Due dates for BAS lodgement can be deferred by BAS agents

If you’re doing your BAS with the help of a Tax or BAS agent you might be aware that although the actual due date for the March quarter BAS is 28th April you can get an extension by using a tax or BAS agent to the 26th of May.

We’ve had quite a few conversations lately with bookkeepers about whether they can do this or not and if not who can they turn to, to do it.

When you lodge a BAS with the ATO you are effectively telling them how much you’ve earnt and spent but more importantly you are defining how much the business actually pays in tax – and they DON’T want you to get this amount wrong.

If the amount is wrong and in your favour you may incur fees and charges and the TAX and BAS agent system (that is managed by the Tax Practitioners Board) has been set up to assume that only someone who has the training and experience is responsible for lodging these important documents. If they get it wrong a small business owner can sue them for the time it takes to fix the problem and for this BAS agents need professional indemnity insurance.

Non-registered Bookkeepers and BAS Agents

The good news for both businesses AND ordinary bookkeepers who are NOT registered BAS agents is that you can have a bookkeeper do your data entry, as well as help you with various aspects of your business accounts and administration (like accounts payable, receivable and even customer service etc) for a good, low rate.

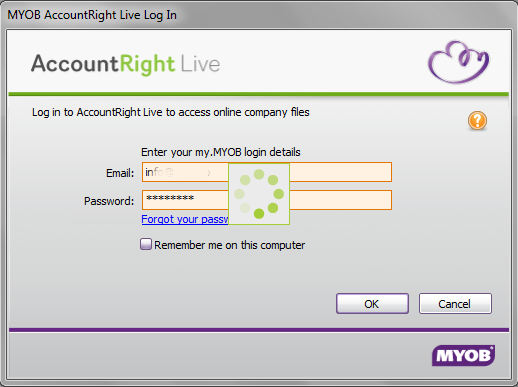

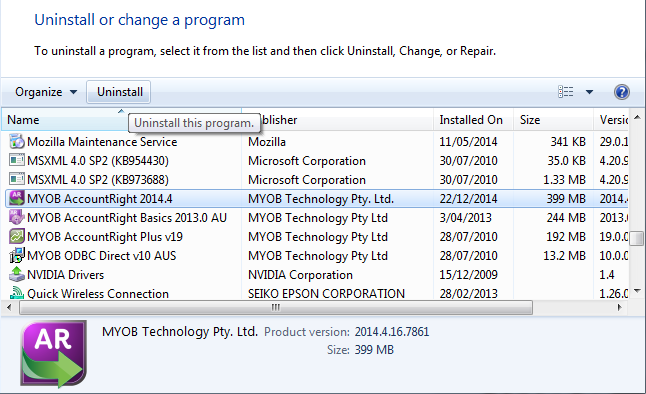

All you need it confidence in using MYOB or Xero accounting software. Our Xero Complete course will teach you everything from setup and configuration through daily transactions like invoices, purchases, expenses and payments and advanced topics like BAS, Reporting, Payroll, Projects and cashflow reporting.

Many of these bookkeepers operate as independent contractors so the small business doesn’t need to employ a staff member to do the books [want to start your own bookkeeping business cheaply? Look at joining National Bookkeeping] and some of them are very experienced in bookkeeping and even running their own businesses.

The good news is that you can still use one of these bookkeepers to take care of the accounts side of your business and use your accountant or a BAS agent for the BAS preparation and lodgement.

Bank reconciliation done right is where all the work is done

Now we have the BAS lodgement details out of the way let’s get into the bank reconciliation. This work is often done by the accounts person or contractor and it’s where most of the time and effort in preparing a BAS is spent. If this is done correctly the BAS preparation is pretty simple so it made us delve a little further into the steps taken in doing this work. Here are the simple steps:

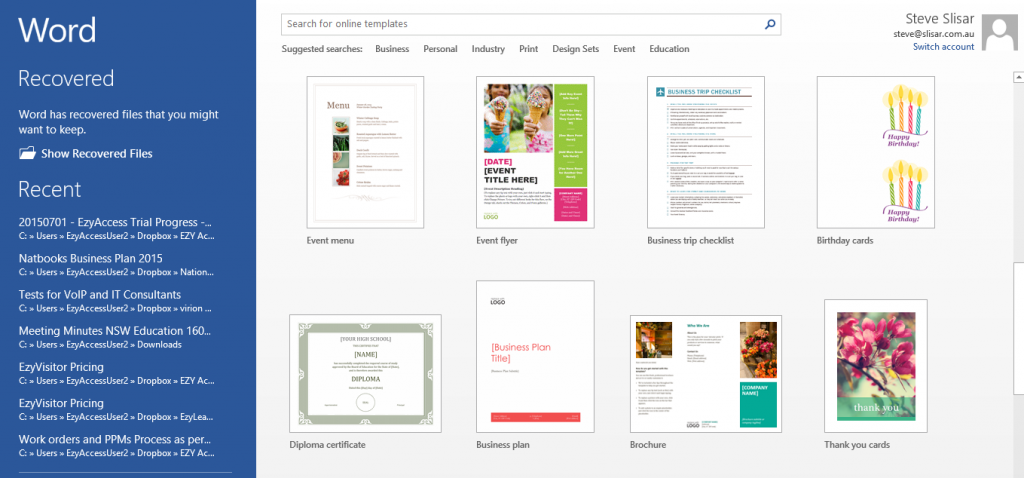

- Launch your accounting software

- Go to the bank reconciliation area

- Start matching entries in your software with lines on the bank statement (much easier and faster with bank feeds and Internet banking).

- Reconcile each month

- Run your BAS report

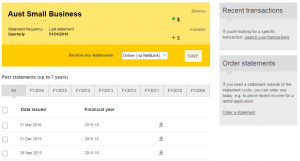

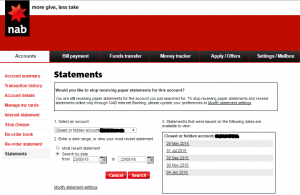

Many people at this stage will need to provide copies of their bank statement to their accountant, BAS agent or bookkeeper so that person can see actually real world evidence of that transaction (sometimes bank feeds are perfect either). It’s at this stage that you realise whether you made the right choice in the bank you choose because not all banks are equal in Australia even if they are grouped as the BIG four. I’ve written about my disappointment in how hard it is to use a bank like NAB before and I’m afraid I’m gong to have to do it again, comparing NAB to CBA for the ease of getting bank statements.

Bank Statements and Internet Banking – Bad news NAB

CBA provide 7 years of storage for bank statements so if you do have to go back and get an old one guess what? No calls to make, not bank statement fees to pay, no need to search through your filing cabinat for paper statements, all you need to do is go back to that period and download the file as a PDF and email it to your accountant or bookkeeper.

To do this with NAB is very similar to walking into one of their branches (well the one they just closed down at Dee Why anyway) – it’s old, clunky and hard to work with and often I’ve found you need to email or call or do physical searching around your office for this rudimentary information – this task alone can make the whole bank reconciliation experience very frustrating.

Do your end of year reports now

While we are on the topic of reporting you may be aware that there are some tax deductions and expenses that you can claim this financial year so it’s a good time to know exactly how you have performed this financial year. Plus you’ll see how far short or ahead you are from last year and you can do your own Jerry Harvey style clearance sale – everything has to go, go, go because we have TOO MUCH stock.

We’re preparing some blogs that’ll be published shortly about some of the deductions and tax breaks you might want to take advantage of. Hopefully after these we’ll be able to focus on our online digital marketing courses like Facebook Pages for business and Facebook advertising for real estate agents! Every one will benefit from these Facebook courses but we’ll slant towards how real estate agents can use Facebook to attract vendors in their local area – it’s fascinating.

They say that, in life, nothing is certain but death and taxes. If you live in Australia, however, it’s fair to say that nothing is certain but death, taxes and

They say that, in life, nothing is certain but death and taxes. If you live in Australia, however, it’s fair to say that nothing is certain but death, taxes and

Has someone been telling you you must get onto social media? Are you a real estate agent with a Facebook page that is pushing people away? Are you spending hundreds of dollars per month and pushing your Facebook community away from what you do and to all the big companies!?

Has someone been telling you you must get onto social media? Are you a real estate agent with a Facebook page that is pushing people away? Are you spending hundreds of dollars per month and pushing your Facebook community away from what you do and to all the big companies!?

Interview with successful business owners

Interview with successful business owners

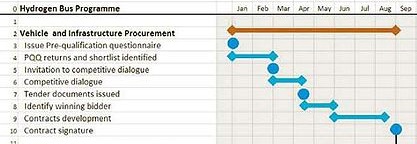

The sales stages for wining new business in the building and construction industry can be a lengthy process that starts with specification and design. An architect will create a design from meetings with clients and gradually this design will turn into a multi-million dollar building that functions perfectly but how does the builder find the right team and resources? By tendering out the work.

The sales stages for wining new business in the building and construction industry can be a lengthy process that starts with specification and design. An architect will create a design from meetings with clients and gradually this design will turn into a multi-million dollar building that functions perfectly but how does the builder find the right team and resources? By tendering out the work. I was speaking with Mat, the Managing Director of UltraFlow Siphonics for our Small Business Marketing and Small Business Sales Courses and he mentioned to me that they could literally be doing tenders every hour of every day. He mentioned that there are many different tendering portals where small (or larger) businesses can register and tender for the work that is available and that the key to a successful tender strategy is to narrow down the tenders you go for to one where your business is suited.

I was speaking with Mat, the Managing Director of UltraFlow Siphonics for our Small Business Marketing and Small Business Sales Courses and he mentioned to me that they could literally be doing tenders every hour of every day. He mentioned that there are many different tendering portals where small (or larger) businesses can register and tender for the work that is available and that the key to a successful tender strategy is to narrow down the tenders you go for to one where your business is suited. Following his $1 billion innovation announcement in December, Prime Minister Malcolm Turnbull received quite a grilling on the ABC program 7.30, hosted by Leigh Sales, who brought up one of the most widely criticised initiatives of the Abbott-Turnbull Coalition government: the NBN.

Following his $1 billion innovation announcement in December, Prime Minister Malcolm Turnbull received quite a grilling on the ABC program 7.30, hosted by Leigh Sales, who brought up one of the most widely criticised initiatives of the Abbott-Turnbull Coalition government: the NBN.

With services like Google Apps, we can run our entire company “server” in the cloud and have experts make sure it is up and running all the time for the cost of less than $100 per month, compared to several thousand dollars to buy the hardware (and have the floor space, data, power and air conditioning) , thousands of dollars in software licences and then having to hire an expert IT service person to manage it all for thousands of dollars per year – particularly if something goes wrong.

With services like Google Apps, we can run our entire company “server” in the cloud and have experts make sure it is up and running all the time for the cost of less than $100 per month, compared to several thousand dollars to buy the hardware (and have the floor space, data, power and air conditioning) , thousands of dollars in software licences and then having to hire an expert IT service person to manage it all for thousands of dollars per year – particularly if something goes wrong. Would you like to hear about MORE innovation in accounting? Want to learn about a cloud-based accounting program that boasts more than twice as many users as Xero?

Would you like to hear about MORE innovation in accounting? Want to learn about a cloud-based accounting program that boasts more than twice as many users as Xero?