Nationally Recognised Courses in Quickbooks, MYOB and Xero Courses do NOT Exist

A lot of our enquiries regarding MYOB, Xero and Quickbooks courses are from students looking for a bookkeeping job or start a bookkeeping business so when they ask about accredited or certified courses in accounting programs its because they want a qualification or because of what they’ve read on training websites – some of them are very confusing. The biggest confusion that I’ve come across lately has been about a Diploma in Xero! it doesn’t exist.

A lot of our enquiries regarding MYOB, Xero and Quickbooks courses are from students looking for a bookkeeping job or start a bookkeeping business so when they ask about accredited or certified courses in accounting programs its because they want a qualification or because of what they’ve read on training websites – some of them are very confusing. The biggest confusion that I’ve come across lately has been about a Diploma in Xero! it doesn’t exist.

The best place to find out the truth about Nationally accredited courses is at the official government websites: http://training.gov.au/Home/Tga and https://www.myskills.gov.au/ and if you do a search at either of these sites for Xero,MYOB or Quickbooks and you’ll find there are no results and the reason is simple – bookkeeping skills are the same regardless of which software program you use.

When the Department of Education & Training began the process of regulating the education industry last decade I explored the options of applying to turn EzyLearn into an RTO and decided against it because of the red tape and high compliance costs. I’ve since spoken to managers at some VERY large companies that initially decided to jump on the RTO bandwagon only to discover many years later that it was all a huge cost for very little benefit. This doesn’t mean that RTO’s are bad, it’s just that the business owner needs to go through an evaluation process to see if it is financially viable. Here’s some recent news about RTO’s that have experienced financial difficulty.

EzyLearn creates, delivers and supports short courses, often called night courses, in the popular accounting software programs for a low cost and with the flexibility of online delivery so you can start quickly anytime (no waiting for a course schedule) and then progress at your own pace. See our Cloud Accounting Courses here.

If you’re looking for a Nationally Accredited Bookkeeping Certificate then learn more about what’s included and the costs for a Cert IV in Bookkeeping.

Compliance Requirements for RTO’s

A great example of one very onerous compliance task for RTO’s is that they need to keep student records for 30 years, 30 years! That’s more onerous that the 7 long years a business needs to keep tax records for the ATO! If you are really interested, take a detailed read of Standard 3 the site that governs RTO’s in Australia, Australian Skills Quality Authority (scroll down just past half way).

EzyLearn has always been a creator of training course content and we focus on keeping our content up to date, marketing it, delivering it via an LMS and supporting students – that includes delivering exceptional value for a low price and using as many learning tools as we can (workbooks, exercise files, training workbooks, knowledge reviews).

EzyLearn has always been a creator of training course content and we focus on keeping our content up to date, marketing it, delivering it via an LMS and supporting students – that includes delivering exceptional value for a low price and using as many learning tools as we can (workbooks, exercise files, training workbooks, knowledge reviews).

When students ask us whether we are accredited or whether our certificates are accredited we try to find out what is most important for them: to get software skills and experience or to get a nationally accredited certificate – there is a MASSIVE difference in price and I’ve written this blog to help you find the right course for your circumstances.

Nationally Accredited Courses and RTO’s

Here are a couple things that will help you find the right course and the right training company.

- Only an RTO (Registered Training Organisation) is able to deliver nationally accredited courses and more specifically the assessments that deem whether you are Competent or Not Yet Competent.

- RTO’s can only deliver Courses based on the subjects available from a Nationally Accredited Library of subjects

If you are thinking about doing a Nationally Accredited Course check out whether that training provider is listed at this site: http://training.gov.au/Search. While you are at it see if the course they advertise is also listed.

Diplomas are Available for Accounting: Check your RTO

See if you can find a Diploma in Xero, or MYOB or Quickbooks? The answer is no, because their isn’t one. What some training companies offer is a Cert IV in Bookkeeping or a Diploma in Accounting and they may focus on using Xero or MYOB or other software but if that is the case you should delve a little deeper into the RTO and see how good they really are. If you search the training.gov.au website you’ll be able to see all of the information about every RTO. The Investment Banking Institute in Melbourne is a highly regarded RTO for the provision of financial services and bookkeeping courses and when you visit their Official Organisation Details page you can see the courses on their “scope”, their contact details and if there are any restrictions on the training they deliver.

See if you can find a Diploma in Xero, or MYOB or Quickbooks? The answer is no, because their isn’t one. What some training companies offer is a Cert IV in Bookkeeping or a Diploma in Accounting and they may focus on using Xero or MYOB or other software but if that is the case you should delve a little deeper into the RTO and see how good they really are. If you search the training.gov.au website you’ll be able to see all of the information about every RTO. The Investment Banking Institute in Melbourne is a highly regarded RTO for the provision of financial services and bookkeeping courses and when you visit their Official Organisation Details page you can see the courses on their “scope”, their contact details and if there are any restrictions on the training they deliver.

If you are really that interested in learning more about accreditation and accredited courses you should take a look at the Cert IV in Bookkeeping. There are 24 available courses but an RTO only needs to deliver 13, of which 6 are core units. That means that apart from the core subjects EVERY RTO is able to mix and match with 18 of the potential elective subjects. I’m not the best at statistics but this means there are LOTS of potential combinations of subjects that can make up a Cert IV in Bookkeeping.

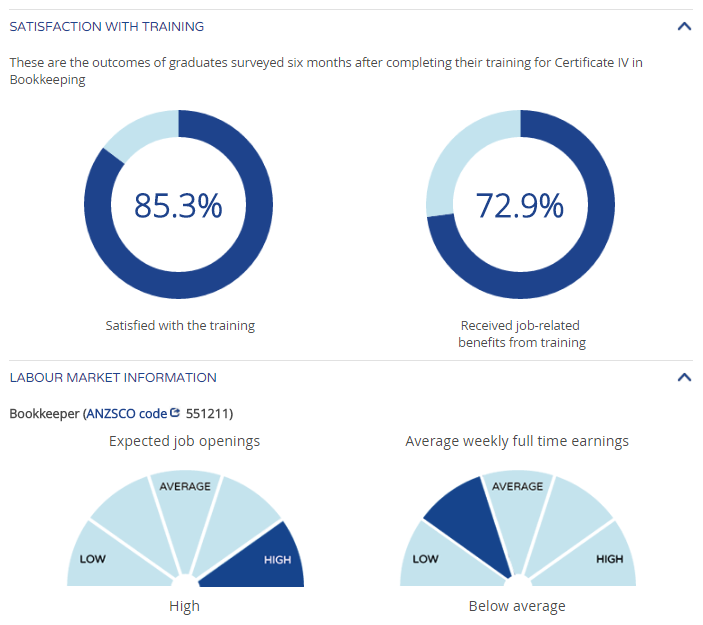

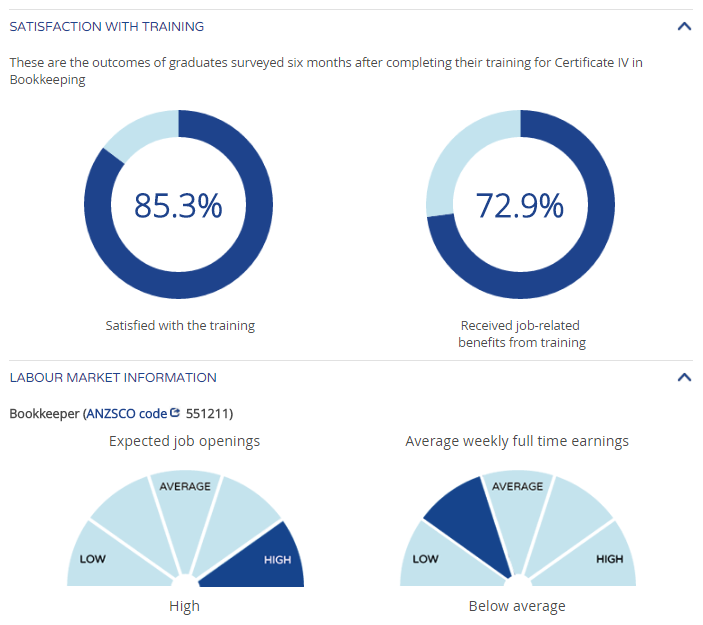

See my conclusion and references for examples of the type of information a good RTO will make available about the student satisfaction (Quality Reporting Indicators).

Accreditation by the Software Company: MYOB, QuickBooks, Xero

Another type of accreditation are those offered by the software companies but let’s be honest, these services are revenue raising “partner” programs and the more “paying” partners a software company has the more money they earn and the more exposure to clients they have. I recall when MYOB was in it’s early days (and still called Data Tech) that the main requirements to become a partner where to do at least 3 installations – but there was not training or quality control beforehand, it was almost like you had to wing it and if you did 3 then you were rewarded with a partner status!

Another type of accreditation are those offered by the software companies but let’s be honest, these services are revenue raising “partner” programs and the more “paying” partners a software company has the more money they earn and the more exposure to clients they have. I recall when MYOB was in it’s early days (and still called Data Tech) that the main requirements to become a partner where to do at least 3 installations – but there was not training or quality control beforehand, it was almost like you had to wing it and if you did 3 then you were rewarded with a partner status!

In those early days EzyLearn delivered MYOB courses and some of the students who came along shared experiences about “MYOB Certified Consultants” who just flew in, set everything up and then flew out leaving a mess that often they wouldn’t fix. These consultants made themselves appear like super heroes who could only possibly come for one day at a time (they were booked out for months of course and charged a fortune). The company’s accountant or accounting staff were usually left to clean up the mess and make everything right. Sure,things may have changed these days and the standards imposed by the software companies are much higher but to me this accreditation is one of the last places a bookkeeper should turn to – and the last accreditation an employer should look for.

The best accreditation in my mind is accreditation (or certification) by the industry and that’s normally delivered by not-for-profit associations that aim to increase the education and compliance of their members.

Accredited by the Industry

There are several associations for bookkeepers who want to become Registered BAS Agents but the most progressive is the Institute of Certified Bookkeepers. This organisation came from the UK where they are still a leading member group, when the Australian Bookkeeping Industry began the process of regulation and they recognised the benefit of letting their partners use their logo to demonstrate their membership status.

There are several associations for bookkeepers who want to become Registered BAS Agents but the most progressive is the Institute of Certified Bookkeepers. This organisation came from the UK where they are still a leading member group, when the Australian Bookkeeping Industry began the process of regulation and they recognised the benefit of letting their partners use their logo to demonstrate their membership status.

We spend over $1000 pa on this membership but we do it because our students are then able to join the Institute as student members.

Conclusion

Firstly,I did NOT see myself writing all this.

Secondly if it’s important for you to receive a nationally accredited qualification do some basic research in the company delivering the courses and make sure they are an RTO and not just using words like Diploma in Xero to confuse you and finally check out the subjects that they include in their Cert IV, you may find one company’s Cert IV is better than another.

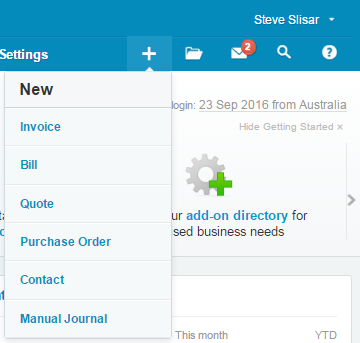

Finally, If you decide you just want to learn how to use the software using practical exercises and following step by step processes that are performed in most companies everyday then enrol into one of our EzyLearn courses. The Certificate we provide is a Certificate of Completion once all our Knowledge Reviews have been completed successfully and these knowledge reviews are at the end of each section of each course. In the MYOB course we have 5 courses.

Finally, If you decide you just want to learn how to use the software using practical exercises and following step by step processes that are performed in most companies everyday then enrol into one of our EzyLearn courses. The Certificate we provide is a Certificate of Completion once all our Knowledge Reviews have been completed successfully and these knowledge reviews are at the end of each section of each course. In the MYOB course we have 5 courses.

The best guarantee I can offer is a 30 day money back guarantee. Happy Learning

Some other references you may find interesting:

A lot of our enquiries regarding

A lot of our enquiries regarding

There are several associations for bookkeepers who want to become Registered BAS Agents but the most progressive is the Institute of Certified Bookkeepers. This organisation came from the UK where they are still a leading member group, when the Australian Bookkeeping Industry began the process of regulation and they recognised the benefit of letting their partners use their logo to demonstrate their membership status.

There are several associations for bookkeepers who want to become Registered BAS Agents but the most progressive is the Institute of Certified Bookkeepers. This organisation came from the UK where they are still a leading member group, when the Australian Bookkeeping Industry began the process of regulation and they recognised the benefit of letting their partners use their logo to demonstrate their membership status. Finally, If you decide you just want to learn how to use the software using practical exercises and following step by step processes that are performed in most companies everyday then enrol into one of our EzyLearn courses. The Certificate we provide is a Certificate of Completion once all our Knowledge Reviews have been completed successfully and these knowledge reviews are at the end of each section of each course. In the MYOB course we have 5 courses.

Finally, If you decide you just want to learn how to use the software using practical exercises and following step by step processes that are performed in most companies everyday then enrol into one of our EzyLearn courses. The Certificate we provide is a Certificate of Completion once all our Knowledge Reviews have been completed successfully and these knowledge reviews are at the end of each section of each course. In the MYOB course we have 5 courses.