We Show You The Reports to Generate Now for End of June

THE LAST QUARTER OF the 2016/17 financial year is upon us, so now is the time to organise your reports and records; including Profit and Loss Statements, Accounts Receivable and Payable, PAYG and Super payments. We’ve previously written about writing off stock and inventory and getting your business expenses in order. In this post we’ll take a look at the reports and records you’ll need for EOFY, which you’ll learn how to produce in our MYOB BAS Reporting and GST or Xero GST, Reporting and BAS training courses.

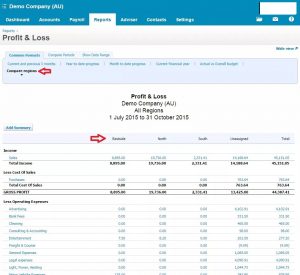

Profit and loss statement

Depending on the structure of your business, you may be legally required to include a P&L statement with your tax return or activity statements. Your tax agent will be able to advise you if your business will be required to file a P&L, which requires all of your bookkeeping to be up-to-date before you can run it.

Even if you don’t have to file one with your activity statements or tax returns, it’s still a good idea to run a P&L for your own sake. A P&L statement identifies whether your business has made a profit or loss and which accounting period these occurred.

Accounts receivable, payable

Find out who owes money to your business and to whom your business owes money. This is obviously part of the credit management process, which any good business will have in place already, but it’s a good idea to keep a steady eye on what’s coming in and what’s going out as EOFY approaches.

PAYG, superannuation

The end of each quarter brings a lot of PAYG and superannuation reporting, but EOFY brings a double whammy of activity statements tax returns and PAYG and superannuation compliance. You’ll need to run these reports so your bookkeeper can complete the payroll component of your returns.

Inventory stocktake

If you sell goods, you’ll need to complete a stocktake of your business’s inventory so that any missing stock can be written off, and to ensure you’re starting a clean slate for the new financial year.

***

Learn how to run the reports you’ll need for EOFY with our MYOB BAS Reporting and GST online training course or our Xero GST, Reporting and BAS training course.

At EzyLearn we offer online training courses to help you up-skill and find employment. Choose from our range of cloud-based online accounting software courses, to business start up and management courses, to marketing and sales courses, or update and further your skills in a range of Microsoft Office programs (Excel, PowerPoint, Word) or social media and WordPress web design).

If you’ve ever fiddled around with PowerPoint, you’d notice there are a few audio sounds you can use insert into your slides. They’re mostly generic sound effects, like the sound of waves or a bird chirping. To be honest with you, none of these are ever appropriate in a PowerPoint presentation, except in some really obscure instances. Or less obscure ones, like a training course teaching you how to insert pre-recorded audio into PowerPoint!

If you’ve ever fiddled around with PowerPoint, you’d notice there are a few audio sounds you can use insert into your slides. They’re mostly generic sound effects, like the sound of waves or a bird chirping. To be honest with you, none of these are ever appropriate in a PowerPoint presentation, except in some really obscure instances. Or less obscure ones, like a training course teaching you how to insert pre-recorded audio into PowerPoint!

EzyLearn Excel, MYOB and Xero online training courses count towards

EzyLearn Excel, MYOB and Xero online training courses count towards

We recently updated our advanced

We recently updated our advanced

Although the process of running a P&L differ between accounting software packages, they usually all contain the same elements, depending only on the business itself. In the first section, the cost of sales is subtracted from the revenue, which highlights gross profit. The business’ operating expenses are then subtracted from the gross profit, which leaves the operating profit. Now, all of the non-operating revenues and expenses must be factored into account, after which the business’ profit or loss will be displayed.

Although the process of running a P&L differ between accounting software packages, they usually all contain the same elements, depending only on the business itself. In the first section, the cost of sales is subtracted from the revenue, which highlights gross profit. The business’ operating expenses are then subtracted from the gross profit, which leaves the operating profit. Now, all of the non-operating revenues and expenses must be factored into account, after which the business’ profit or loss will be displayed.

We’ve recently updated our

We’ve recently updated our

Bank feeds are an important aspect of reconciling your (or your client’s) accounts. Our

Bank feeds are an important aspect of reconciling your (or your client’s) accounts. Our