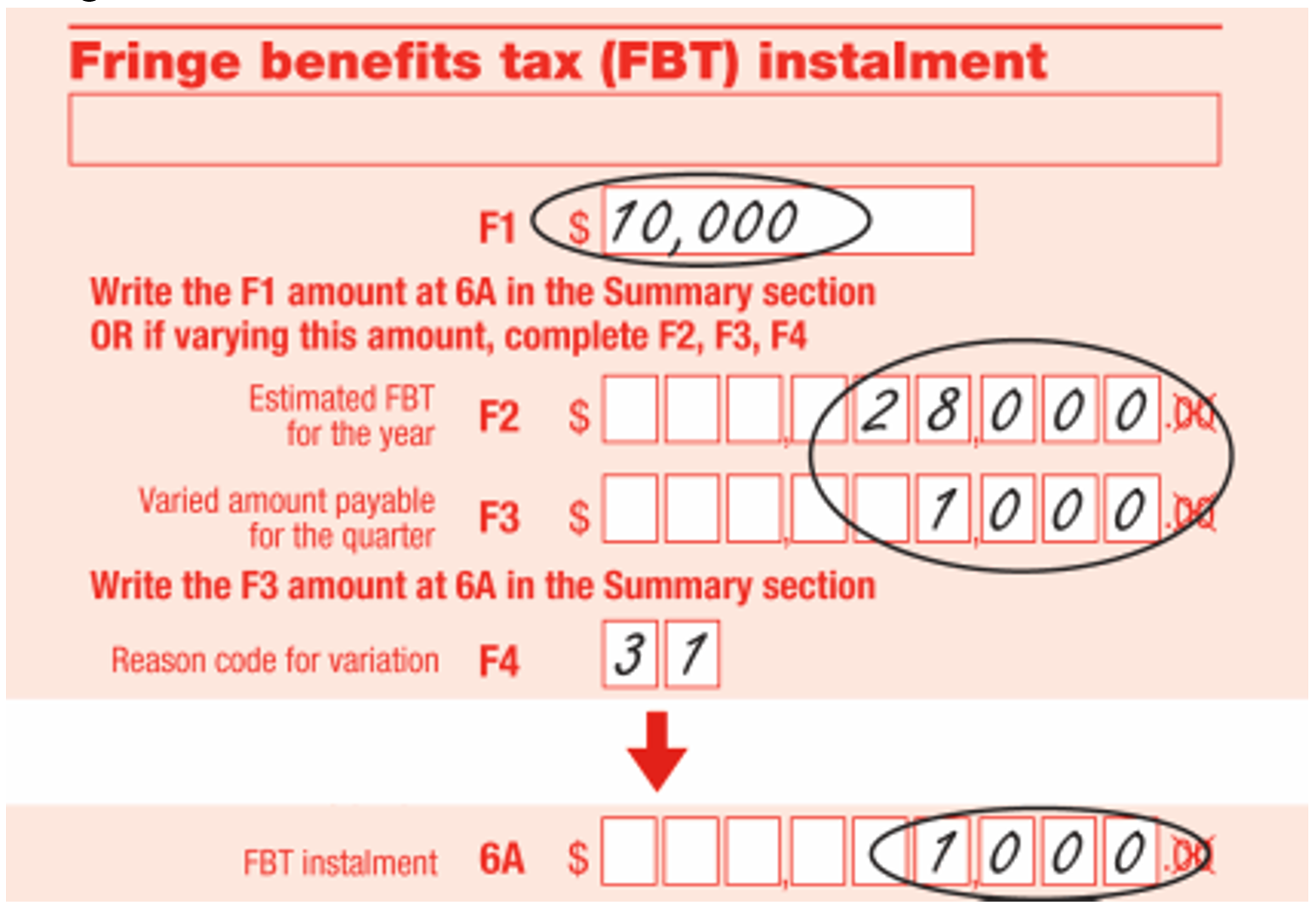

Do you provide your employees with gym memberships or concert tickets? Or maybe you work for a company that provides you with a vehicle or accommodation? There are lots of perks that business can provide to their employees outside of salaries and wages – and these are called fringe benefits and they may apply to you if you worked at home due to COVID-19.

FBT is not as simple as handing out freebies. Employers have to pay tax on these benefits they provide, and the amount can depend on the type of fringe benefit they’re providing.

We’ve written before about how fringe benefits tax is important to consider when you engage a new worker, but let’s look more in-depth into what fringe benefits are all about, and how to ensure you comply with your liabilities:

Continue reading Are You Complying With Your Fringe Benefits Tax Liability of up to 47% (especially COVID-19 related ones)?