Interview with successful business owners

Interview with successful business owners

Between October 2015 and January 2016 I’ve been doing something a little different and something that I haven’t really done in the past. You could say it’s part of the development of new ideas and concepts for EzyLearn and I don’t know how it will work out but am very interested in your opinion and feedback.

Business StartUp Course – EzyStartUp

Over the summer break we renamed our Small Business Course to the EzyStartUp Course and we’ve more clearly targeted that it is for people who are moving from being an employee to working as an independent contractor (with a bigger more comprehensive and detailed Business Plan Package coming later in the year for bigger businesses) and as part of these changes I’ve been interviewing successful business owners about all aspects of their business.

Setup, Legal, Vision, Ideas, Structure, Forecasts

I’ve been lucky to have met a lot of business owners of the last 20 years because many of them have been willing to share intimate details of their businesses in my interviews and the information covers all aspects of the business process from setup and planning to marketing and sales to exit strategies and succession planning. One of the people I interviewed is Tracey Dickson, who bought a promotional products business, built it up and made it valuable using technology and sold it when she was ready to exit. I’ve interviewed Tracey for a number of subjects for The Australian Small Business Centre Pty Ltd and in particular I’ve delved into what she’s gone through in writing a new children’s book based on a character she created called Will Hallam. You can watch the introductory video interview below.

Ideas turn into products that are packaged for markets who buy and use them

The process of creating these videos went a little like this.

- I looked at each of the topics in the ASBC Small Business Management Courses

- I compiled a list of questions that I thought are relevant for each topic (some as a result of further research)

- Looked around at people I know in various different business types (importer, retail, professional services, marketing, sales trainer)

- Studied these business owners websites and business to compile questions that cover the course contents but also relate to their business

- Interviewed the business owner with input from them before and in between videos

After going through all the technical and know-how aspects about the steps you need to take it dawned on me that all of these business owners had something more than just knowledge and experience, they had all those character traits that make business owners successful. They include:

- being inquisitive

- always asking questions

- learning new things

- studying their market

- evaluating their business

- making changes if needed

- sticking at it

- trying again and again

- working to a plan

- working out another way to do things

There are probably many other words or phrases that can be used to describe these traits and they all add up to what makes these people and these interviews so valuable. For many people starting out in business for the first time it’s weird just keeping a time sheet and invoicing for the work they do and then following up for payment so listening to experienced business people and understanding the right attitudes will make as big a difference as the technical know how itself.

Will Hallam is for kids between 7-11 and Tracey has a global opportunity

Tracey is a meticulous person who puts in the ground work and she’s passionate enough about her new project that she’s taken the time to understand how the publishing industry works and what her readers (and their parents) are looking for. I think you’ll find her insights and thought processes very useful and please make a comment on Facebook or Linkedin to let me know your thoughts.

If you like what you’re reading so far subscribe to this blog and check out the new EzyStartUp Course.

Here’s my Introduction video interview with Tracey

Was one of your New Years resolutions to:

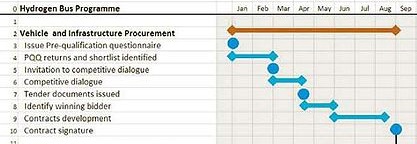

Was one of your New Years resolutions to: The sales stages for wining new business in the building and construction industry can be a lengthy process that starts with specification and design. An architect will create a design from meetings with clients and gradually this design will turn into a multi-million dollar building that functions perfectly but how does the builder find the right team and resources? By tendering out the work.

The sales stages for wining new business in the building and construction industry can be a lengthy process that starts with specification and design. An architect will create a design from meetings with clients and gradually this design will turn into a multi-million dollar building that functions perfectly but how does the builder find the right team and resources? By tendering out the work. I was speaking with Mat, the Managing Director of UltraFlow Siphonics for our Small Business Marketing and Small Business Sales Courses and he mentioned to me that they could literally be doing tenders every hour of every day. He mentioned that there are many different tendering portals where small (or larger) businesses can register and tender for the work that is available and that the key to a successful tender strategy is to narrow down the tenders you go for to one where your business is suited.

I was speaking with Mat, the Managing Director of UltraFlow Siphonics for our Small Business Marketing and Small Business Sales Courses and he mentioned to me that they could literally be doing tenders every hour of every day. He mentioned that there are many different tendering portals where small (or larger) businesses can register and tender for the work that is available and that the key to a successful tender strategy is to narrow down the tenders you go for to one where your business is suited.

Following his $1 billion innovation announcement in December, Prime Minister Malcolm Turnbull received quite a grilling on the ABC program 7.30, hosted by Leigh Sales, who brought up one of the most widely criticised initiatives of the Abbott-Turnbull Coalition government: the NBN.

Following his $1 billion innovation announcement in December, Prime Minister Malcolm Turnbull received quite a grilling on the ABC program 7.30, hosted by Leigh Sales, who brought up one of the most widely criticised initiatives of the Abbott-Turnbull Coalition government: the NBN.

Fewer families today can prosper on a single income, but even if they can, there are even fewer mums who want to completely disconnect from the working world. The benefits of being employed and contributing to the corporate world extend beyond the financial; working provides a person with a sense of accomplishment, by keeping them stimulated and engaged in something they enjoy. Unfortunately, there are many barriers, both financial and practical, that prevent many women returning to work after having children.

Fewer families today can prosper on a single income, but even if they can, there are even fewer mums who want to completely disconnect from the working world. The benefits of being employed and contributing to the corporate world extend beyond the financial; working provides a person with a sense of accomplishment, by keeping them stimulated and engaged in something they enjoy. Unfortunately, there are many barriers, both financial and practical, that prevent many women returning to work after having children.