Costs of starting a business are tax deductible

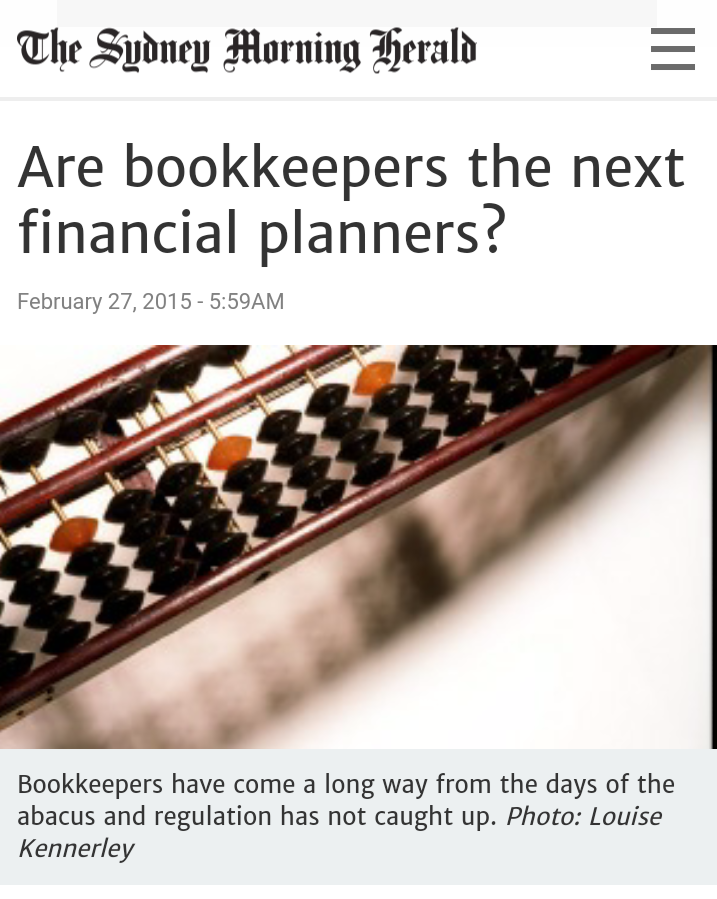

If you’re subscribed to this blog and you’ve been following our recent posts, then you should be aware that we’ve recently partnered with National Bookkeeping to deliver online training courses to their new licensees. We’ve also been writing about the $20k tax breaks introduced in the recent budget, which allows businesses to immediately write off asset purchases up the $20k as a tax deduction (rather than being depreciated over time).

If you’re subscribed to this blog and you’ve been following our recent posts, then you should be aware that we’ve recently partnered with National Bookkeeping to deliver online training courses to their new licensees. We’ve also been writing about the $20k tax breaks introduced in the recent budget, which allows businesses to immediately write off asset purchases up the $20k as a tax deduction (rather than being depreciated over time).

While we caution you to be prudent when it comes to making business purchases, if you had been thinking about becoming an independent consultant and starting a home-based business and needed to make any purchases – office furniture, technology, a training course – now’s the time to do it.

Now that we’ve reached June, there are just a couple weeks left of this financial year, which means that any business purchases you make between now and June 30 will immediately go toward reducing your taxable income for this current financial year. This even includes the cost of becoming a National Bookkeeping licensee.

A tax-deductible license fee

Typically, when you buy a franchise or become a licensee, the franchise or license fee you pay forms part of the cost-base for your franchise or licensed business as your capital asset, and cannot be claimed as a tax deduction. However, because EzyLearn is a partner and is providing its entire suite of training courses to new licensees, the fee to join National Bookkeeping is technically considered a self-education expense.

Self-education expenses, when they directly relate to your business, are a hundred percent tax deductible. If you register before the end of this financial year – that is, June 30 – then you claim it as an immediate tax deduction, and reduce your taxable income by $1,600 straight off the bat – and that’s not to mention any other asset purchases you make, like new cars, office furniture, technology and the like.

Aside from being instantly gratifying to be able to claim a business expense back right away, it’ll also mean that you’ve technically started your new business in the black as opposed to in the red like new most businesses do. So whether the license fee results in a bigger tax cheque this year or just reduces the amount of tax you have to pay to the ATO, it’s still money in your pocket that you can reinvest into other areas of your business.

Register before June 30 to avoid starting your business in the red

One of the biggest hindrances to growth in the first year of business is poor cash flow, and unfortunately many small businesses experience poor cash flow in their first year of trading. It typically occurs when a business makes a number of, albeit necessary, business purchases that leave them cash strapped until they can file a tax return at the end of the financial year. As a result, it makes it difficult to spend money on marketing or to hire a contractor to carry out work you’re not skilled for – developing a smartphone app for your business, say.

As a result, you either miss out on investing in opportunities that will help to grow your business in the long term, or you wind up trying to muddle through it yourself, which is both a waste of your time and is also false economy, because you’re losing money by not attending to the tasks that are going to generate immediate revenue (completing someone’s BAS, for example).

Even though becoming a licensee is a low-risk new business option, which usually includes most of the things you need to start and grow your business during its infancy, like sales and marketing collateral – in fact, National Bookkeeping licensees will want for nothing as nearly everything, with the exception of an ABN and Cert IV accreditation, is included in the license fee – there is some flexibility to how you operate your business, which means that if you decide you want to branch out and offer content marketing services, you may need to regularly work with a designer or developer.

You’ll need money to pay them, and if you want to keep up a good relationship with your suppliers, you’ll want to pay them quickly and on time. Ideally, your end client will do the same for you, but oftentimes they don’t. If you’re always waiting to be paid before you can pay your suppliers, it’s not going to foster good relationships with either your client or your suppliers.

Start your National Bookkeeping business in the black

So that’s why it’s a good idea to register with National Bookkeeping and become a licensee before June 30. It’ll mean being able to claim back the entire license fee this financial year, so you can give your business the best change at growing and becoming a success from the very start.

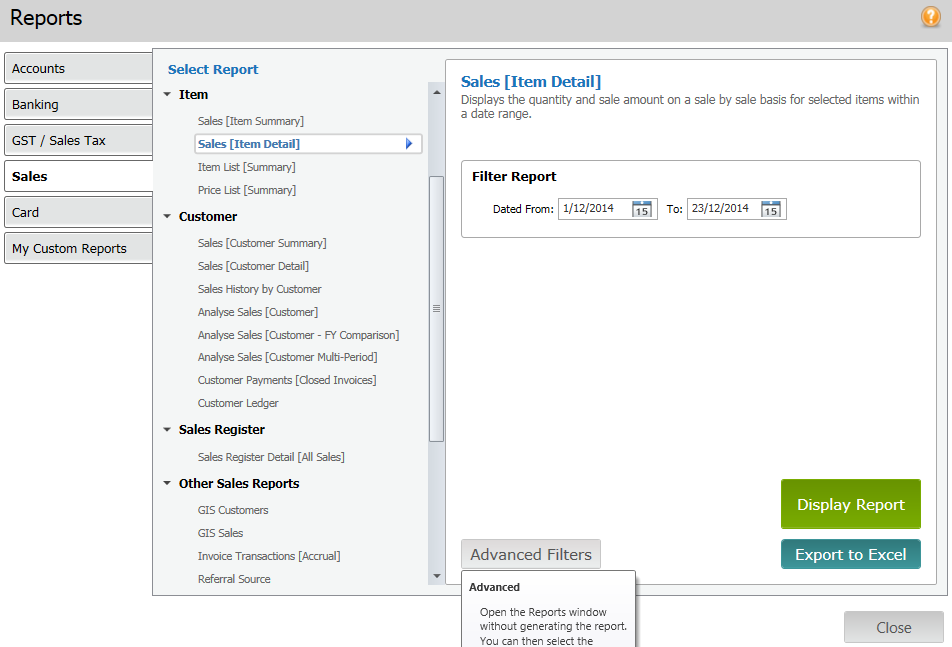

As a National Bookkeeping licensee, you’ll receive full access to our entire suite of training courses, including our small business management course, which covers all of the important aspects of operating a small business, like developing a business plan, managing the financials, and researching the market – in this case, useful if you decide to offer additional services, besides just bookkeeping.

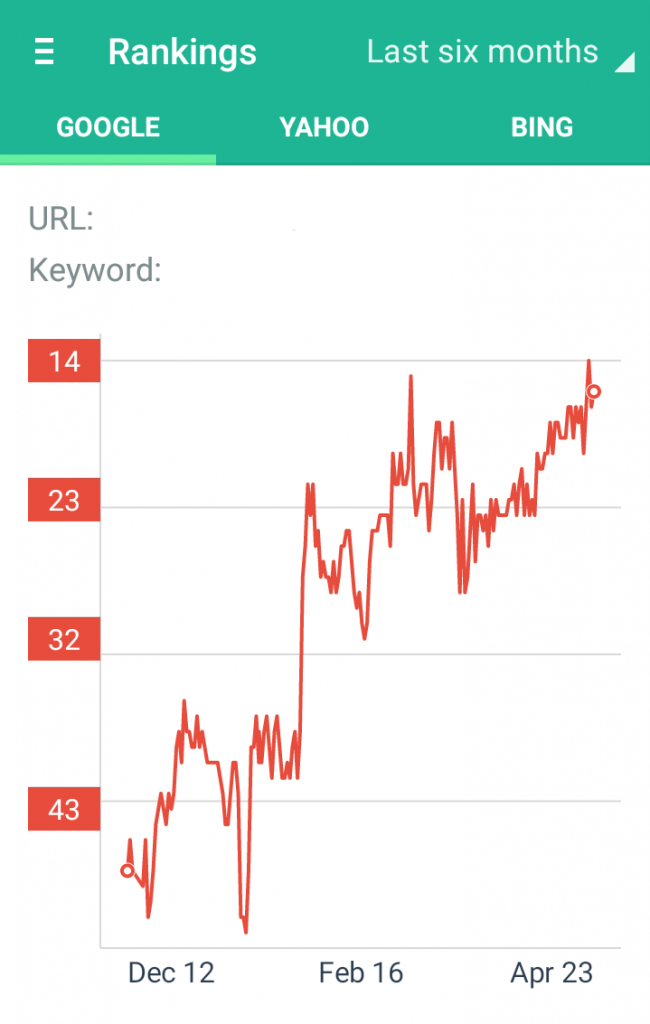

You’ll also gain access to any future courses we develop, and we currently have a content marketing course in the pipeline. I’ve mentioned in a blog post already that content marketing has become a real focus for many businesses now that they’ve come to realise how important it is to engage and interact with their customers online.

Develop your skills to expand your business

The content marketing course we’re developing is designed to give people the skills they need to start their own home-based content marketing business, which you may decide to utilise by expanding your services beyond just bookkeeping and operate a business that offers a Complete Business Operations service to other businesses.

For a lot of medium-sized enterprises – a plumbing business, for instance – that has a number of staff or contractors and struggles to keep up with the administrative side of the business, being able to deal with just one business would be far more convenient than having to engage each one separately – a bookkeeper, a virtual assistant, and a marketing agency.

But then again, you may just decide to take the skills you’ve learned, create your own content marketing strategy for your business, and implement it yourself. It’s up to you.

Achieve success through education and flexibility

National Bookkeeping and EzyLearn wants you to have the best chance at succeeding in your business venture, and we believe that the best way to achieve success is through education, and that the more skills you have and knowledge you possess, the more likely you are to achieve it.

I honestly, don’t know many other franchises or licensed businesses with that level of commitment to education, nor to the flexibility that comes with it. So if you would like to start a home-based bookkeeping business, but want to have the flexibility to expand you services beyond just bookkeeping, while also having the security that a licensed business offers – an established business model and name, access to infrastructure, training, and coaching – then it’s worth your while to look into being a licensee with National Bookkeeping.

Visit their website for more information, contact the team, or if you’d just like to get started today – before June 30 so you can claim your licence fee back right away – register your interest online.

THE INTERNET HAS CHANGED the way businesses market their services to prospects, from a simple sales message to an educational one.

THE INTERNET HAS CHANGED the way businesses market their services to prospects, from a simple sales message to an educational one.

If you’re

If you’re

We had our office Christmas party (for our Sydney team) this week and I went through and individually thanked each of my team for their contribution during the year. I’m very lucky to be working with a great bunch of people – although, you know what they say:”The harder I work the luckier I get” – and I used our Christmas lunch to thank each of them publicly (in front of their peers) for their efforts because I think it’s important.

We had our office Christmas party (for our Sydney team) this week and I went through and individually thanked each of my team for their contribution during the year. I’m very lucky to be working with a great bunch of people – although, you know what they say:”The harder I work the luckier I get” – and I used our Christmas lunch to thank each of them publicly (in front of their peers) for their efforts because I think it’s important. One of our team members said she’s going on holidays and really needs the time off because she will be studying VERY hard next year. She’ll have 5 weeks off and she’s 21. I started to wonder if I am a workaholic, am a little twisted in my opinion of what makes a good holiday or that I just love what I am doing, but I offered to give her work to do while she was on holidays overseas for that long period of time – after all, isn’t it great to earn some money working from your computer, using the internet for a couple hours each day and then getting into the festivities!?

One of our team members said she’s going on holidays and really needs the time off because she will be studying VERY hard next year. She’ll have 5 weeks off and she’s 21. I started to wonder if I am a workaholic, am a little twisted in my opinion of what makes a good holiday or that I just love what I am doing, but I offered to give her work to do while she was on holidays overseas for that long period of time – after all, isn’t it great to earn some money working from your computer, using the internet for a couple hours each day and then getting into the festivities!?