used by merchants and traders to keep track of their finances.

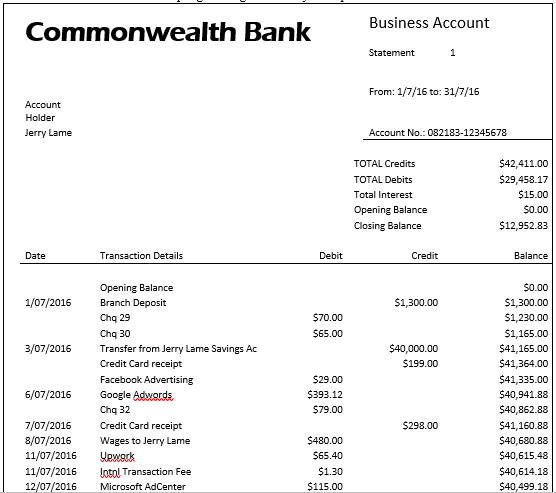

Bank feeds are an important aspect of reconciling your (or your client’s) accounts. Our

Bank feeds are an important aspect of reconciling your (or your client’s) accounts. Our