MYOB – Bain Capital Cashing In While They Can

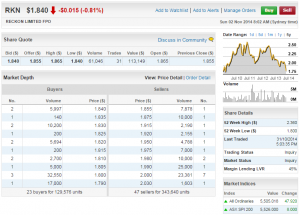

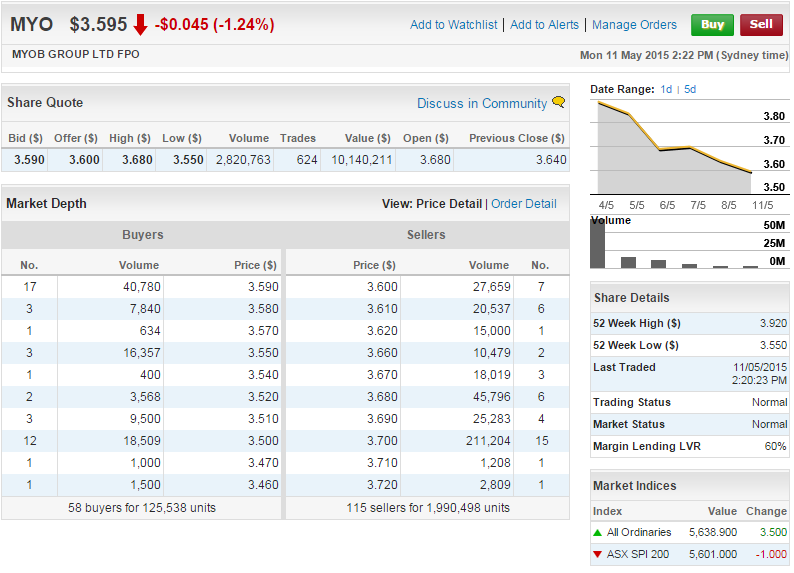

You may be aware that MYOB is once again listed on the Australian Stock Exchange (ASX) as Bain Capital aim to grab some cash back for the massive investment they made in the accounting software company.

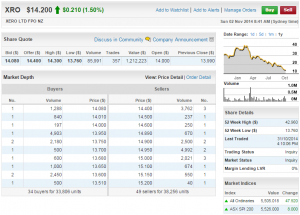

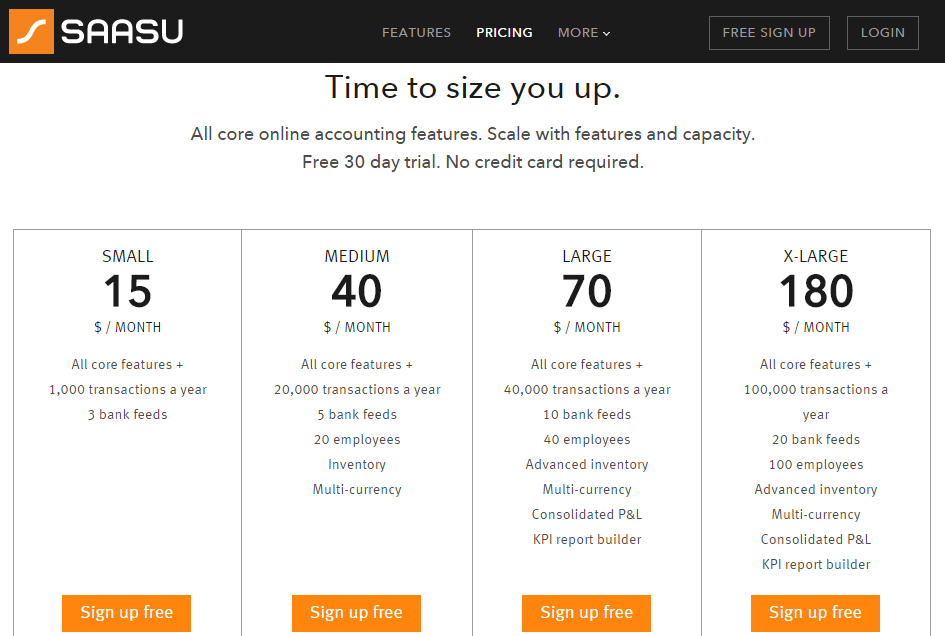

In the recent lull in the share price of companies on the ASX in general you’d think that MYOB company executives are worried about getting their money back let alone making a return on their initial investment. After all they are now competing globally with small startups like Xero (and SAASU) as well as MASSIVE accounting software companies like Intuit.

We’ve always been committed to MYOB accounting software training courses because the software is so popular with most Australian accountants and it is (even today) by far the most used accounting program for small business in Australia.. BUT, we’ve noticed a significant increase in enrolments for our Xero Accounting Training Courses and we wondered why? Why is August and September such a popular time for enrolments in Xero and it was then obvious.

[quote]Everyone is finishing off their end of year accounts for the 2015 financial year and those that want to make a change away from MYOB are switching to Xero now.[/quote]

Our Xero Course is Now Beefed Up and it’s Yours for Nothing Extra

We’ve just increased the cost of our Xero courses because we’ve beefed it up with:

- 3 new Xero Training Course Workbooks,

- More detailed Xero knowledge review questions AND some

- Industry specific training guides for the tradies who want to change to Xero.

[box type=”tick” size=”large” style=”rounded” border=”full”]Existing Xero students can access all of these new training aids for no extra cost and that is a great feature of our 12 month membership offer- you can lock in the current price and get all of the future benefits as we get the Xero course to the same level of detail as our popular MYOB courses.[/box]

Xero Seems to be the Tradies Choice

Ever since I interviewed Ken from Love My Home Theatre I started to realise the appeal of Xero for tradies! Plumbers, Electricians, Concreters, Builders, Pest Inspectors, Painters and most other tradies are always out doing their work whether they are quoting, working or finishing off they are always seeing their customers and potential customers so it make sense for them to do as much as they can while they are ont and about. They also have to keep good records of:

- Products they purchase for their customers

- Resources they allocate to their customers

- Money that is owed after the work is completed

- Progress payments as the jobs are gradually completed

Bookkeeping is also something that isn’t second nature for tradies and it’s usually done by their wifes, partners, a trusted friend or someone who knows their industry very well. Being cloud-based (online) accounting software tradies can now create quotes using an iPad or other mobile device and the invoicing, debtors follow-up and bank reconciliation can be done by a bookkeeper (from anywhere).

For this reason we’ve created a Xero Training Guide for Plumbers and Concreters. We’ve got some classic examples of how a plumber may buy products from Reece plumbing on their account for one of their clients and they need to keep track of this purchase.

Reece Plumbing Integrates with Xero

One of the most interesting observations about what Reece Plumbing have done with their purchase and payment system is their integration with Xero Accounting software so that customers don’t need to perform data entry and automatically have a copy of each of their tax invoices.

The benefits sited by Reece are:

- No need for manual uploads of tax invoices/receipts

- No data entry mistakes

- Save time and money

- See your tax invoices in Xero

Learn more about the benefits of using the Reece Plumbing Xero Integration.

After School Holidays is a Good Time to Learn How to Use Xero?

If it is time for you to migrate or transfer your accounting information to a new platform we’d love to help you. We’ve also had a lot of bookkeepers learn how to use Xero so it’s clear there is a ground swell to good online (cloud) accounting software and Xero seem to have done well so far. If you are interested in adding Xero to your pack of software skills take advantage of our current prices – you can always start your course when you come back from school holidays and the kids are back in school.

Will the NEW Quickbooks Make a Comeback?

I’ve written before about Quickbooks and they are still doing great stuff with their pricing. As the blog image above suggests they have maintained a steady first year discount for at least 12 months (from our observations) and maybe this is their strategy to squeeze the margins for much smaller startups like Xero.

It’s a good time to note that the Quickbooks we’re talking about is the NEW Quickbooks from the massive US Company Intuit, not the one that WAS distributed in Australia by Reckon before Intuit and Reckon dissolved their distribution agreement.

I’ve taken the time to explore Quickbooks and it’s pretty impressive and easy to use. If its something you want to learn about make sure you visit our Quickbooks Training Course page and pre-register to receive the course at an Introductory price.

The other week, we wrote a couple of blog posts, discussing the recent $5.5b worth of breaks [

The other week, we wrote a couple of blog posts, discussing the recent $5.5b worth of breaks [ When I started my blog more than 5 years ago, I felt a bit like a computer nerd. I mean, who wanted to read about

When I started my blog more than 5 years ago, I felt a bit like a computer nerd. I mean, who wanted to read about

With services like Google Apps, we can run our entire company “server” in the cloud and have experts make sure it is up and running all the time for the cost of less than $100 per month, compared to several thousand dollars to buy the hardware (and have the floor space, data, power and air conditioning) , thousands of dollars in software licences and then having to hire an expert IT service person to manage it all for thousands of dollars per year – particularly if something goes wrong.

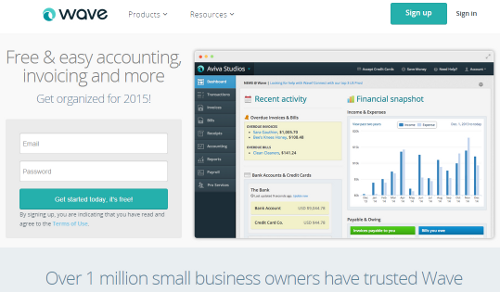

With services like Google Apps, we can run our entire company “server” in the cloud and have experts make sure it is up and running all the time for the cost of less than $100 per month, compared to several thousand dollars to buy the hardware (and have the floor space, data, power and air conditioning) , thousands of dollars in software licences and then having to hire an expert IT service person to manage it all for thousands of dollars per year – particularly if something goes wrong. Would you like to hear about MORE innovation in accounting? Want to learn about a cloud-based accounting program that boasts more than twice as many users as Xero?

Would you like to hear about MORE innovation in accounting? Want to learn about a cloud-based accounting program that boasts more than twice as many users as Xero?