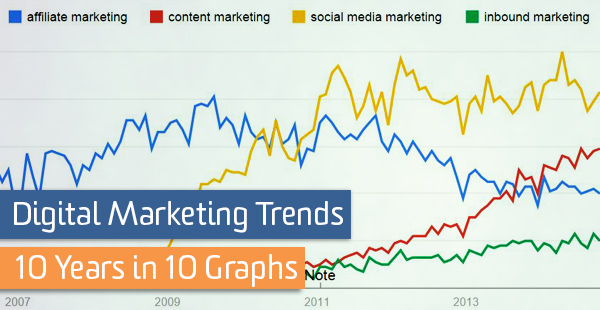

What’s all this about content marketing?

We’re busy developing a new content marketing course because as a form of online marketing, content marketing is finally starting to come into its own. Content marketing has actually been around for many years – it’s been known as custom publishing, branded content, branded journalism, and custom media – but as it became more popular, marketers began referring to it as content marketing to make it easier to for their clients to understand.

We’re busy developing a new content marketing course because as a form of online marketing, content marketing is finally starting to come into its own. Content marketing has actually been around for many years – it’s been known as custom publishing, branded content, branded journalism, and custom media – but as it became more popular, marketers began referring to it as content marketing to make it easier to for their clients to understand.

Content marketing is basically the process of creating valuable, informative content – blog posts, email newsletters, ebooks, etc – and sharing it online to help attract and retain customers. But because it requires a lot of content to be produced and regularly, many small businesses are outsourcing their content marketing needs.

Your content marketing needs to have a purpose

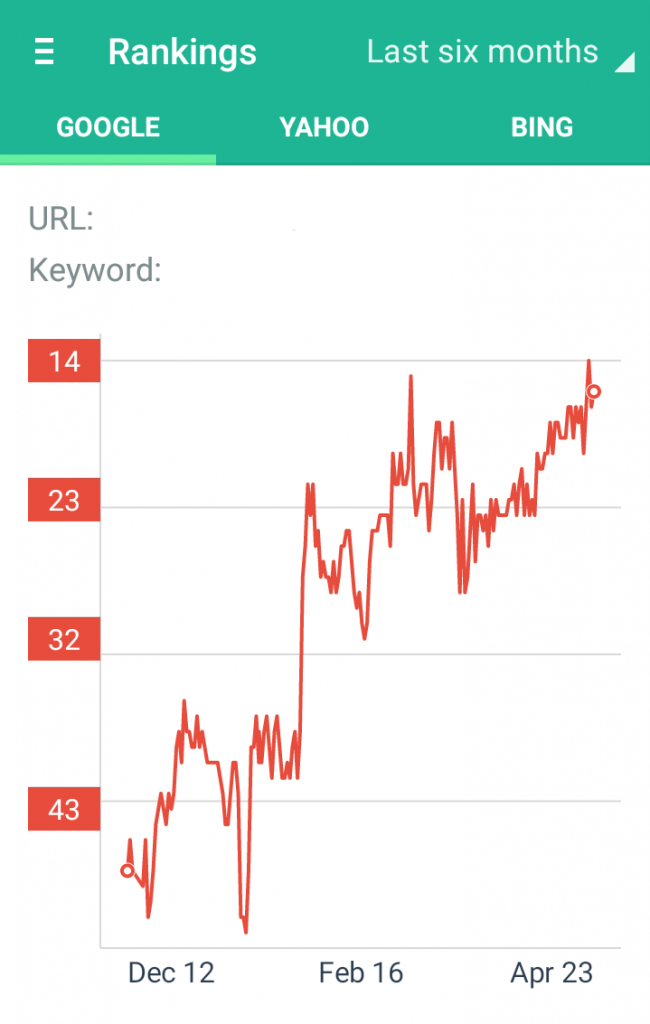

To make the most out your content marketing, you need to have goals and a strategy in place to achieve them so you’re not just wasting your time. This is the same as traditional marketing activities, which we cover in our Small Business Management Course. You also need to be able monitor how each piece of content is going at achieving those goals.

If you’re also hiring a content writer or strategist to help you with your content marketing, you also need a way to easily collaborate. Now, if only there was a way to monitor and analyse your content marketing AND schedule and set content marketing tasks for those people you’re working with…

A tool for schedule and managing content marketing

Well, as we’ve recently discovered, there is! It’s a cloud-based content marketing and editorial calendar called CoSchedule and it allows you to schedule and create content marketing tasks, assign those tasks to your team, create and publish blog posts, share links to content via social media, and monitor the success of your content and the social media platform all within the CoSchedule app.

It’s a very powerful, very useful tool for small businesses that work with a number of remote workers who are based around the country, as it allows complete collaboration with your team and also integrates seamlessly with WordPress. It also helps you to optimise your blog titles and your social media sharing to help drive your web traffic.

By providing you with detail stats – and also integrating with most web analytics software, including Google Analytics – you can see what content performs well and what doesn’t, so you can improve you content in the future.

You need to know your readers to succeed

Because content marketing is about creating engaging and interesting content, whether it’s blog posts or ebooks or something else, it’s vital that you know what content your customers like and what the don’t, so you can ensure you’re always keeping them engaged.

In a post I wrote about content marketing not so long ago, I mentioned how important it is to know and understand your reader, because that’s what’ll help you to engage and interest them with your content. If you have highly engaged people consuming your content, they’re more like to share it with their friends, family and other people in their social networks.

This helps to spread the word about your business, which will bring you more customers and make you more money. But better than that, it’ll also help you to see new opportunities and areas into which you can expand your business.

Content marketing can help expand your business too

We used the feedback we received from our content marketing activities when we decided to develop the Xero training courses and the currently in-development content marketing course; it also guided us in our decision to partner with National Bookkeeping who are taking on licensees and helping them to start their own bookkeeping business.

Yes, we got all that from content marketing! Because through our content marketing, we got to know you, our readers, and what you were interested in and that allowed us to look for the types of courses and business opportunities that would interest you. You can do the same for your business too.

Learn about content marketing from the experts

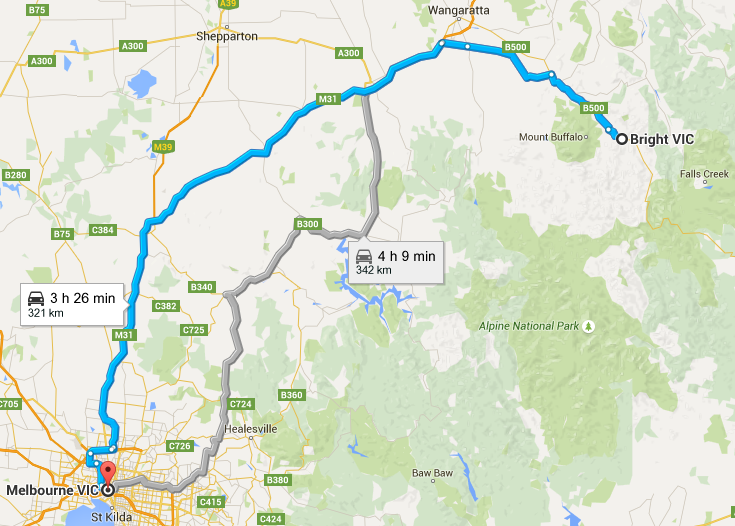

If you’d like to learn about content marketing, our new content marketing course is currently in development. We’re working with an Australian journalist, a successful small business owner, and a digital marketing specialist to create a relevant, easy-to-follow course that’ll guide you through the process step-by-step. In the meantime, you can subscribe to our blog to continue reading our posts, where we’ll keep you updated on how it’s progressing.

If you’re looking for the opportunity to start your own home-based bookkeeping business, we recommend you get in touch with National Bookkeeping, who is taking on licensees. We’ve made all of our courses available to them, which will include our content marketing course when it becomes available so their licensees can learn all about starting and operating their own bookkeeping business.

What about content marketing for real estate agents

We’ve recently become aware of the need for real estate agents to build their own personal profile and credibility online. Property vendors who want to sell their property are (like the rest of us) increasing looking online for selling agents who have good experience and great reputation to sell their properties at the highest possible price and as quickly as possible. Watch this space as we learn more.

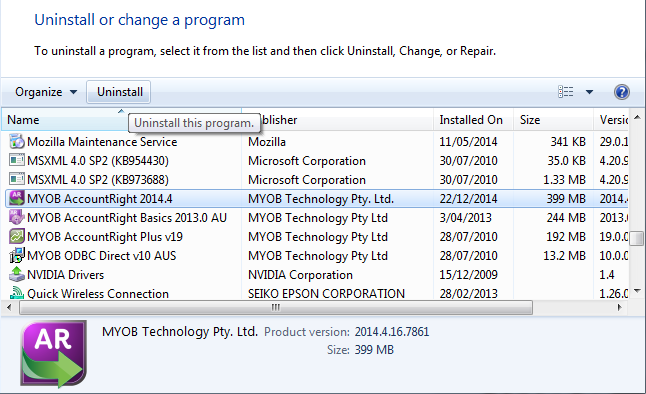

The premium MYOB product with the PLUS on the end of its name has always come with Inventory and Payroll. These have been the major services that justify the premium price that users have been willing to pay. Now Xero comes with it as standard! Is it another nail in MYOB’s coffin?

The premium MYOB product with the PLUS on the end of its name has always come with Inventory and Payroll. These have been the major services that justify the premium price that users have been willing to pay. Now Xero comes with it as standard! Is it another nail in MYOB’s coffin?

Margaret Carey is a registered BAS agent, accounting software and cloud specialist, and owner of the accounting software consultancy firm

Margaret Carey is a registered BAS agent, accounting software and cloud specialist, and owner of the accounting software consultancy firm

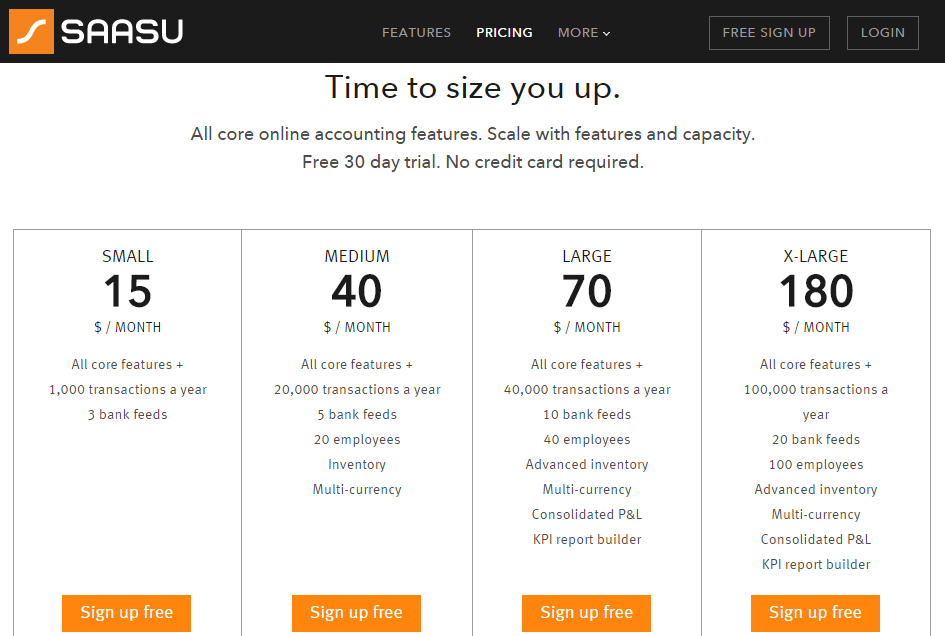

With services like Google Apps, we can run our entire company “server” in the cloud and have experts make sure it is up and running all the time for the cost of less than $100 per month, compared to several thousand dollars to buy the hardware (and have the floor space, data, power and air conditioning) , thousands of dollars in software licences and then having to hire an expert IT service person to manage it all for thousands of dollars per year – particularly if something goes wrong.

With services like Google Apps, we can run our entire company “server” in the cloud and have experts make sure it is up and running all the time for the cost of less than $100 per month, compared to several thousand dollars to buy the hardware (and have the floor space, data, power and air conditioning) , thousands of dollars in software licences and then having to hire an expert IT service person to manage it all for thousands of dollars per year – particularly if something goes wrong. Would you like to hear about MORE innovation in accounting? Want to learn about a cloud-based accounting program that boasts more than twice as many users as Xero?

Would you like to hear about MORE innovation in accounting? Want to learn about a cloud-based accounting program that boasts more than twice as many users as Xero?