Finally, after 23 years we’re making our training manuals available for sale! Not the ones we created 23 years ago but our latest versions of course.

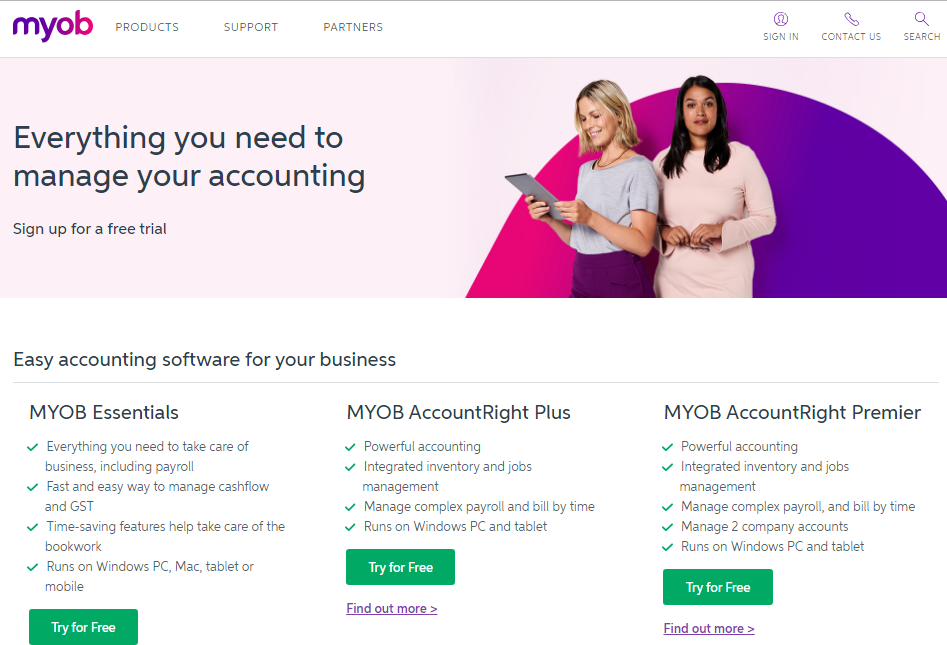

Training manuals are an important learning tool for our courses because they contain the step-by-step exercises that the course is based around. Our first release of training manuals covers credit management, accounts receivable, accounts payable, data entry of quotes, invoices, purchases and payments – all the things that most businesses need.

Purchase yours now and download them instantly.

Continue reading Announcement: MYOB, Xero and QuickBooks Training Manuals now available for sale