Extend Your Online Course Access

Do you need another 12 months course access? Rather than enrol into your courses again and pay the extra courses fees you can now achieve this using an EzyLearn affiliate subscription – no matter how many courses you’ve enrolled into. EzyLearn online short courses can be completed within 2-3 weeks but many students use them as a resource after their course is completed. With the EzyLearn Affiliate Subscription you get continued access to every single course you’ve enrolled into since 2013 for one annual fee!

Becoming an EzyLearn affiliate is the cheapest way of extending your course access a further 12 months but you need to complete all assessments within 12 months to get your Certificate or a fee may apply. Software changes all the time now that it is created in a dynamic and fast changing development environment and that means that we need to keep maintaining and updating our training course content – you get access to those changes as an Affiliate.

Learn more about EzyLearn’s Updates and Additions Policy.

Get Ongoing Student Support

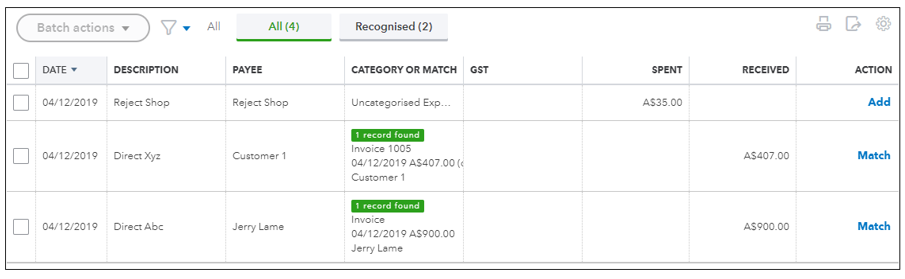

Xero, MYOB & Quickbooks Online are accounting programs in the cloud and because they are now based on a subscription model they are constantly updated and the updates are pushed out live. Not only do you receive ongoing online course access as an affiliate but you also receive ongoing knowledge support of the training materials and new content we create.

As a member you receive ongoing support from our team on all the course contents you’ve already enrolled into as long as you are a member.

Learn more about how Ezylearn courses work and how your learning is supported

Ask questions on topics that are NOT included in the courses

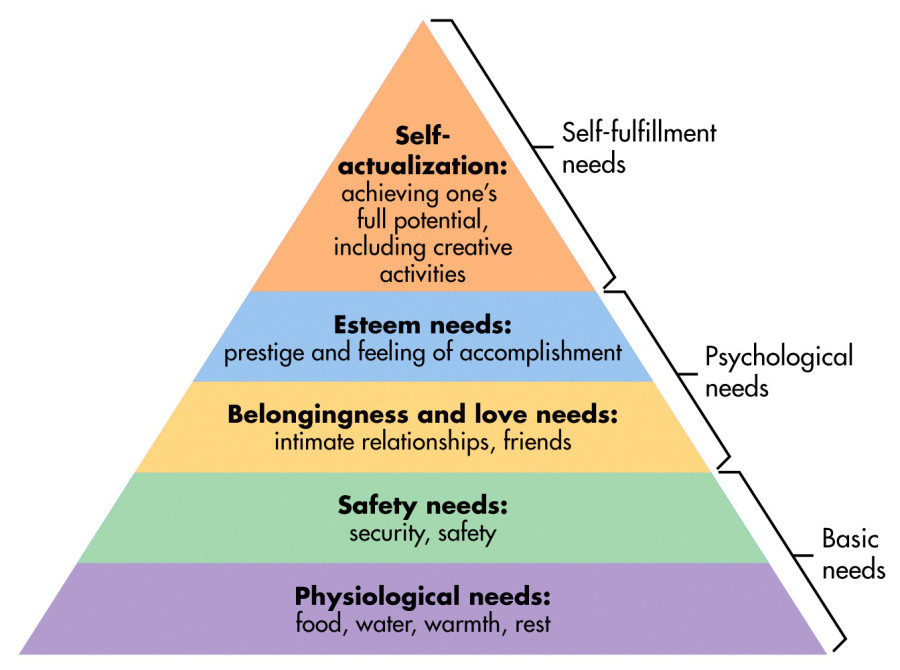

EzyLearn ANSWERS is a program we launched to help guide our training development based on the needs of our students. Student members use Ezylearn training courses for lots of different reasons, including:

- employees to upskill and fill out gaps in their knowledge for their current jobs,

- job seekers to increase their confidence to apply for and get jobs,

- corporate managers to ensure their staff are using productive features of the software

- business owners who want their staff to have a solid understanding of how to use their business software

Our courses are designed based on real world scenarios and the questions we receive via EzyLearn ANSWERS helps us constantly improve.

Learn more about EzyLearn ANSWERS

Earn a Second Passive Income

Love EzyLearn online training courses and fantastic student support and want to promote it to people you know (or even those you don’t)?

When you join the EzyLearn affiliate program you can earn an affiliate commission if someone follows your link and enrols into a course!

Affiliate marketing is used by massive online organisations like Amazon and some people even consider Xero’s sales model to be a form of affiliate marketing because bookkeepers and accountants can make a margin from the monthly subscription fees. You can now do this for training with EzyLearn if you want to.

As an EzyLearn affiliate you can earn a share of the income just by writing about our courses in social media and helping other people discover us and our courses.

Digital Marketing Training

Included in this program is training in beginner level skills about digital marketing. These skills can be applied to the business where you currently work as well as in operating your own online business. The main benefits to students is that you get to use digital marketing assets that are already being used effectively in the real world in your own digital marketing campaigns.

The knowledge, tools and digital assets available and included in this training program enable you to start and run your own online businesses without the headache and risk of huge upfront capital costs. Learn how to use Facebook, Linkedin and other social media platforms to share information about businesses you are passionate about and believe in and benefit financially when they enrol and go with your suggestions.

Start an Online Business Course

Starting a business is daunting for most people but having an online business where you can work from home is a dream. Having an online business can give you a huge amount of flexibility but also comes with the requirements to do the work required. There’s no such thing as a free lunch online training and tutoring businesses come with some unique benefits, including:

- All courses and delivered and supported by a training company with over 20 years experience

- All services are delivered online via the Internet (no fright issues)

- You earn a commission of each sale and potential to follow a career path as a tutor

- You can work from home and in your own hours.

[schema type=”product” url=”https://ezylearn.com.au/product/ezylearn-affiliate-membership/” name=”Microsoft Excel, Xero Accounting, MYOB Education Training affiliate system” description=”Learn how to do social media marketing to share what you know and be rewarded financially” brand=”EzyLearn” manfu=”EzyLearn” model=”Online Training Courses & Support” price=”$199.00″ condition=”New” ]