Microsoft Excel: helping to forecast returns and manage investment property finances

Microsoft Excel: helping to forecast returns and manage investment property finances

I WENT THROUGH SEVERAL different spreadsheets (which are incorporated into our Microsoft Excel & Property Investment online training courses) when I had to calculate borrowing capacity and expected return for an investment property in Newcastle recently. Microsoft Excel is a great tool for managing your investment property portfolio finances and to help students understand financial literacy we recently created some new training content for our Advanced Microsoft Excel training courses, which covers common calculations that investors go through when they look at potential debt or equity investments in new startup businesses.

Determine the NPV of a project

Net present value (NPV) is a core component of investment budgeting. It’s a comprehensive way to to calculate whether a proposed project (such as a home renovation) will add value to the investment or not.

An NPV formula involves many financial concepts in the one formula:

- cash flows,

- the time value of money,

- the discount rate over the duration of the project, and so on.

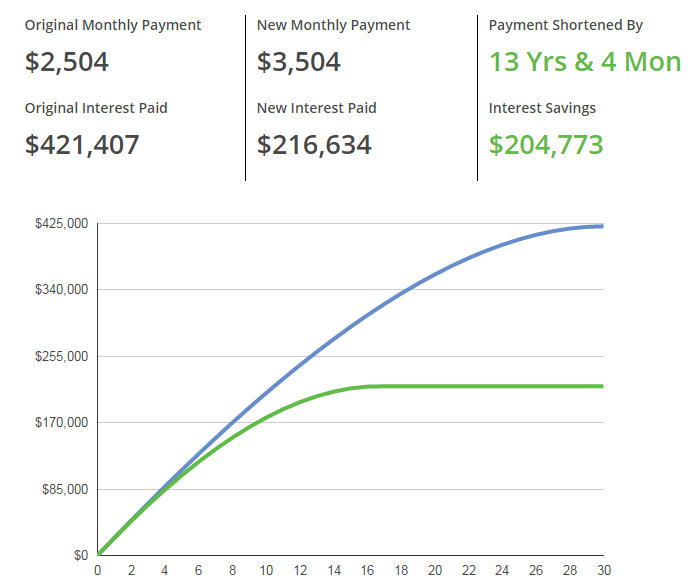

Any NPV greater than $0 represents a value-added project, with $0 representing your break-even point. A negative dollar figure suggests the project won’t add value or deliver any return on investment. There are two ways to calculate NPV of an investment in Excel — by separating out the component cash flows and calculating each step individually, or by creating an NPV formula in Excel to do that for you. I can tell you from the Applied Finance degree I did with Kaplan that Excel makes it a LOT easier.

Determine the IRR of your investments

The Internal Rate of Return (IRR) is a metric used to measure the profitability of a potential investment. IRR is a discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero. IRR calculations rely on the same formula components that NPV does. In general, the higher a project’s IRR, the more desirable it is to undertake. You can also use IRR to rank multiple prospective projects you may be considering for an investment property, assuming the costs are equal among each project. The one with the highest IRR would be considered the one that should be undertaken first. If this all sounds a little complicated you may never need to worry about it but rest assured the companies in your superannuation fund who work hard on making money every year will be using these regularly.

New Excel 2016 training course content for Lifelong learning

We’ve updated our Microsoft Excel course content to the latest version of Excel, but we also include all versions of Excel software in our training courses. When you enrol in Excel 2016, you’ll also get access to the content for Excel 2013, 2010, 2007 and even 2003 if you need it. Because we create our own course content, training workbooks, exercise files and videos, we can (and do) update them regularly. We’ve also just updated our Xero training courses to the latest version of the Xero software.

When you enrol for lifetime course access, you get free access to all of these versions forever. You’ll learn how to use Excel to manage your investment property finances in our latest Goal Seek, Data Consolidation and Solver advanced Microsoft Excel training courses. Visit our website for more information or to enrol.

This free app, by ASIC MoneySmart, lets you connect your bank account to the app, categorise your expenses, nominate a spending limit, and create expense reminders that can be sent to as text messages ahead of their due date.

This free app, by ASIC MoneySmart, lets you connect your bank account to the app, categorise your expenses, nominate a spending limit, and create expense reminders that can be sent to as text messages ahead of their due date.  If you didn’t know it already, the Australian Tax Office has its own mobile app. It allows you to access the ATO’s online services, lodge and track your tax return (yes, right from your mobile phone), work out key tax dates and access tools and calculators.

If you didn’t know it already, the Australian Tax Office has its own mobile app. It allows you to access the ATO’s online services, lodge and track your tax return (yes, right from your mobile phone), work out key tax dates and access tools and calculators.