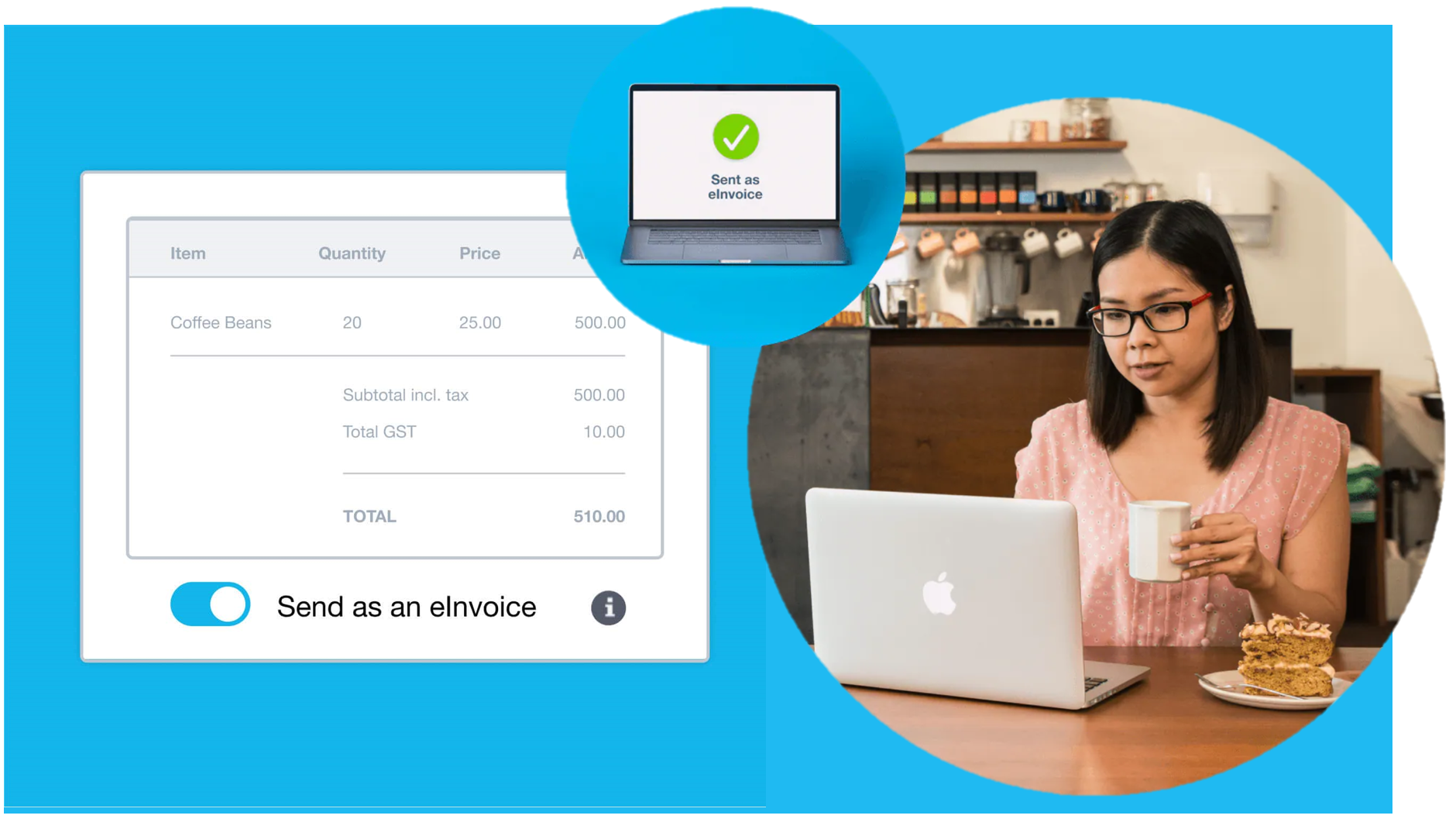

Invoices can be a hassle for both businesses and their clients. There’s nothing fun about chasing up that client about their late payment, nor is it an efficient use of time to trawl through emails and inboxes trying to find that invoice from however long ago.

The Commonwealth Government is pushing ahead with an alternative, that looks like it will make things a bit easier for everyone.

eInvoicing is on the rise! And since software like Xero has jumped in on the change, it’s important for small businesses to know what eInvoicing is all about:

Continue reading Here’s What Businesses Need to Know About eInvoicing in Xero