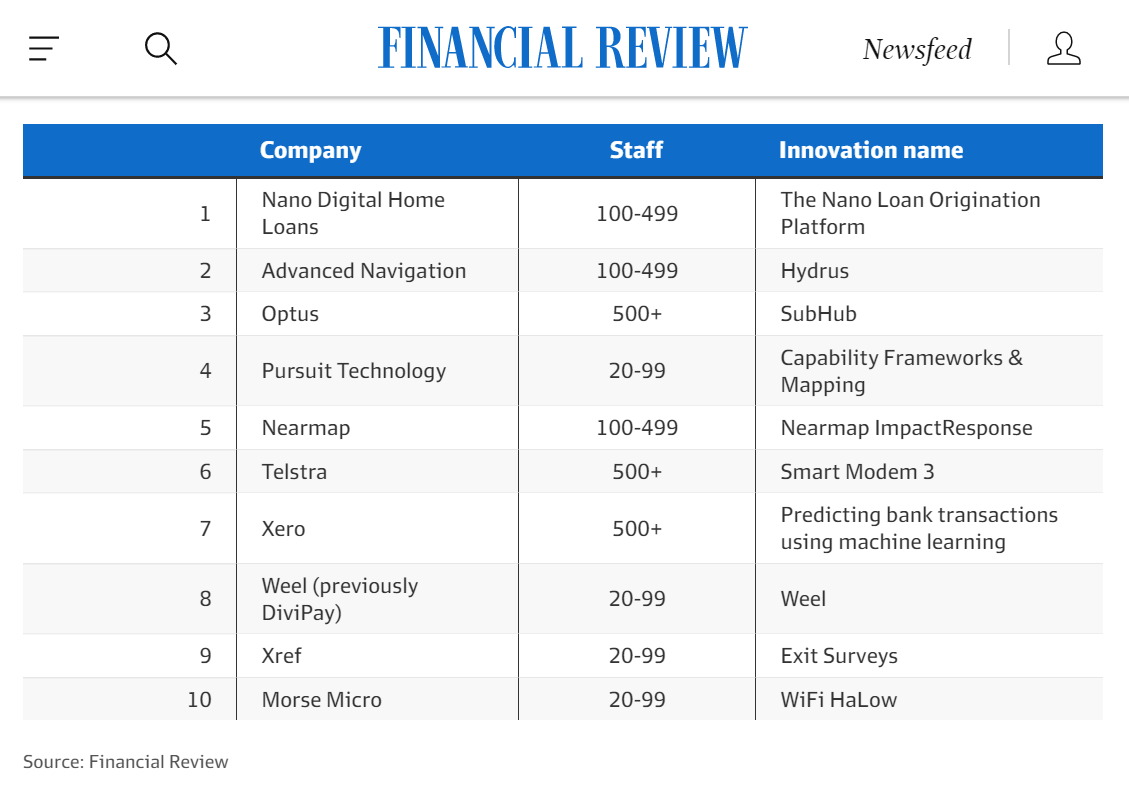

Xero wrote about their AI achievements using machine learning to predict the name and account code for your transactions when performing a bank reconciliation. Bank feeds have been a constant and regular theme in Xero’s marketing and this reinforces how they are using technology to reduce the time it takes to reconcile.

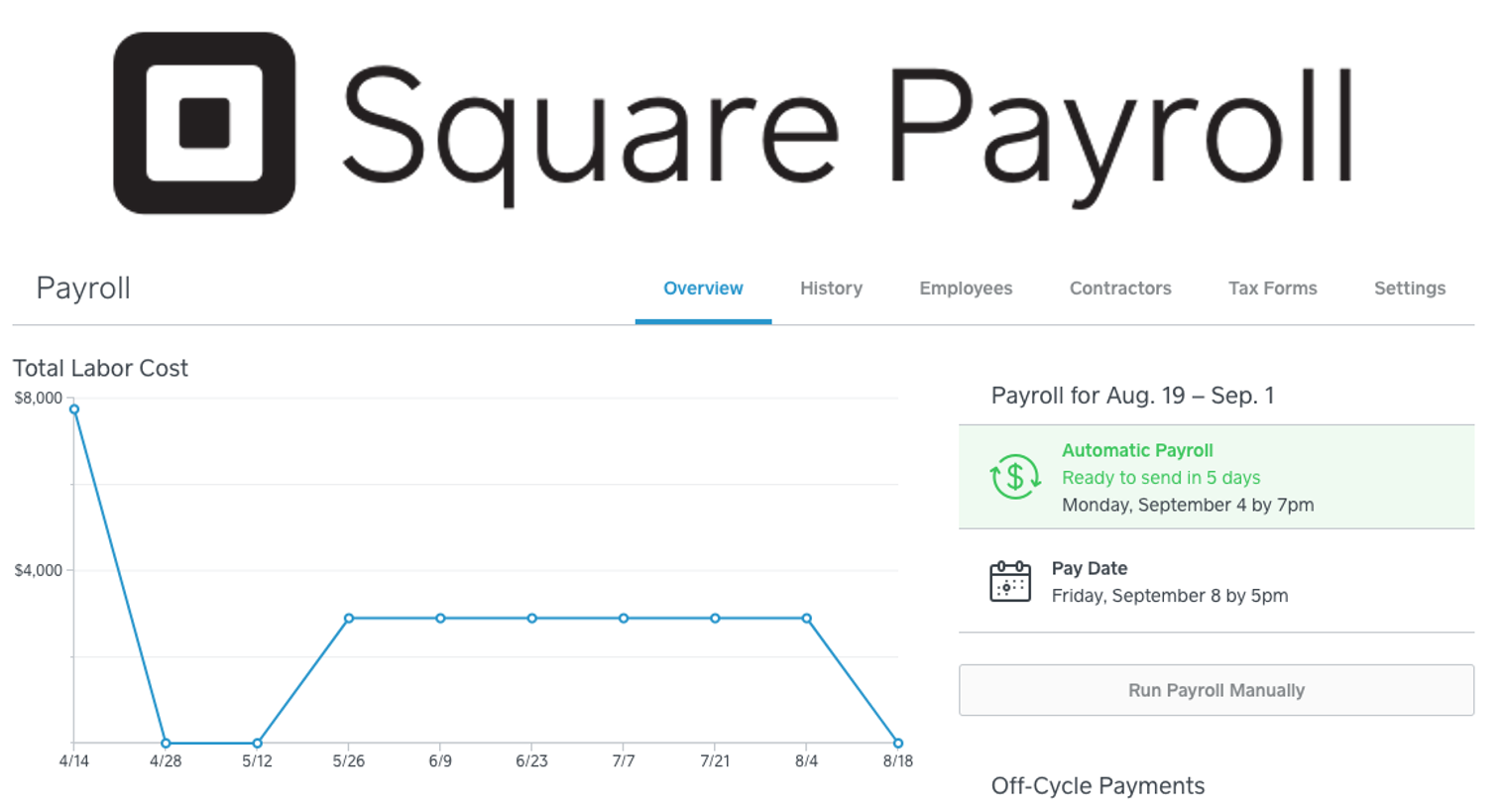

It makes sense that a bank like NAB or CBA buys MYOB because if you could automatically make sure that your finances in your MYOB or Xero software reflected exactly what your bank statements say you’d eliminate half the work that junior bookkeepers do.

Continue reading Xero Boast Top Innovator in “AFR BOSS Most Innovative list”, Just Behind Telstra!